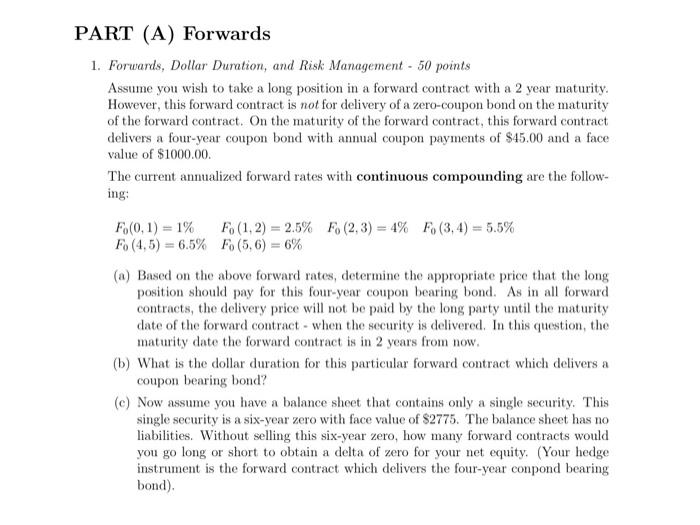

PART (A) Forwards 1. Forwards, Dollar Duration, and Risk Management - 50 points Assume you wish to take a long position in a forward contract with a 2 year maturity. However, this forward contract is not for delivery of a zero-coupon bond on the maturity of the forward contract. On the maturity of the forward contract, this forward contract delivers a four-year coupon bond with annual coupon payments of $45.00 and a face value of $1000.00 The current annualized forward rates with continuous compounding are the follow- ing F.(0,1)= 1% F. (1.2) = 2.5% (2,3) = 4% F. (3.4) = 5.5% F. (4,5) = 6.5% Fo(5,6) = 6% (a) Based on the above forward rates, determine the appropriate price that the long position should pay for this four-year coupon bearing bond. As in all forward contracts, the delivery price will not be paid by the long party until the maturity date of the forward contract - when the security is delivered. In this question, the maturity date the forward contract is in 2 years from now. (6) What is the dollar duration for this particular forward contract which delivers a coupon bearing bond? (e) Now assume you have a balance sheet that contains only a single security. This single security is a six-year zero with face value of $2775. The balance sheet has no liabilities. Without selling this six-year zero, how many forward contracts would you go long or short to obtain a delta of zero for your net equity. (Your hedge instrument is the forward contract which delivers the four-year conpond bearing bond) PART (A) Forwards 1. Forwards, Dollar Duration, and Risk Management - 50 points Assume you wish to take a long position in a forward contract with a 2 year maturity. However, this forward contract is not for delivery of a zero-coupon bond on the maturity of the forward contract. On the maturity of the forward contract, this forward contract delivers a four-year coupon bond with annual coupon payments of $45.00 and a face value of $1000.00 The current annualized forward rates with continuous compounding are the follow- ing F.(0,1)= 1% F. (1.2) = 2.5% (2,3) = 4% F. (3.4) = 5.5% F. (4,5) = 6.5% Fo(5,6) = 6% (a) Based on the above forward rates, determine the appropriate price that the long position should pay for this four-year coupon bearing bond. As in all forward contracts, the delivery price will not be paid by the long party until the maturity date of the forward contract - when the security is delivered. In this question, the maturity date the forward contract is in 2 years from now. (6) What is the dollar duration for this particular forward contract which delivers a coupon bearing bond? (e) Now assume you have a balance sheet that contains only a single security. This single security is a six-year zero with face value of $2775. The balance sheet has no liabilities. Without selling this six-year zero, how many forward contracts would you go long or short to obtain a delta of zero for your net equity. (Your hedge instrument is the forward contract which delivers the four-year conpond bearing bond)