Answered step by step

Verified Expert Solution

Question

1 Approved Answer

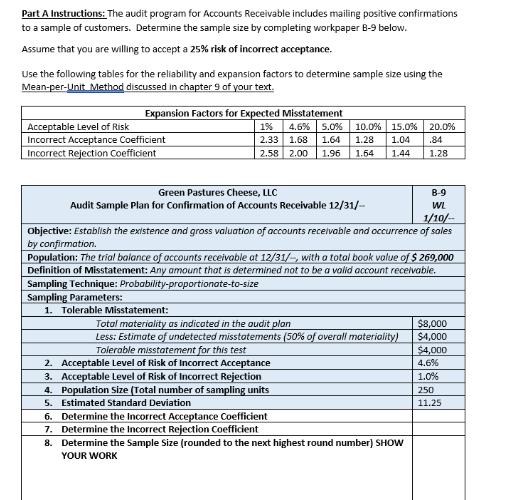

Part A Instructions: The audit program for Accounts Receivable includes mailing positive confirmations to a sample of customers. Determine the sample size by completing

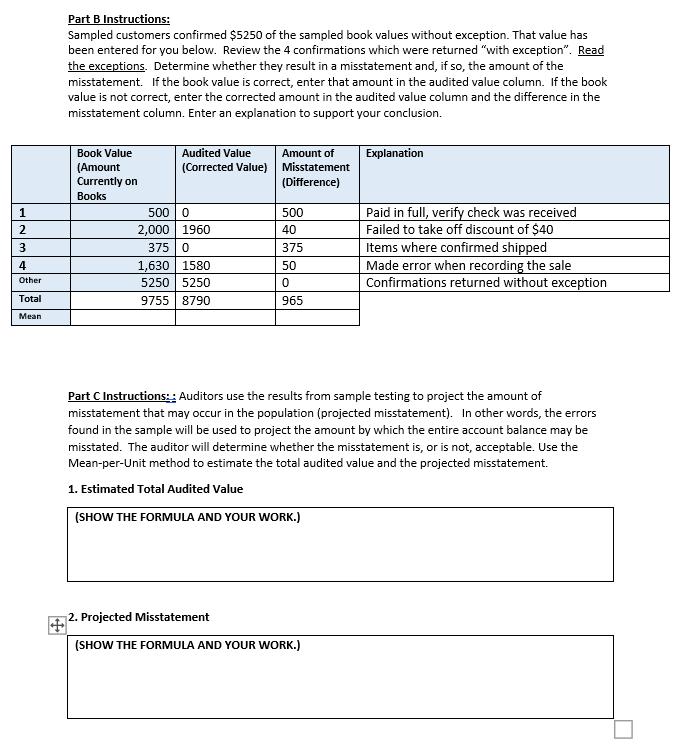

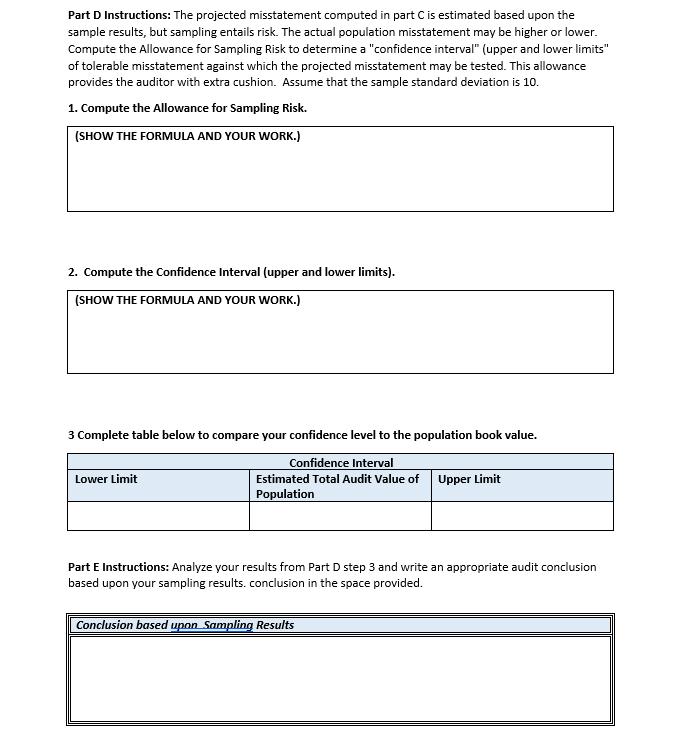

Part A Instructions: The audit program for Accounts Receivable includes mailing positive confirmations to a sample of customers. Determine the sample size by completing workpaper B-9 below. Assume that you are willing to accept a 25% risk of incorrect acceptance. Use the following tables for the reliability and expansion factors to determine sample size using the Mean-per-Unit Method discussed in chapter 9 of your text. Expansion Factors for Expected Misstatement Acceptable Level of Risk Incorrect Acceptance Coefficient Incorrect Rejection Coefficient 1% 4.6% 5.0% 10.0% 15.0% 2.33 1.68 1.64 1.28 1.04 2.58 2.00 1.96 1.54 1.44 20.0% .84 1.28 Green Pastures Cheese, LLC Audit Sample Plan for Confirmation of Accounts Receivable 12/31/-- B-9 WL 1/10/- Objective: Establish the existence and gross valuation of accounts receivable and occurrence of sales by confirmation. Population: The trial balance of accounts receivable at 12/31/-, with a total book value of $269,000 Definition of Misstatement: Any amount that is determined not to be a valid account receivable. Sampling Technique: Probability-proportionate-to-size Sampling Parameters: 1. Tolerable Misstatement: Total materiality as indicated in the audit plan Less: Estimate of undetected misstatements (50% of overall materiality) Tolerable misstatement for this test $8,000 $4,000 $4,000 2. Acceptable level of Risk of Incorrect Acceptance 3. Acceptable level of Risk of Incorrect Rejection 4. Population Size (Total number of sampling units 5. Estimated Standard Deviation 6. Determine the Incorrect Acceptance Coefficient 7. Determine the Incorrect Rejection Coefficient 8. Determine the Sample Size (rounded to the next highest round number) SHOW YOUR WORK 4.6% 1.0% 250 11.25 Part B Instructions: Sampled customers confirmed $5250 of the sampled book values without exception. That value has been entered for you below. Review the 4 confirmations which were returned "with exception". Read the exceptions. Determine whether they result in a misstatement and, if so, the amount of the misstatement. If the book value is correct, enter that amount in the audited value column. If the book value is not correct, enter the corrected amount in the audited value column and the difference in the misstatement column. Enter an explanation to support your conclusion. Book Value (Amount Audited Value (Corrected Value) Currently on Amount of Misstatement (Difference) Explanation Books 1 500 0 500 2 2,000 1960 40 3 375 0 375 4 1,630 1580 50 Other 5250 5250 0 Total Mean 9755 8790 965 Paid in full, verify check was received Failed to take off discount of $40 Items where confirmed shipped Made error when recording the sale Confirmations returned without exception Part C Instructions: Auditors use the results from sample testing to project the amount of misstatement that may occur in the population (projected misstatement). In other words, the errors found in the sample will be used to project the amount by which the entire account balance may be misstated. The auditor will determine whether the misstatement is, or is not, acceptable. Use the Mean-per-Unit method to estimate the total audited value and the projected misstatement. 1. Estimated Total Audited Value (SHOW THE FORMULA AND YOUR WORK.) 2. Projected Misstatement (SHOW THE FORMULA AND YOUR WORK.) Part D Instructions: The projected misstatement computed in part C is estimated based upon the sample results, but sampling entails risk. The actual population misstatement may be higher or lower. Compute the Allowance for Sampling Risk to determine a "confidence interval" (upper and lower limits" of tolerable misstatement against which the projected misstatement may be tested. This allowance provides the auditor with extra cushion. Assume that the sample standard deviation is 10. 1. Compute the Allowance for Sampling Risk. (SHOW THE FORMULA AND YOUR WORK.) 2. Compute the Confidence Interval (upper and lower limits). (SHOW THE FORMULA AND YOUR WORK.) 3 Complete table below to compare your confidence level to the population book value. Lower Limit Confidence Interval Estimated Total Audit Value of Upper Limit Population Part E Instructions: Analyze your results from Part D step 3 and write an appropriate audit conclusion based upon your sampling results. conclusion in the space provided. Conclusion based upon Sampling Results

Step by Step Solution

★★★★★

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

To help you with the audit sampling exercise provided I will walk you through the steps to calculate the Estimated Total Audited Value Projected Misstatement Allowance for Sampling Risk and the Confid...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started