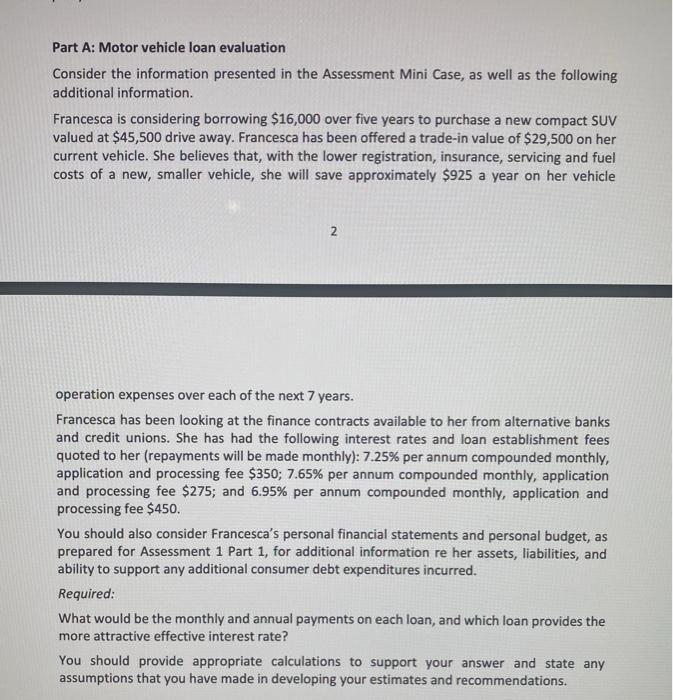

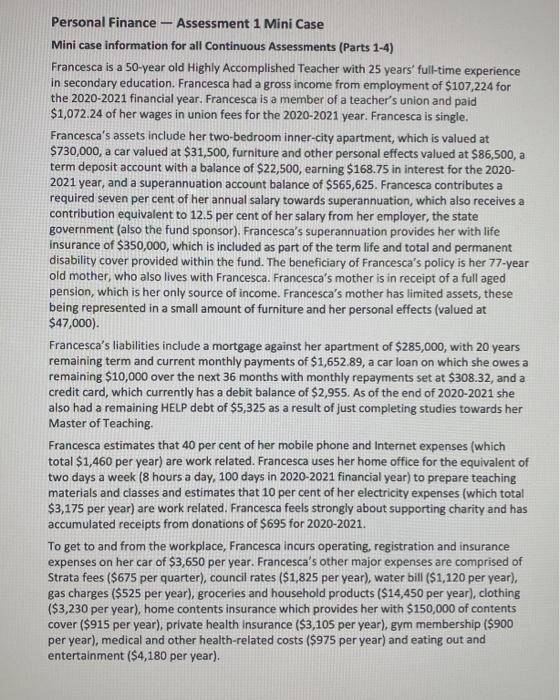

Part A: Motor vehicle loan evaluation Consider the information presented in the Assessment Mini Case, as well as the following additional information. Francesca is considering borrowing $16,000 over five years to purchase a new compact SUV valued at $45,500 drive away. Francesca has been offered a trade-in value of $29,500 on her current vehicle. She believes that, with the lower registration, insurance, servicing and fuel costs of a new, smaller vehicle, she will save approximately $925 a year on her vehicle operation expenses over each of the next 7 years. Francesca has been looking at the finance contracts available to her from alternative banks and credit unions. She has had the following interest rates and loan establishment fees quoted to her (repayments will be made monthly): 7.25% per annum compounded monthly, application and processing fee $350; 7.65% per annum compounded monthly, application and processing fee $275; and 6.95% per annum compounded monthly, application and processing fee $450. You should also consider Francesca's personal financial statements and personal budget, as prepared for Assessment 1 Part 1, for additional information re her assets, liabilities, and ability to support any additional consumer debt expenditures incurred. Required: What would be the monthly and annual payments on each loan, and which loan provides the more attractive effective interest rate? You should provide appropriate calculations to support your answer and state any assumptions that you have made in developing your estimates and recommendations. Part A: Motor vehicle loan evaluation Consider the information presented in the Assessment Mini Case, as well as the following additional information. Francesca is considering borrowing $16,000 over five years to purchase a new compact SUV valued at $45,500 drive away. Francesca has been offered a trade-in value of $29,500 on her current vehicle. She believes that, with the lower registration, insurance, servicing and fuel costs of a new, smaller vehicle, she will save approximately $925 a year on her vehicle operation expenses over each of the next 7 years. Francesca has been looking at the finance contracts available to her from alternative banks and credit unions. She has had the following interest rates and loan establishment fees quoted to her (repayments will be made monthly): 7.25% per annum compounded monthly, application and processing fee $350; 7.65% per annum compounded monthly, application and processing fee $275; and 6.95% per annum compounded monthly, application and processing fee $450. You should also consider Francesca's personal financial statements and personal budget, as prepared for Assessment 1 Part 1, for additional information re her assets, liabilities, and ability to support any additional consumer debt expenditures incurred. Required: What would be the monthly and annual payments on each loan, and which loan provides the more attractive effective interest rate? You should provide appropriate calculations to support your answer and state any assumptions that you have made in developing your estimates and recommendations