Question

Part A : It is May 15, 2000 and an investor is planning to invest $100 million in one of the two portfolios below. The

Part A : It is May 15, 2000 and an investor is planning to invest $100 million in one of the two portfolios below. The investors main concern is the change in interest rates that might affect the short term value of the portfolio. Compute the change in price of the security stemming from duration and convexity. Which portfolio is less sensitive to changes in interest rates? The portfolios are the following: (Please answer both parts using excel, thank you!)

Part B : Consider the exercise above. You are told that the mean of daily change in interest rates is zero and that the variance of the daily change of interest rates is 3.451 x 10 - 7. What is the annualized expected return taking into account convexity?

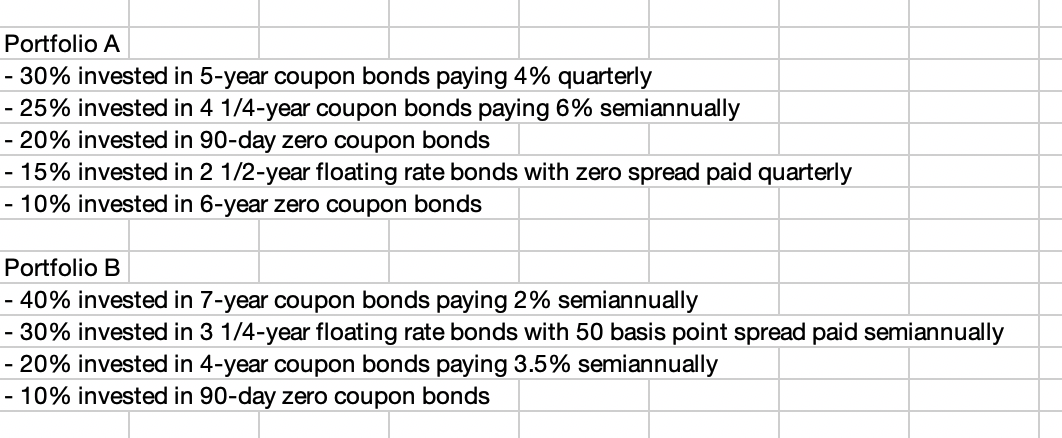

Portfolio A - 30% invested in 5-year coupon bonds paying 4% quarterly - 25% invested in 4 1/4-year coupon bonds paying 6% semiannually - 20% invested in 90-day zero coupon bonds 15% invested in 2 1/2-year floating rate bonds with zero spread paid quarterly - 10% invested in 6-year zero coupon bonds Portfolio B - 40% invested in 7-year coupon bonds paying 2% semiannually - 30% invested in 3 1/4-year floating rate bonds with 50 basis point spread paid semiannually - 20% invested in 4-year coupon bonds paying 3.5% semiannually - 10% invested in 90-day zero coupon bondsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started