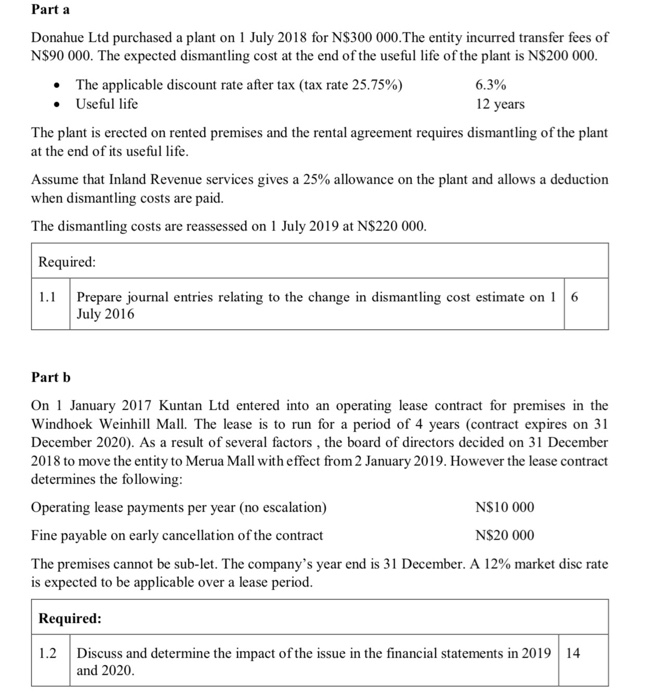

Part a Donahue Ltd purchased a plant on 1 July 2018 for N$300 000. The entity incurred transfer fees of N$90 000. The expected dismantling cost at the end of the useful life of the plant is N$200 000. The applicable discount rate after tax (tax rate 25.75%) 6.3% Useful life 12 years The plant is erected on rented premises and the rental agreement requires dismantling of the plant at the end of its useful life. Assume that Inland Revenue services gives a 25% allowance on the plant and allows a deduction when dismantling costs are paid. The dismantling costs are reassessed on 1 July 2019 at N$220 000. Required: 1.1 Prepare journal entries relating to the change in dismantling cost estimate on 16 July 2016 Part b On 1 January 2017 Kuntan Ltd entered into an operating lease contract for premises in the Windhoek Weinhill Mall. The lease is to run for a period of 4 years (contract expires on 31 December 2020). As a result of several factors , the board of directors decided on 31 December 2018 to move the entity to Merua Mall with effect from 2 January 2019. However the lease contract determines the following: Operating lease payments per year (no escalation) N$10 000 Fine payable on early cancellation of the contract N$20 000 The premises cannot be sub-let. The company's year end is 31 December. A 12% market disc rate is expected to be applicable over a lease period. Required: 1.2 Discuss and determine the impact of the issue in the financial statements in 2019 14 and 2020. Part a Donahue Ltd purchased a plant on 1 July 2018 for N$300 000. The entity incurred transfer fees of N$90 000. The expected dismantling cost at the end of the useful life of the plant is N$200 000. The applicable discount rate after tax (tax rate 25.75%) 6.3% Useful life 12 years The plant is erected on rented premises and the rental agreement requires dismantling of the plant at the end of its useful life. Assume that Inland Revenue services gives a 25% allowance on the plant and allows a deduction when dismantling costs are paid. The dismantling costs are reassessed on 1 July 2019 at N$220 000. Required: 1.1 Prepare journal entries relating to the change in dismantling cost estimate on 16 July 2016 Part b On 1 January 2017 Kuntan Ltd entered into an operating lease contract for premises in the Windhoek Weinhill Mall. The lease is to run for a period of 4 years (contract expires on 31 December 2020). As a result of several factors , the board of directors decided on 31 December 2018 to move the entity to Merua Mall with effect from 2 January 2019. However the lease contract determines the following: Operating lease payments per year (no escalation) N$10 000 Fine payable on early cancellation of the contract N$20 000 The premises cannot be sub-let. The company's year end is 31 December. A 12% market disc rate is expected to be applicable over a lease period. Required: 1.2 Discuss and determine the impact of the issue in the financial statements in 2019 14 and 2020