Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A Noeninal interest rates and yield curves A necent sludy of inationary expectations has revealed that the consensus among nterest rate movements will affect

PART A

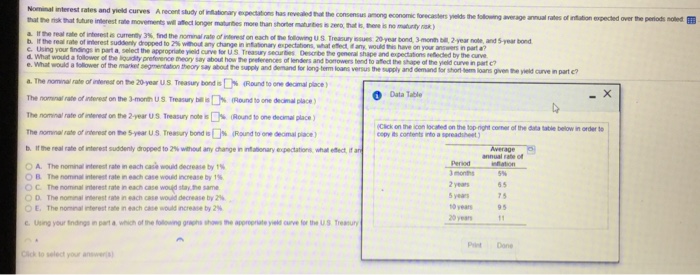

Noeninal interest rates and yield curves A necent sludy of inationary expectations has revealed that the consensus among nterest rate movements will affect longer maturtes more than shorter maturies s economic torecasters yelds the tollowing average annual rates of intation expecled over the periods noled a lf te real tate of intereste currerty 3% fnd the nmnal rate of norest on each of D6 folowing U S Treasury 6sues 207ear bond, Mont, b. 2-year note. the rea rate of rterest sudden, dopped to 2% any dur ge n ntaserary expedrers.ut-ot ,ank-og tu ha e. Using your tindings in part a, select the appropriate yieid curve for U.S Treasury securbes Describe the general shape and expectations seflected by the curve d. What would a follower of the liqudity preference meory say about how the preferences of lenders a e. What and borrowers tend to affledt the shape of the yield curve in part c? long-term loans versus the supply and demand for short sem loans gven the yield curve in part c? would a tolliower of the market segmentation theory say aboud the supply and demand for a. The normnal rate ofiterear on he 20-year u s Treasury bordis[ % (Rand toone domal place ) The nonnar rate ofntre on the 3-mort, US Treasury bas% "Round to one de inal place ) The nominal rate of interneat on the 2-year U S Treasury note isRound to one decimal place) Data Tabl copy ts contents into a spreadsheet b. "thereal rate ofit rest suddenly dopped to 2% wrot any hager, ntatonary expectations what elect at an annual rate of Periodation T-nornal rterest rate n each case would decrease by 1% each case wood increase by 1% A. months 2 years years 10 years95 5% 65 7 5 OB. nonnal interest fate C The nominal interest rate in each case woud stay the same D. The nonnai meest tate n each case woad decrease by 2% E. The no ral rivest rate n each case would ncrease by 2% 20 years Pint Done Cick to select your answe Noeninal interest rates and yield curves A necent sludy of inationary expectations has revealed that the consensus among nterest rate movements will affect longer maturtes more than shorter maturies s economic torecasters yelds the tollowing average annual rates of intation expecled over the periods noled a lf te real tate of intereste currerty 3% fnd the nmnal rate of norest on each of D6 folowing U S Treasury 6sues 207ear bond, Mont, b. 2-year note. the rea rate of rterest sudden, dopped to 2% any dur ge n ntaserary expedrers.ut-ot ,ank-og tu ha e. Using your tindings in part a, select the appropriate yieid curve for U.S Treasury securbes Describe the general shape and expectations seflected by the curve d. What would a follower of the liqudity preference meory say about how the preferences of lenders a e. What and borrowers tend to affledt the shape of the yield curve in part c? long-term loans versus the supply and demand for short sem loans gven the yield curve in part c? would a tolliower of the market segmentation theory say aboud the supply and demand for a. The normnal rate ofiterear on he 20-year u s Treasury bordis[ % (Rand toone domal place ) The nonnar rate ofntre on the 3-mort, US Treasury bas% "Round to one de inal place ) The nominal rate of interneat on the 2-year U S Treasury note isRound to one decimal place) Data Tabl copy ts contents into a spreadsheet b. "thereal rate ofit rest suddenly dopped to 2% wrot any hager, ntatonary expectations what elect at an annual rate of Periodation T-nornal rterest rate n each case would decrease by 1% each case wood increase by 1% A. months 2 years years 10 years95 5% 65 7 5 OB. nonnal interest fate C The nominal interest rate in each case woud stay the same D. The nonnai meest tate n each case woad decrease by 2% E. The no ral rivest rate n each case would ncrease by 2% 20 years Pint Done Cick to select your answe

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started