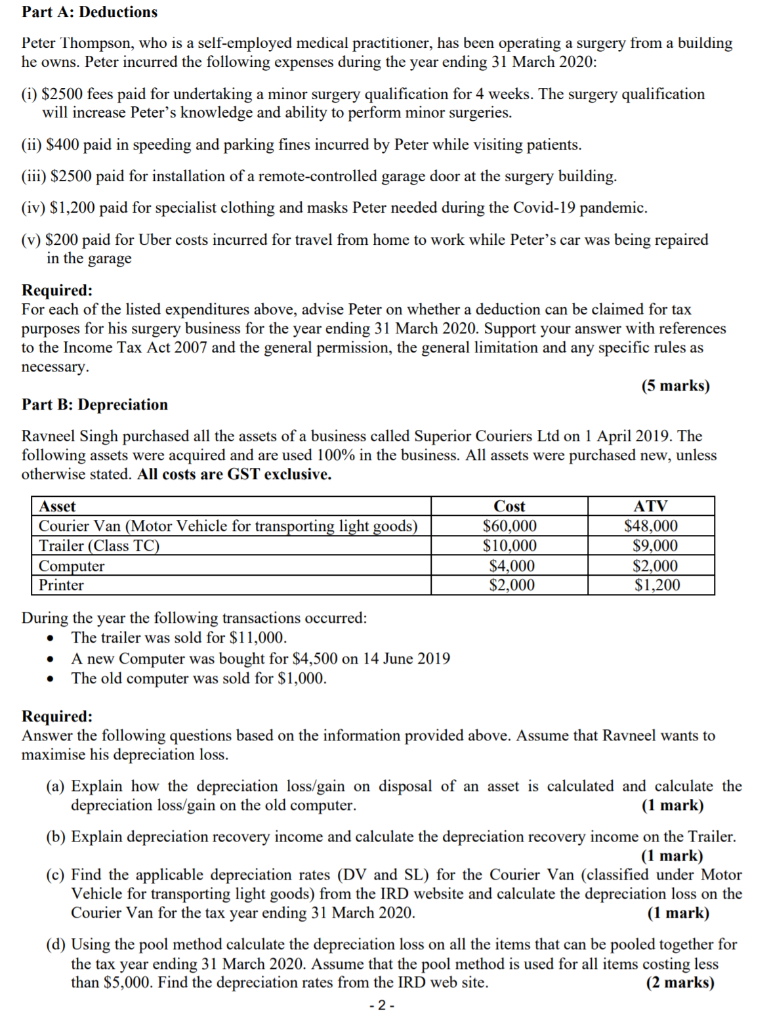

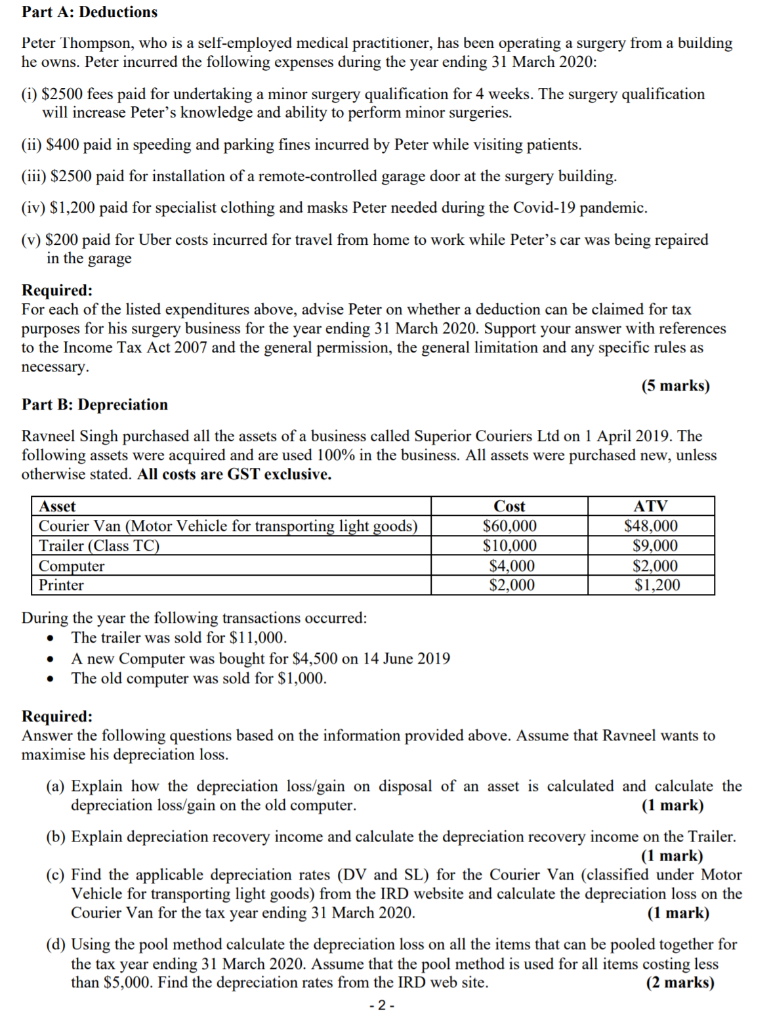

Part A: Deductions Peter Thompson, who is a self-employed medical practitioner, has been operating a surgery from a building he owns. Peter incurred the following expenses during the year ending 31 March 2020: (i) $2500 fees paid for undertaking a minor surgery qualification for 4 weeks. The surgery qualification will increase Peter's knowledge and ability to perform minor surgeries. (ii) $400 paid in speeding and parking fines incurred by Peter while visiting patients. (iii) $2500 paid for installation of a remote-controlled garage door at the surgery building. (iv) $1,200 paid for specialist clothing and masks Peter needed during the Covid-19 pandemic. (v) $200 paid for Uber costs incurred for travel from home to work while Peter's car was being repaired in the garage Required: For each of the listed expenditures above, advise Peter on whether a deduction can be claimed for tax purposes for his surgery business for the year ending 31 March 2020. Support your answer with references to the Income Tax Act 2007 and the general permission, the general limitation and any specific rules as necessary. (5 marks) Part B: Depreciation Ravneel Singh purchased all the assets of a business called Superior Couriers Ltd on 1 April 2019. The following assets were acquired and are used 100% in the business. All assets were purchased new, unless otherwise stated. All costs are GST exclusive. Asset Courier Van (Motor Vehicle for transporting light goods) Trailer (Class TC) Computer Printer Cost $60,000 $10,000 $4,000 $2,000 ATV $48,000 $9,000 $2,000 $1,200 . During the year the following transactions occurred: The trailer was sold for $11,000. A new Computer was bought for $4,500 on 14 June 2019 The old computer was sold for $1,000. . Required: Answer the following questions based on the information provided above. Assume that Ravneel wants to maximise his depreciation loss. (a) Explain how the depreciation loss/gain on disposal of an asset is calculated and calculate the depreciation loss/gain on the old computer. (1 mark) (b) Explain depreciation recovery income and calculate the depreciation recovery income on the Trailer. (1 mark) (c) Find the applicable depreciation rates (DV and SL) for the Courier Van (classifi under Motor Vehicle for transporting light goods) from the IRD website and calculate the depreciation loss on the Courier Van for the tax year ending 31 March 2020. (1 mark) (d) Using the pool method calculate the depreciation loss on all the items that can be pooled together for the tax year ending 31 March 2020. Assume that the pool method is used for all items costing less than $5,000. Find the depreciation rates from the IRD web site. (2 marks) - 2 - Part A: Deductions Peter Thompson, who is a self-employed medical practitioner, has been operating a surgery from a building he owns. Peter incurred the following expenses during the year ending 31 March 2020: (i) $2500 fees paid for undertaking a minor surgery qualification for 4 weeks. The surgery qualification will increase Peter's knowledge and ability to perform minor surgeries. (ii) $400 paid in speeding and parking fines incurred by Peter while visiting patients. (iii) $2500 paid for installation of a remote-controlled garage door at the surgery building. (iv) $1,200 paid for specialist clothing and masks Peter needed during the Covid-19 pandemic. (v) $200 paid for Uber costs incurred for travel from home to work while Peter's car was being repaired in the garage Required: For each of the listed expenditures above, advise Peter on whether a deduction can be claimed for tax purposes for his surgery business for the year ending 31 March 2020. Support your answer with references to the Income Tax Act 2007 and the general permission, the general limitation and any specific rules as necessary. (5 marks) Part B: Depreciation Ravneel Singh purchased all the assets of a business called Superior Couriers Ltd on 1 April 2019. The following assets were acquired and are used 100% in the business. All assets were purchased new, unless otherwise stated. All costs are GST exclusive. Asset Courier Van (Motor Vehicle for transporting light goods) Trailer (Class TC) Computer Printer Cost $60,000 $10,000 $4,000 $2,000 ATV $48,000 $9,000 $2,000 $1,200 . During the year the following transactions occurred: The trailer was sold for $11,000. A new Computer was bought for $4,500 on 14 June 2019 The old computer was sold for $1,000. . Required: Answer the following questions based on the information provided above. Assume that Ravneel wants to maximise his depreciation loss. (a) Explain how the depreciation loss/gain on disposal of an asset is calculated and calculate the depreciation loss/gain on the old computer. (1 mark) (b) Explain depreciation recovery income and calculate the depreciation recovery income on the Trailer. (1 mark) (c) Find the applicable depreciation rates (DV and SL) for the Courier Van (classifi under Motor Vehicle for transporting light goods) from the IRD website and calculate the depreciation loss on the Courier Van for the tax year ending 31 March 2020. (1 mark) (d) Using the pool method calculate the depreciation loss on all the items that can be pooled together for the tax year ending 31 March 2020. Assume that the pool method is used for all items costing less than $5,000. Find the depreciation rates from the IRD web site. (2 marks) - 2