Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A Nefarious Limited s reporting period ends on 3 1 March each year. On 3 0 September 2 0 2 2 an item of

Part A

Nefarious Limiteds reporting period ends on March each year. On September an item of factory property, plant and equipment that originally cost $Accumulated depreciation at April $ was traded in on a new item of property, plant and equipment that cost $ Nefarious Limited received $ on the trade in on the old property, plant and equipment. The installation of the new item of property, plant and equipment was completed on December and was ready for immediate use.

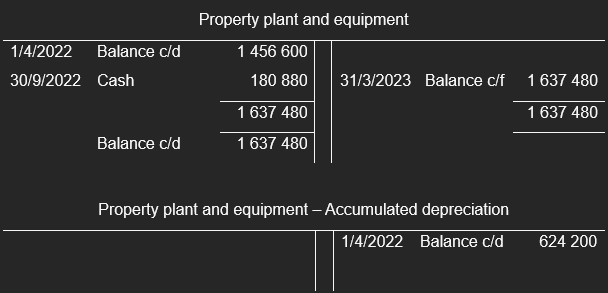

At March the property plant and equipment ledger account appeared as follows:

Property plant and equipment

Property plant and equipment Accumulated depreciation

As the junior accountnt was uncertain whether depreciation should be provided on the item of property, plant and equipment acquired or disposed of during the reporting period, he made the decision not to account for depreciation in the reporting period. An examination of the annual report reveals that property. Plant and equipment is depreciated on the straight line basis at per cent per annum.

The only entry to record the acquisition of the new item of property, plant and equipment that appeared in the accounting records was:

Sept

Dr Property, plant and equipment

Cr Cash

Entry to account for the acquisition of property, plant and equipment $ less trade in amount of $

REQUIRED:

a Prepare the journal entryies that the junior accountant should have made to correctly account for the sale of the property, plant and equipment.

b From the above information what amounts would be disclosed in the statement of comprehensive income Profit or loss and statement of financial position for the reporting period ending March You must clearly distinguish between statement of comprehensive income and statement of financial position disclosures. You are NOT required to prepare any accompanying financial statement note.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started