Answered step by step

Verified Expert Solution

Question

1 Approved Answer

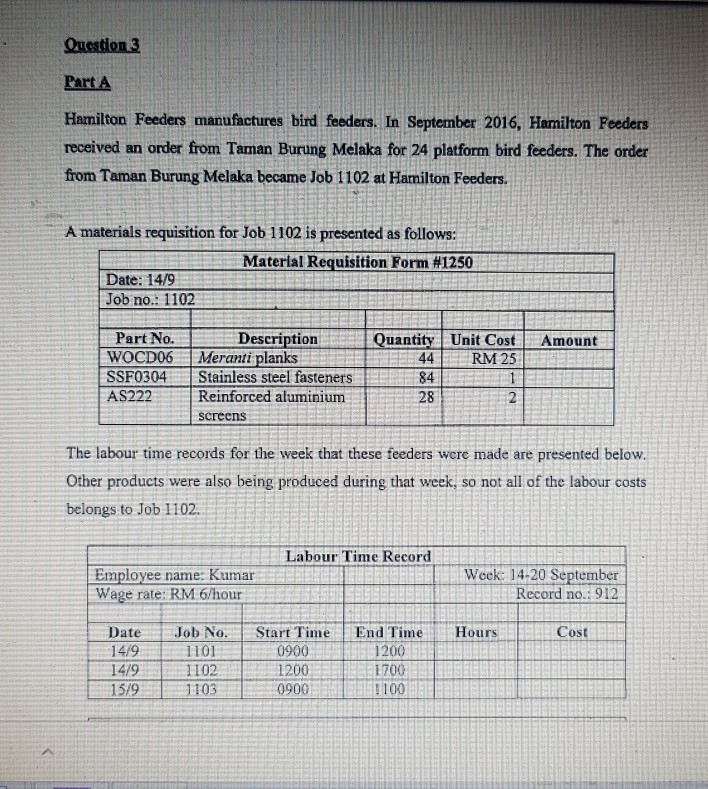

Part A Hamilton Feeders manufactures bird feeders. In September 2016, Hamilton Feeders received an order from Taman Burung Melaka for 24 platform bird feeders. The

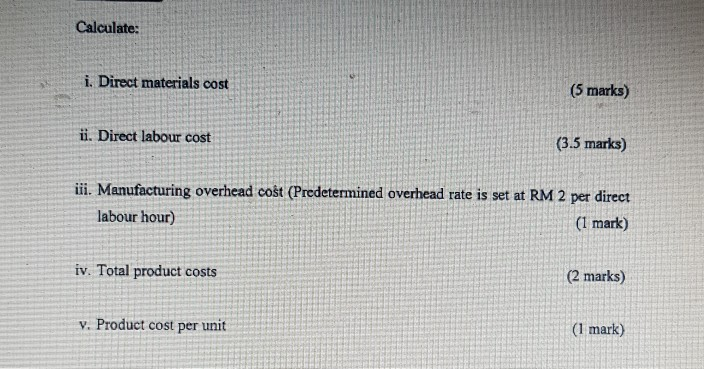

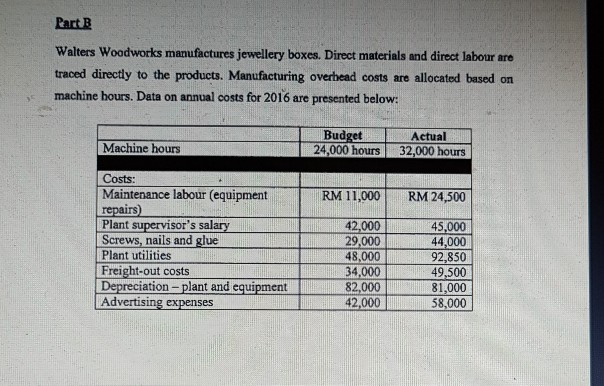

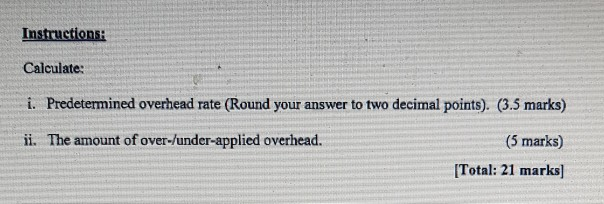

Part A Hamilton Feeders manufactures bird feeders. In September 2016, Hamilton Feeders received an order from Taman Burung Melaka for 24 platform bird feeders. The order from Taman Burung Melaka became Job 1102 at Hamilton Feeders. A materials requisition for Job 1102 is presented as follows Material Requisition Form #1250 Date: 14/9 Job no.: 1102 Part No. uantityUnit Cost Amount RM 25 Descr Ion WOCD06 Meranti planks SSF0304 Stainless steel fasteners84 AS222 Reinforced aluminiu 28 screens The labour time records for the week that these feeders were made are presented below Other products were also being produced during that week, so not all of the labour costs belongs to Job 1102. Labour Time Kecord Employee name: Kumar Wage rate: RM 6/hour Week: 14-20 September Record no.: 912 DateJob No.Start Time End TimeHours 14/9 419 15/9 Cost 1101 102 1103 0900 1200 0900 1700 1100 Calculate: i. Direct materials cost (5 marks) ii. Direct labour cost (3.5 marks) ii. Manufacturing overhead cost (Predetermined overhead rate is set at RM 2 per direct labour hour) (1 mark) (2 marks) (1 mark) iv. Total product costs v. Product cost per unit Part B Walters Woodworks manufactures jewellery boxes. Direct materials and direct labour are traced directly to the products. Manufacturing overhead costs are allocated based on machine bours. Data on annual costs for 2016 are presented below: Budget 24,000 hours 32,000 hours Actual Machine hours Costs: Maintenance labour (equipment RM 11,000RM 24,500 Plant Screws, nails and glue Plant utilities Freight-out costs Depreciation- plant and equipment Advertising expenses sor's salary 42,000 29,000 48,000 34,000 82,000 42,000 45,000 44,000 92,850 49,500 81.000 58,000 Instructions: Calculate: i. Predetermined overhead rate (Round your answer to two decimal points). (3.5 marks) ii. The amount of over-/under-applied overhead. (5 marks) Total: 21 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started