PART A.

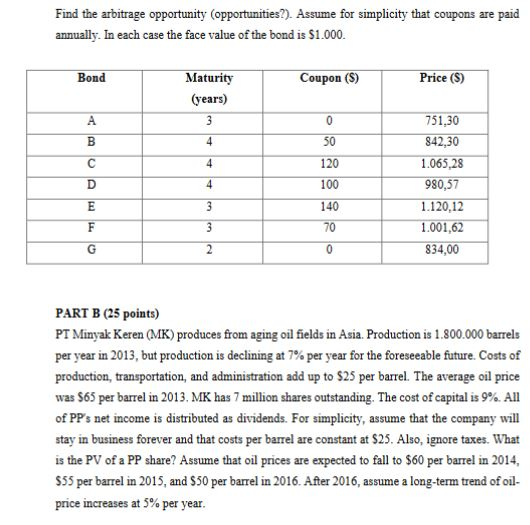

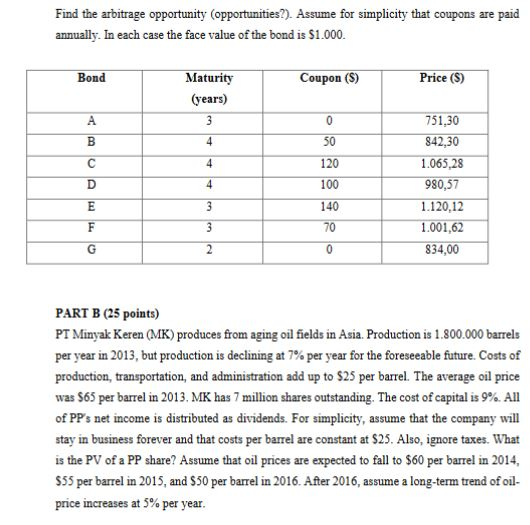

Find the arbitrage opportunity (opportunities?). Assume for simplicity that coupons are paid annually. In each case the face value of the bond is $1.000. Bond Coupon ($) Price (S) Maturity (years) 751,30 842,30 1.065,28 980,57 1.120,12 1.001,62 834,00 PART B (25 points) PT Minyak Keren (MK) produces from aging oil fields in Asia. Production is 1.800.000 barrels per year in 2013, but production is declining at 7% per year for the foreseeable future. Costs of production, transportation, and administration add up to $25 per barrel. The average oil price was $65 per barrel in 2013. MK has 7 million shares outstanding. The cost of capital is 9%. All of PP's net income is distributed as dividends. For simplicity, assume that the company will stay in business forever and that costs per barrel are constant at $25. Also, ignore taxes. What is the PV of a PP share? Assume that oil prices are expected to fall to $60 per barrel in 2014, $55 per barrel in 2015, and $50 per barrel in 2016. After 2016, assume a long-term trend of oil- price increases at 5% per year. Find the arbitrage opportunity (opportunities?). Assume for simplicity that coupons are paid annually. In each case the face value of the bond is $1.000. Bond Coupon ($) Price (S) Maturity (years) 751,30 842,30 1.065,28 980,57 1.120,12 1.001,62 834,00 PART B (25 points) PT Minyak Keren (MK) produces from aging oil fields in Asia. Production is 1.800.000 barrels per year in 2013, but production is declining at 7% per year for the foreseeable future. Costs of production, transportation, and administration add up to $25 per barrel. The average oil price was $65 per barrel in 2013. MK has 7 million shares outstanding. The cost of capital is 9%. All of PP's net income is distributed as dividends. For simplicity, assume that the company will stay in business forever and that costs per barrel are constant at $25. Also, ignore taxes. What is the PV of a PP share? Assume that oil prices are expected to fall to $60 per barrel in 2014, $55 per barrel in 2015, and $50 per barrel in 2016. After 2016, assume a long-term trend of oil- price increases at 5% per year