Answered step by step

Verified Expert Solution

Question

1 Approved Answer

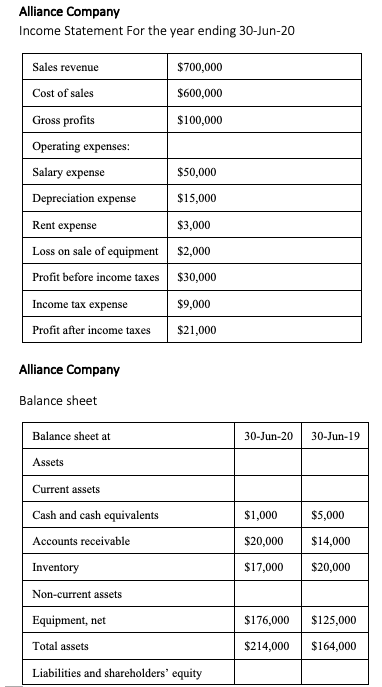

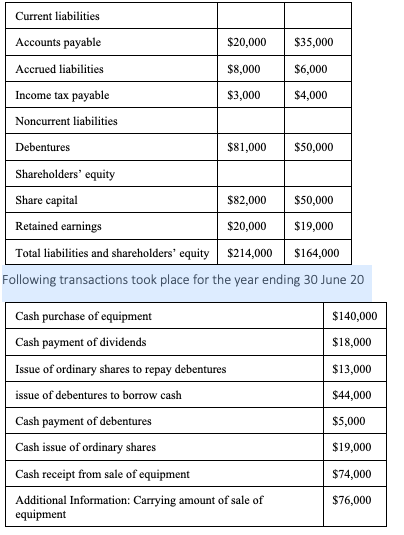

Part A: Compute and show the cash flows from operating activities using indirect method Part B: Compute and show the cash flows from investing activities

Part A: Compute and show the cash flows from operating activities using indirect method

Part B: Compute and show the cash flows from investing activities

Part C: Compute and show the cash flows from financing activities

Part D: Compute and show the net change in cash

Alliance Company Income Statement For the year ending 30-Jun-20 $700,000 $600,000 $100,000 $50,000 Sales revenue Cost of sales Gross profits Operating expenses: Salary expense Depreciation expense Rent expense Loss on sale of equipment Profit before income taxes Income tax expense Profit after income taxes $15,000 $3,000 $2,000 $30,000 $9,000 $21,000 Alliance Company Balance sheet Balance sheet at 30-Jun-20 30-Jun-19 Assets $1,000 $5,000 $20,000 $14,000 Current assets Cash and cash equivalents Accounts receivable Inventory Non-current assets Equipment, net $17,000 $20,000 $176,000 $125,000 Total assets $214,000 $164,000 Liabilities and shareholders' equity Current liabilities Accounts payable $20,000 $35,000 Accrued liabilities $8,000 $6,000 Income tax payable $3,000 $4,000 Noncurrent liabilities Debentures $81,000 $50,000 Shareholders' equity Share capital $82,000 $50,000 Retained earnings $20,000 $19,000 Total liabilities and shareholders' equity $214,000 $164,000 Following transactions took place for the year ending 30 June 20 $140,000 $18,000 $13,000 $44,000 Cash purchase of equipment Cash payment of dividends Issue of ordinary shares to repay debentures issue of debentures to borrow cash Cash payment of debentures Cash issue of ordinary shares Cash receipt from sale of equipment Additional Information: Carrying amount of sale of equipment $5,000 $19,000 $74,000 $76,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started