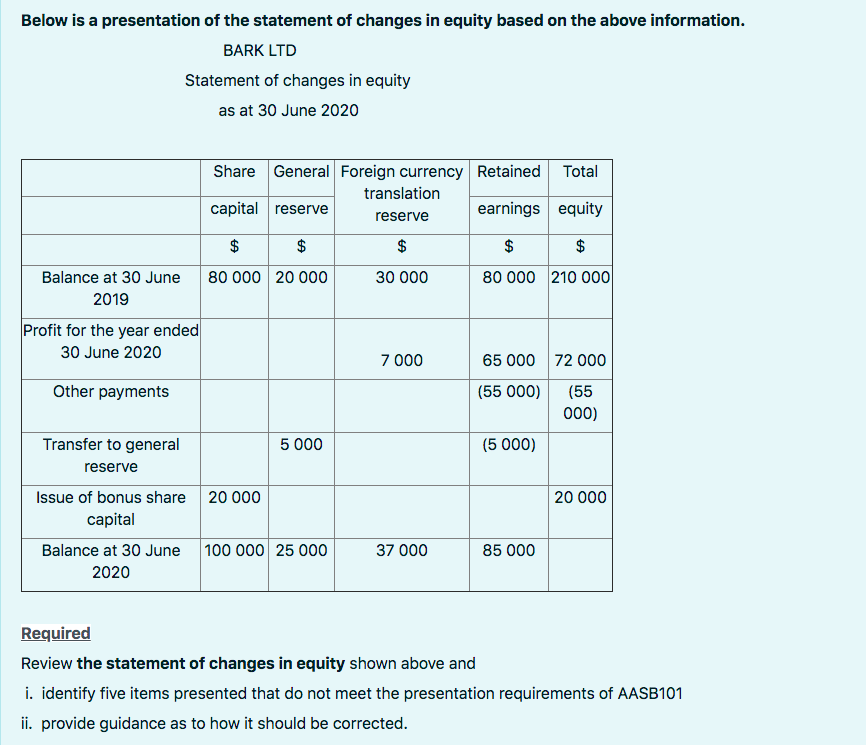

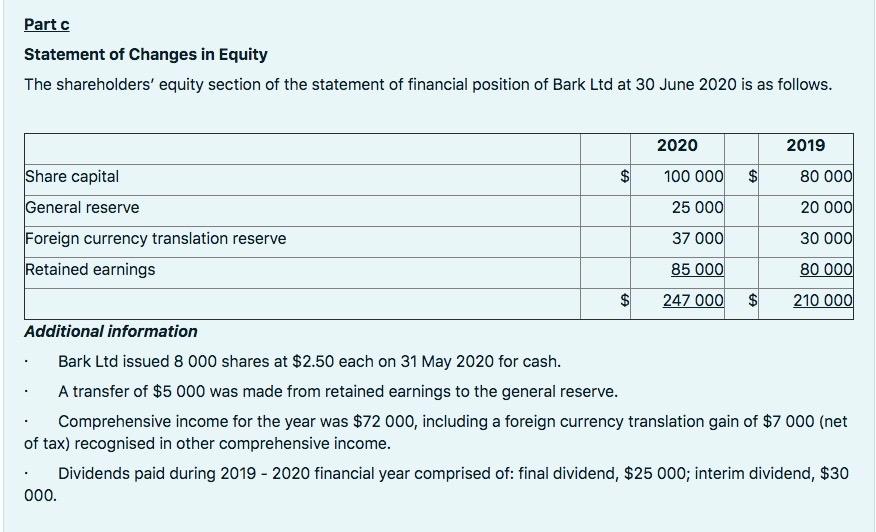

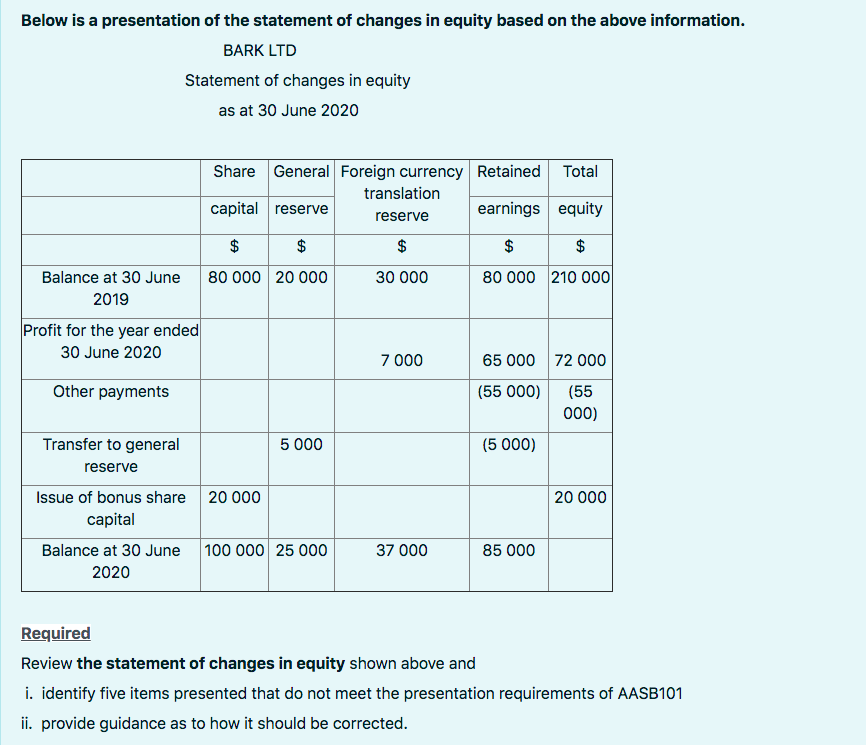

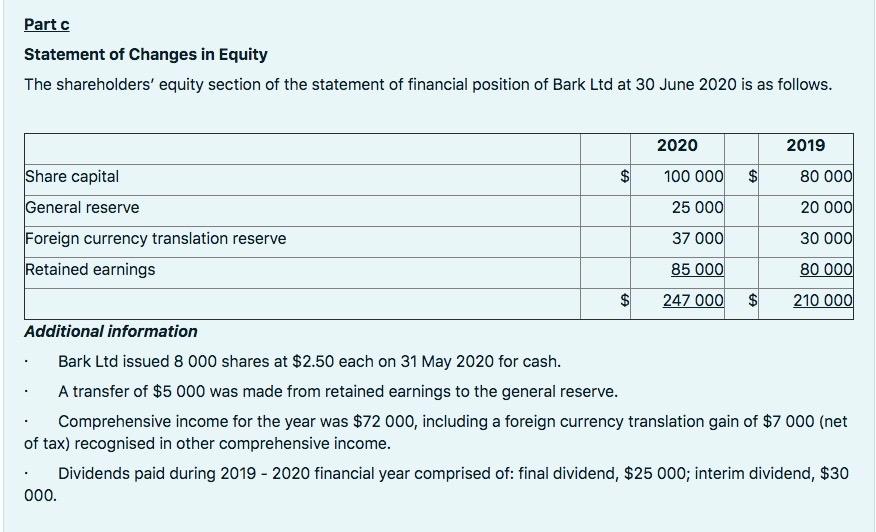

Part a Explain two reasons why it is important for entities to disclose the measurement bases used in preparing the financial statements. Part b Revenue Recognition i. Saha Ltd sells goods to Jack Ltd. The agreement between the two parties states that Jack Ltd pays for the goods in advance of delivery which will occur in 12 months' time. Control of the goods passes to Jack Ltd at the date of delivery. Jack Ltd pays $40 000 to Saha Ltd on 1 July 2019. Saha Ltd delivers the goods to Jack Ltd on 1 July 2020. Required Advise Saha Ltd using journal entries on how to appropriately recognise the revenue from this transaction as per the recognition criteria in AASB 15/IFRS 15. ii. C Ltd sells goods to Go Ltd. Go Ltd enters into an agreement to buy the goods from C Ltd for $50 000 on 1 September 2020. C Ltd delivers the goods on 10 September 2020. Go Ltd pays for the goods on 30 September 2020 The agreement states that, from the date of delivery, C Ltd must provide maintenance for these goods for the first 12 months. Go Ltd is entitled to a refund of 15% of the amount paid if C Ltd does not satisfactorily maintain the goods for the year as required. Required Prepare the journal entries to be recorded by C Ltd as per the recognition criteria in AASB 15/IFRS 15 assuming that there is no refund after 12 months. Below is a presentation of the statement of changes in equity based on the above information. BARK LTD Statement of changes in equity as at 30 June 2020 Share General Foreign currency Retained Total translation capital reserve earnings equity reserve $ $ $ $ $ Balance at 30 June 80 000 20 000 30 000 80 000 210 000 2019 Profit for the year ended 30 June 2020 7 000 65 000 72 000 Other payments (55 000) (55 000) Transfer to general 5 000 (5000) reserve 20 000 20 000 Issue of bonus share capital Balance at 30 June 100 000 25 000 37 000 85 000 2020 Required Review the statement of changes in equity shown above and i. identify five items presented that do not meet the presentation requirements of AASB101 ii. provide guidance as to how it should be corrected. Partc Statement of Changes in Equity The shareholders' equity section of the statement of financial position of Bark Ltd at 30 June 2020 is as follows. 2020 2019 $ 100 000 $ 80 000 25 000 20 000 Share capital General reserve Foreign currency translation reserve Retained earnings 37 000 30 000 85 000 80 000 $ 247 000 $ 210 000 Additional information Bark Ltd issued 8 000 shares at $2.50 each on 31 May 2020 for cash. A transfer of $5 000 was made from retained earnings to the general reserve. Comprehensive income for the year was $72 000, including a foreign currency translation gain of $7 000 (net of tax) recognised in other comprehensive income. . Dividends paid during 2019 - 2020 financial year comprised of: final dividend, $25 000; interim dividend, $30 000. Part a Explain two reasons why it is important for entities to disclose the measurement bases used in preparing the financial statements. Part b Revenue Recognition i. Saha Ltd sells goods to Jack Ltd. The agreement between the two parties states that Jack Ltd pays for the goods in advance of delivery which will occur in 12 months' time. Control of the goods passes to Jack Ltd at the date of delivery. Jack Ltd pays $40 000 to Saha Ltd on 1 July 2019. Saha Ltd delivers the goods to Jack Ltd on 1 July 2020. Required Advise Saha Ltd using journal entries on how to appropriately recognise the revenue from this transaction as per the recognition criteria in AASB 15/IFRS 15. ii. C Ltd sells goods to Go Ltd. Go Ltd enters into an agreement to buy the goods from C Ltd for $50 000 on 1 September 2020. C Ltd delivers the goods on 10 September 2020. Go Ltd pays for the goods on 30 September 2020 The agreement states that, from the date of delivery, C Ltd must provide maintenance for these goods for the first 12 months. Go Ltd is entitled to a refund of 15% of the amount paid if C Ltd does not satisfactorily maintain the goods for the year as required. Required Prepare the journal entries to be recorded by C Ltd as per the recognition criteria in AASB 15/IFRS 15 assuming that there is no refund after 12 months. Below is a presentation of the statement of changes in equity based on the above information. BARK LTD Statement of changes in equity as at 30 June 2020 Share General Foreign currency Retained Total translation capital reserve earnings equity reserve $ $ $ $ $ Balance at 30 June 80 000 20 000 30 000 80 000 210 000 2019 Profit for the year ended 30 June 2020 7 000 65 000 72 000 Other payments (55 000) (55 000) Transfer to general 5 000 (5000) reserve 20 000 20 000 Issue of bonus share capital Balance at 30 June 100 000 25 000 37 000 85 000 2020 Required Review the statement of changes in equity shown above and i. identify five items presented that do not meet the presentation requirements of AASB101 ii. provide guidance as to how it should be corrected. Partc Statement of Changes in Equity The shareholders' equity section of the statement of financial position of Bark Ltd at 30 June 2020 is as follows. 2020 2019 $ 100 000 $ 80 000 25 000 20 000 Share capital General reserve Foreign currency translation reserve Retained earnings 37 000 30 000 85 000 80 000 $ 247 000 $ 210 000 Additional information Bark Ltd issued 8 000 shares at $2.50 each on 31 May 2020 for cash. A transfer of $5 000 was made from retained earnings to the general reserve. Comprehensive income for the year was $72 000, including a foreign currency translation gain of $7 000 (net of tax) recognised in other comprehensive income. . Dividends paid during 2019 - 2020 financial year comprised of: final dividend, $25 000; interim dividend, $30 000