Part A has 16 journal entries

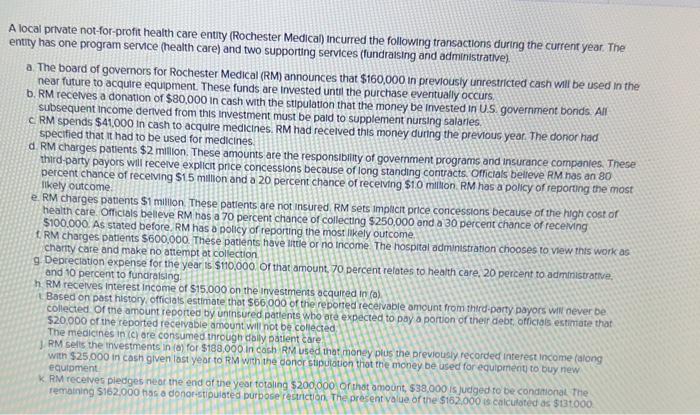

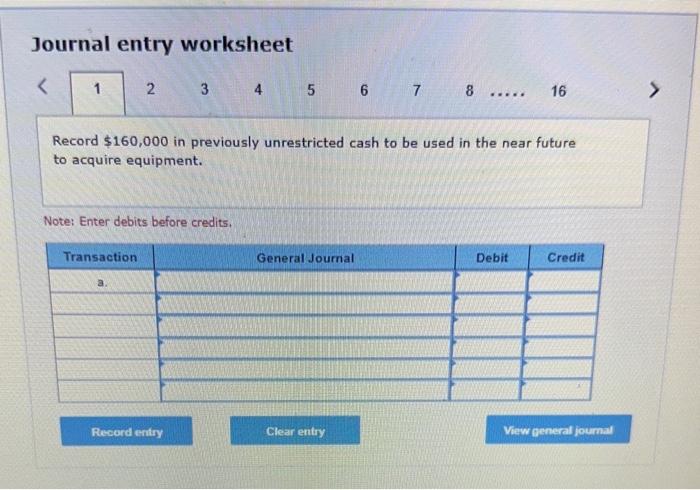

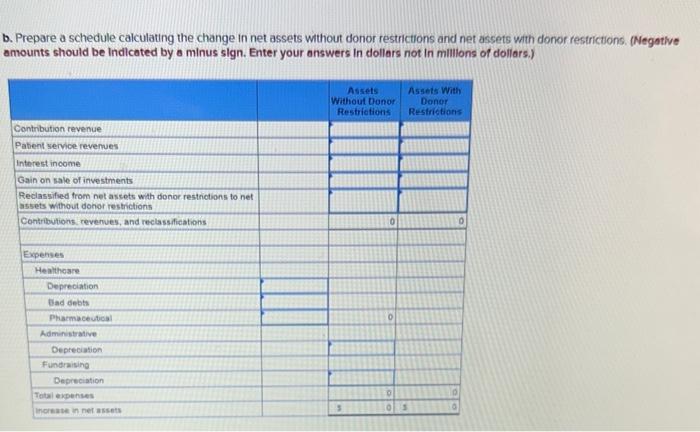

A local private not-for-profit health care entty (Rochester Medical) Incurred the following transactions during the current year. The entity has one program service (health care) and two supporting services (fundraising and administrative). a. The board of governors for Rochester Medical (RM) announces that $160,000 in prevlously unrestricted cash will be used in the near future to acquire equipment. These funds are invested until the purchase eventually occurs b. RM recelves a donation of $80,000 in cash with the stipulation that the money be invested in U.S. government bonds. All subsequent income derived from this investment must be paid to supplement nursing salaries. c. RM spends $41,000 in cash to acquire medicines. RM had recelved this money during the prevous year. The donor had specified that it had to be used for medicines. d. RM charges pattents $2 milion. These amounts are the responsibility of government programs and insurance companles. These third-party payors will recelve explicit price concessions because of long standing contracts. Officials belleve RM has an 80 percent chance of recelving $15 million and a 20 percent chance of recelving $1.0 million. RM has a policy of reporting the most likely outcome e. RM charges patients $1 million. These patients are not insured RM sets implicit price concessions because of the high cost of healih care. Officials belleve RM has a 70 percent chance of collecting $250,000 and a 30 percent chance of receling $100,000. As stated before. RM has a policy of reporting the most likely outcome 1. RM charges pattents $600,000. These patlents have litle or no income. The hospital administration chooses to view this work as charity care and make no attempt at collection 9. Depreciation expense for the year is $110,000 Of that amount 70 percentrelates to health care, 20 percent to adminisuattie, and 10 percent to fundralsing. h. RM receives interest Income of $15.000 on the investments ocquired in (o) 1. Based on past history, officals estimate that $66,000 of the reponed recelvable omount from third-party payors will oever be collected or the amount reported by untnsured patlents who ate expected to pay a portion of their debt, officiats estintate that $20,000 or the reported recelvable amount will not be collected The medicines in (c) ore consumed through dally patient care J RM selts the investments in (0) for $188,000 in cosh RM used that money plus the previously recarded interest income (along With $25,000 in cosh given lost year to RM wth the oonor staputation thot the money be used for equipmeny to buy new equibment K. RM receives piedges ne or the end of the year totaling $200,doo or thot omount, $38,000 is uudged to be conditionat. the remaining $162,000 tiss a donor stipuiloted purbose reanction. The, present value of the $162,000 is calculoted as $13 toco. Journal entry worksheet Record $160,000 in previously unrestricted cash to be used in the near future to acquire equipment. Note: Enter debits before credits. b. Prepare a schedule calculating the change in net assets without donor restrictions and net assets with donor restrictions. (Negative amounts should be Indicated by a minus sign. Enter your answers in dollars not In mililons of dollars.)