Answered step by step

Verified Expert Solution

Question

1 Approved Answer

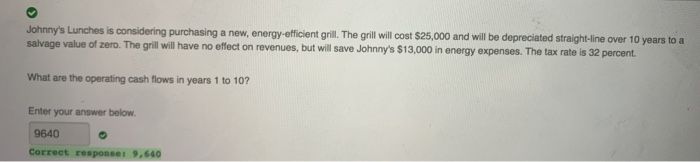

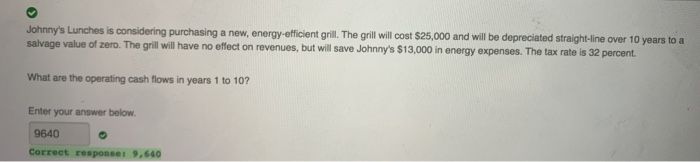

part A needed for part B Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $25,000 and will be depreciated straight-line

part A needed for part B

Johnny's Lunches is considering purchasing a new, energy-efficient grill. The grill will cost $25,000 and will be depreciated straight-line over 10 years to a salvage value of zero. The grill will have no effect on revenues, but will save Johnny's $13,000 in energy expenses. The tax rate is 32 percent. What are the operating cash flows in years 1 to 10? Enter your answer below 9640 Correct responset 9,640 If the discount rate is 14 percent, what is the net present value of the grill? Use the correct value for operating cash flow. Enter your answer below. Number Section Attempt 1 of 1 Verify

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started