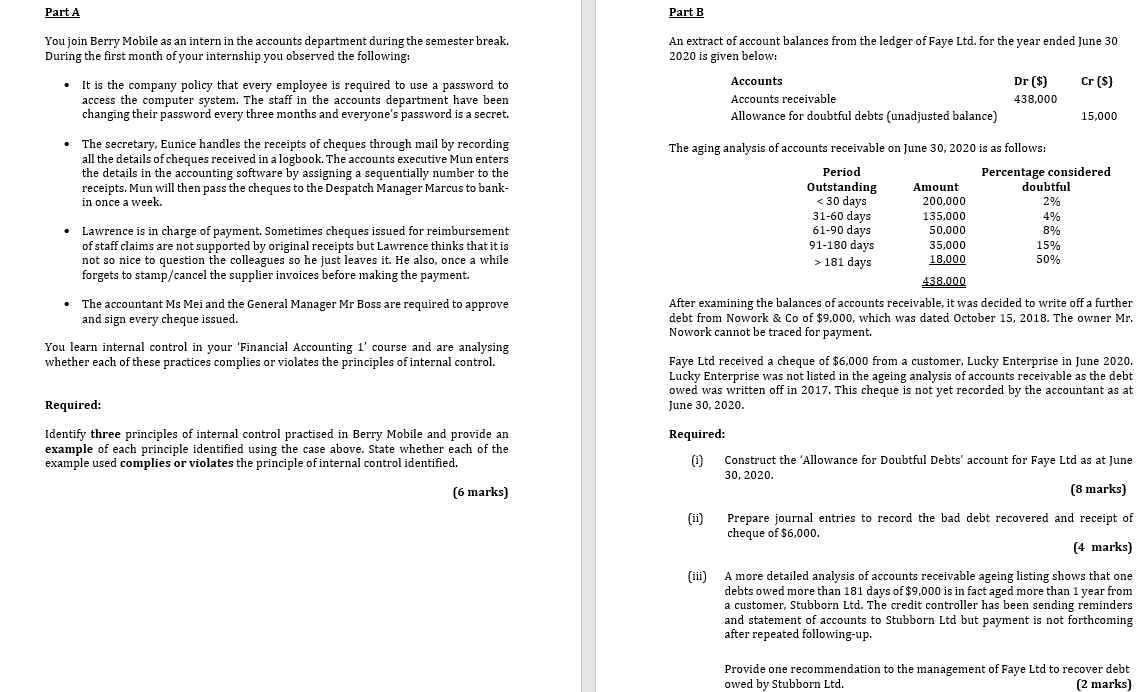

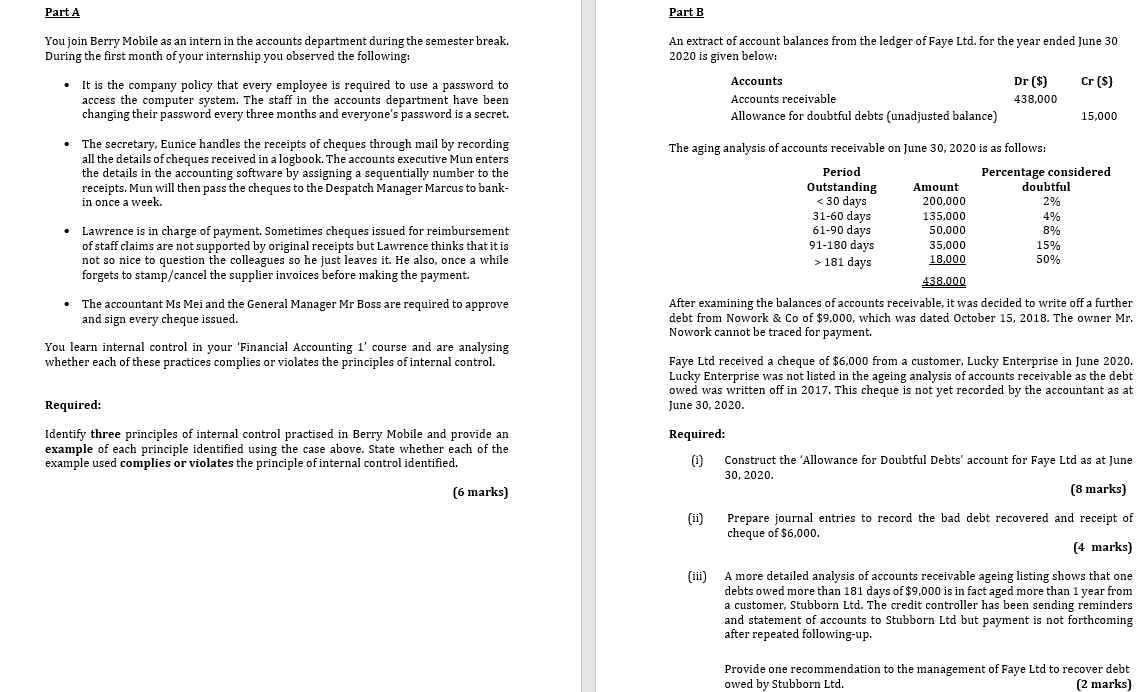

Part A Part B An extract of account balances from the ledger of Faye Ltd. for the year ended June 30 2020 is given below: You join Berry Mobile as an intern in the accounts department during the semester break. During the first month of your internship you observed the following: It is the company policy that every employee is required to use a password to access the computer system. The staff in the accounts department have been changing their password every three months and everyone's password is a secret. Cr ($) Accounts Accounts receivable Allowance for doubtful debts (unadjusted balance) Dr ($) 438,000 15,000 The secretary, Eunice handles the receipts of cheques through mail by recording all the details of cheques received in a logbook. The accounts executive Mun enters the details in the accounting software by assigning a sequentially number to the receipts. Mun will then pass the cheques to the Despatch Manager Marcus to bank- in once a week. Lawrence is in charge of payment. Sometimes cheques issued for reimbursement of staff claims are not supported by original receipts but Lawrence thinks that it is not so nice to question the colleagues so he just leaves it. He also, once a while forgets to stamp/cancel the supplier invoices before making the payment. The accountant Ms Mei and the General Manager Mr Boss are required to approve and sign every cheque issued. You learn internal control in your 'Financial Accounting 1' course and are analysing whether each of these practices complies or violates the principles of internal control. The aging analysis of accounts receivable on June 30, 2020 is as follows: Period Percentage considered Outstanding Amount doubtful 181 days 18,000 50% 438.000 After examining the balances of accounts receivable, it was decided to write off a further debt from Nowork & Co of $9,000, which was dated October 15, 2018. The owner Mr. Nowork cannot be traced for payment. Faye Ltd received a cheque of $6,000 from a customer, Lucky Enterprise in June 2020. Lucky Enterprise was not listed in the ageing analysis of accounts receivable as the debt owed was written off in 2017. This cheque is not yet recorded by the accountant as at June 30, 2020. Required: Identify three principles of internal control practised in Berry Mobile and provide an example of each principle identified using the case above. State whether each of the example used complies violates the principle of in rnal identified. Required: (i) Construct the 'Allowance for Doubtful Debts' account for Faye Ltd as at June 30, 2020. (8 marks) (6 marks) (ii) Prepare journal entries to record the bad debt recovered and receipt of cheque of $6,000. (4 marks) (iii) A more detailed analysis of accounts receivable ageing listing shows that one debts owed more than 181 days of $9,000 is in fact aged more than 1 year from a customer, Stubborn Ltd. The credit controller has been sending reminders and statement of accounts to Stubborn Ltd but payment is not forthcoming after repeated following-up. Provide one recommendation to the management of Faye Ltd to recover debt owed by Stubborn Ltd. (2 marks)