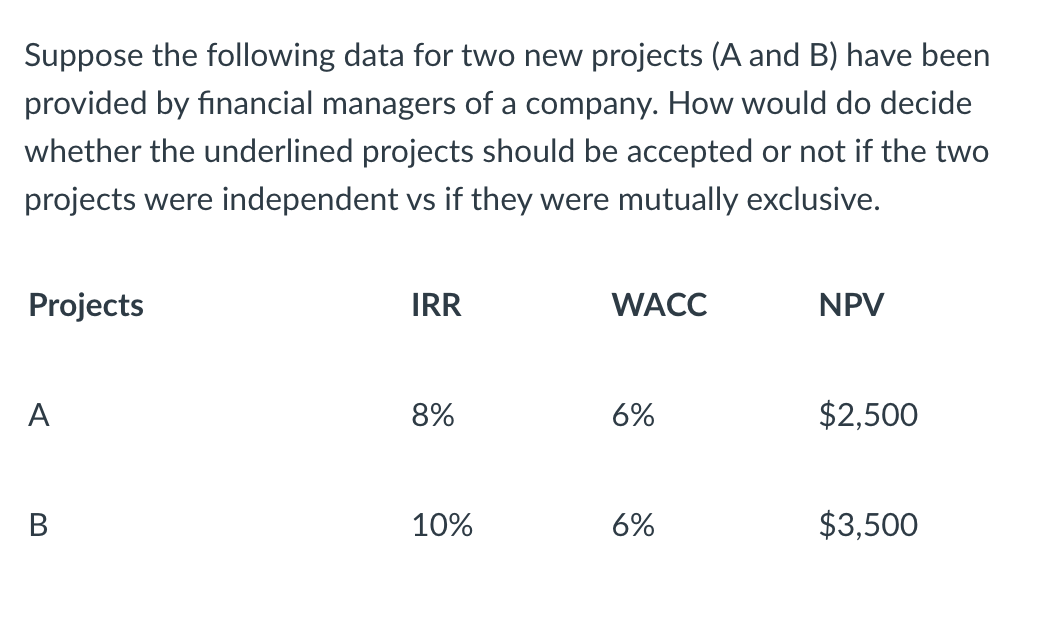

Question

Part A has been answered, please answer only part B Projects are independent : If IRR higher than WACC then only project accepted If NPV

Part A has been answered, please answer only part B

Projects are independent :

If IRR higher than WACC then only project accepted

If NPV positive , project accepted

Project A and B both has higher IRR than WACC and positive NPV so both project accepted

If projects are mutually exclusive:

Only one project selected if one of the project has higher NPV or IRR.

Here, project B has higher NPV and IRR than Project A, so project A only accepted and project B rejected.

Above is the answer to part A

ANSWER THIS Q ONLY:

Part B:

Instructions: Compute and interpret the following tasks. Show all the steps to obtain your results. Showing only the final answer without interpreting the results you obtained would lead to penalty.

Suppose the average rate of return of an investment was 12% and its standard deviation was 20%. What should be the range of returns within which we are 95% confident that the next periods return would lie?

View keyboard shortcuts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started