Part A is correct. I just need help with Part B. Thank you!

Part A is correct. I just need help with Part B. Thank you!

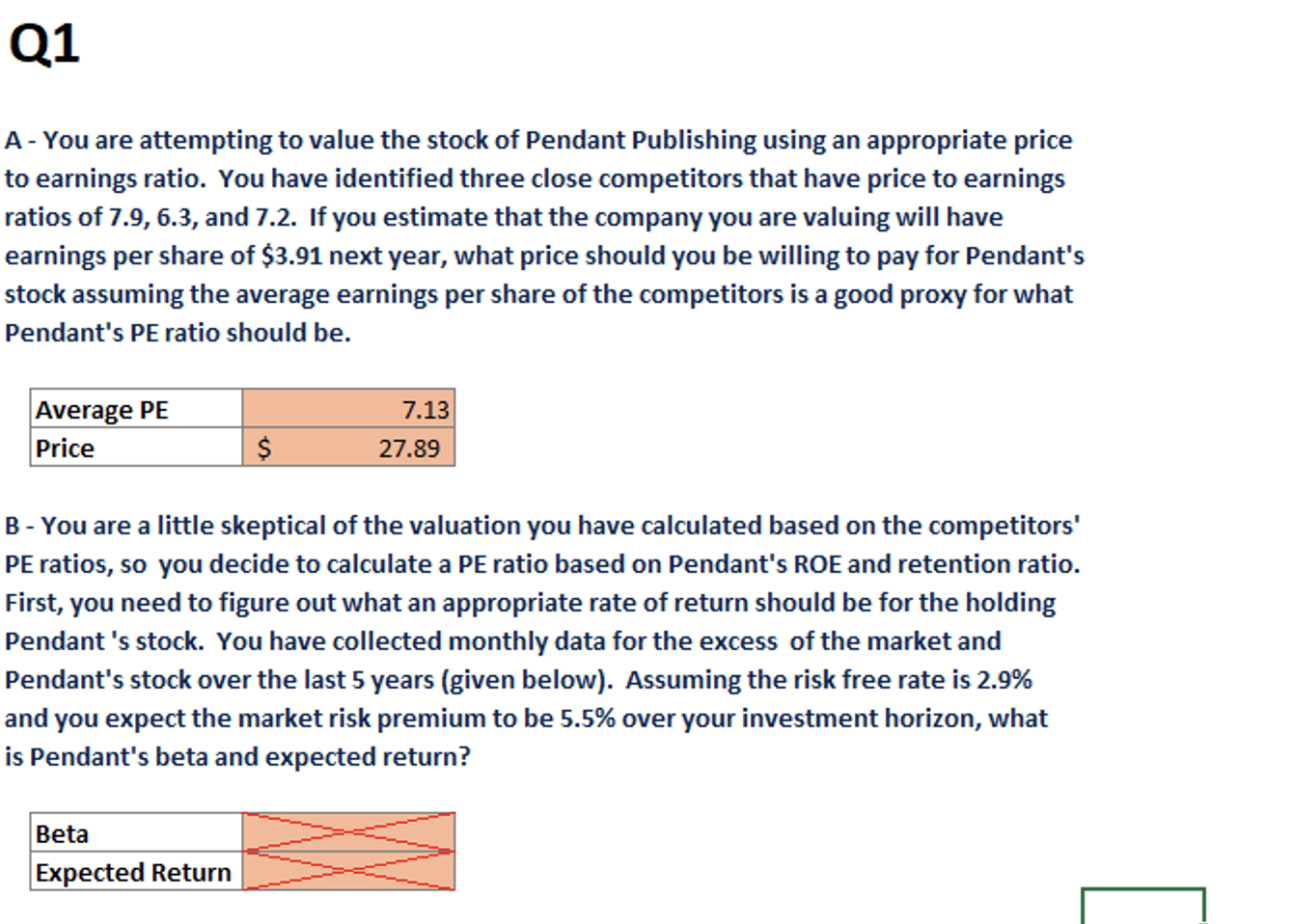

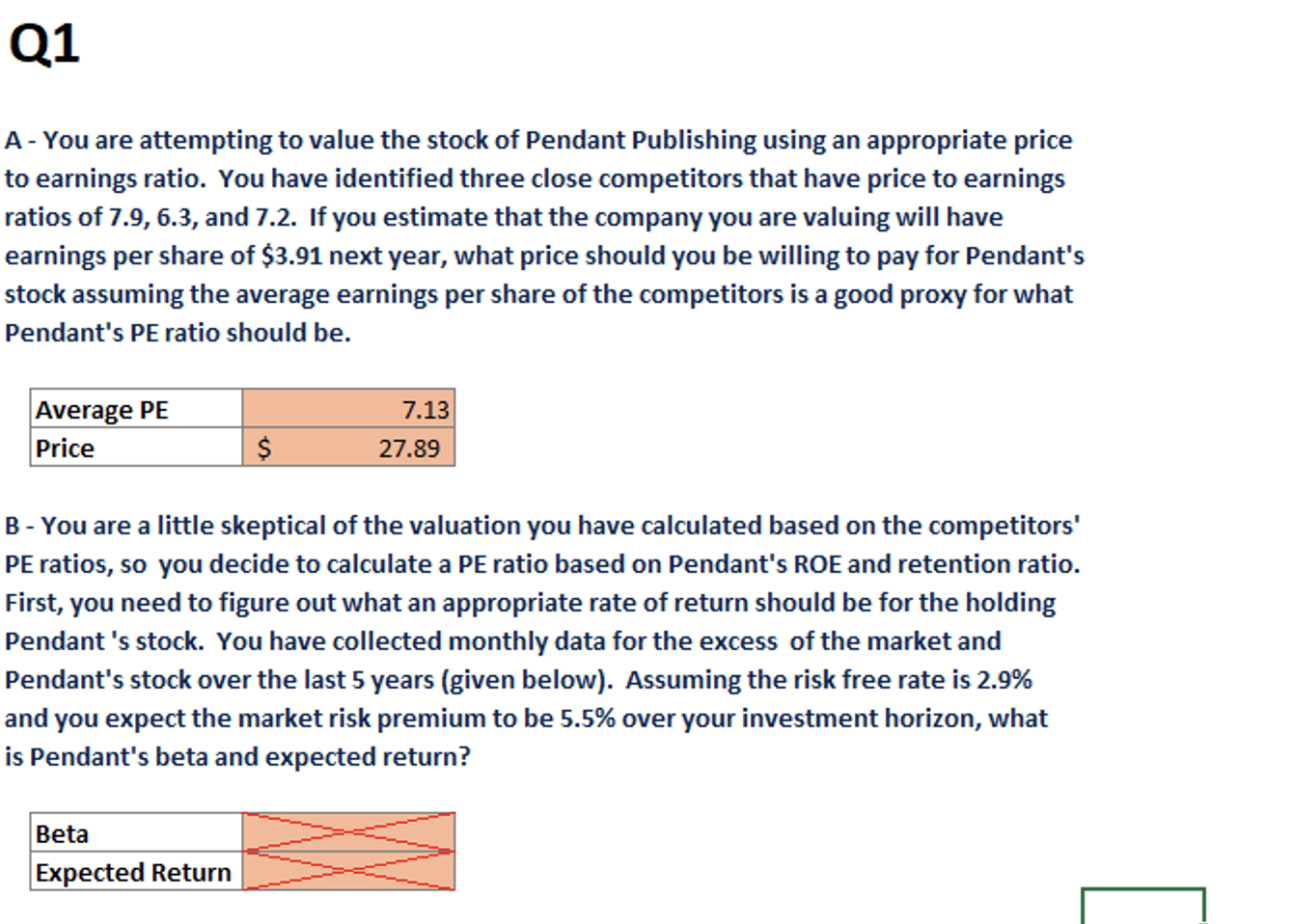

Q1 A - You are attempting to value the stock of Pendant Publishing using an appropriate price to earnings ratio. You have identified three close competitors that have price to earnings ratios of 7.9, 6.3, and 7.2. If you estimate that the company you are valuing will have earnings per share of $3.91 next year, what price should you be willing to pay for Pendant's stock assuming the average earnings per share of the competitors is a good proxy for what Pendant's PE ratio should be. 7.13 Average PE Price $ 27.89 B - You are a little skeptical of the valuation you have calculated based on the competitors' PE ratios, so you decide to calculate a PE ratio based on Pendant's ROE and retention ratio. First, you need to figure out what an appropriate rate of return should be for the holding Pendant 's stock. You have collected monthly data for the excess of the market and Pendant's stock over the last 5 years (given below). Assuming the risk free rate is 2.9% and you expect the market risk premium to be 5.5% over your investment horizon, what is Pendant's beta and expected return? Beta Expected Return Q1 A - You are attempting to value the stock of Pendant Publishing using an appropriate price to earnings ratio. You have identified three close competitors that have price to earnings ratios of 7.9, 6.3, and 7.2. If you estimate that the company you are valuing will have earnings per share of $3.91 next year, what price should you be willing to pay for Pendant's stock assuming the average earnings per share of the competitors is a good proxy for what Pendant's PE ratio should be. 7.13 Average PE Price $ 27.89 B - You are a little skeptical of the valuation you have calculated based on the competitors' PE ratios, so you decide to calculate a PE ratio based on Pendant's ROE and retention ratio. First, you need to figure out what an appropriate rate of return should be for the holding Pendant 's stock. You have collected monthly data for the excess of the market and Pendant's stock over the last 5 years (given below). Assuming the risk free rate is 2.9% and you expect the market risk premium to be 5.5% over your investment horizon, what is Pendant's beta and expected return? Beta Expected Return

Part A is correct. I just need help with Part B. Thank you!

Part A is correct. I just need help with Part B. Thank you!