part A^^

Part B^^

part C^^^

Please answer Part A,B, and C. Part A is 90% complete already. i will thumbs if you do all three parts and the answers are correct :)

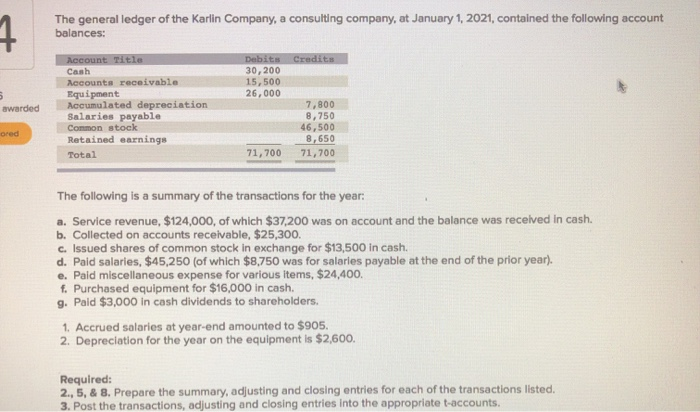

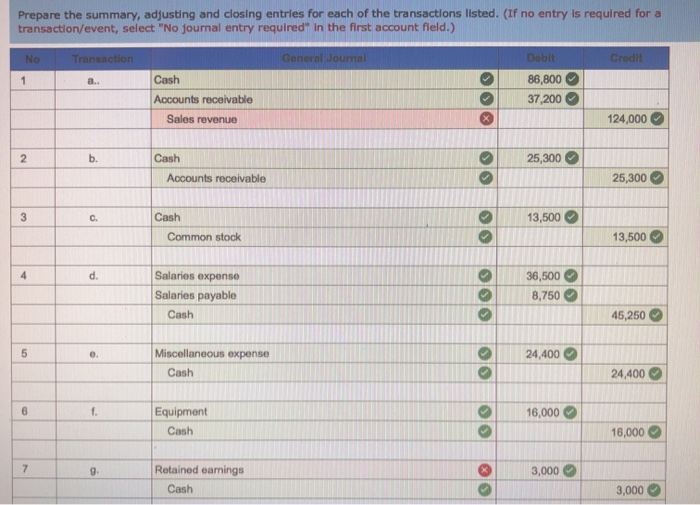

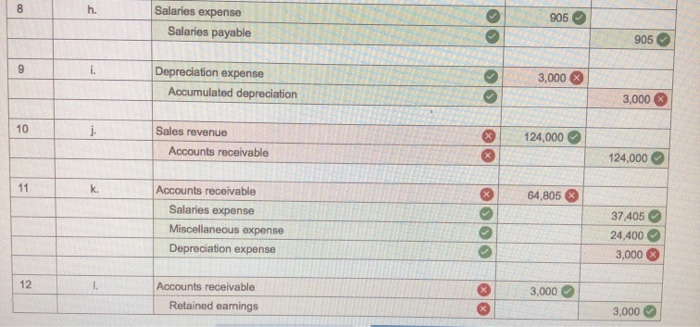

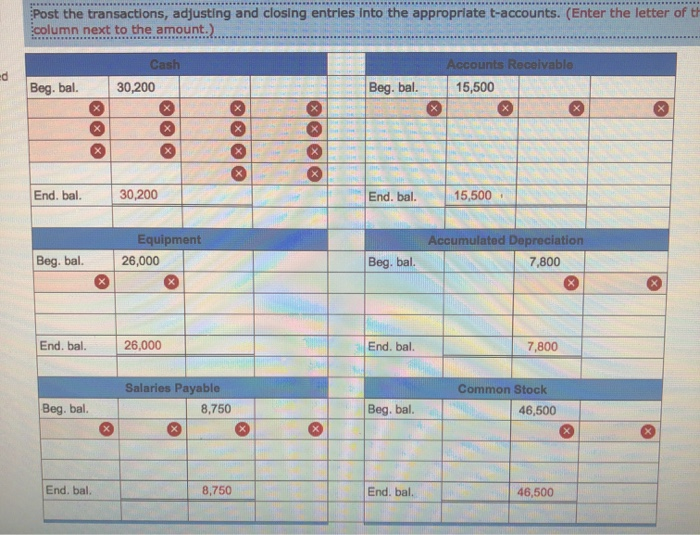

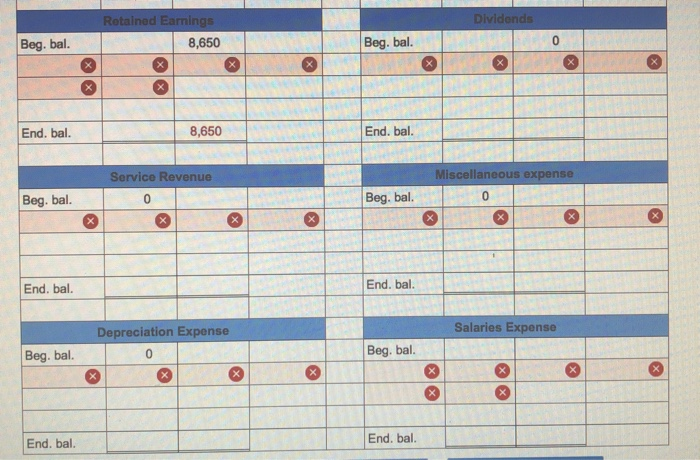

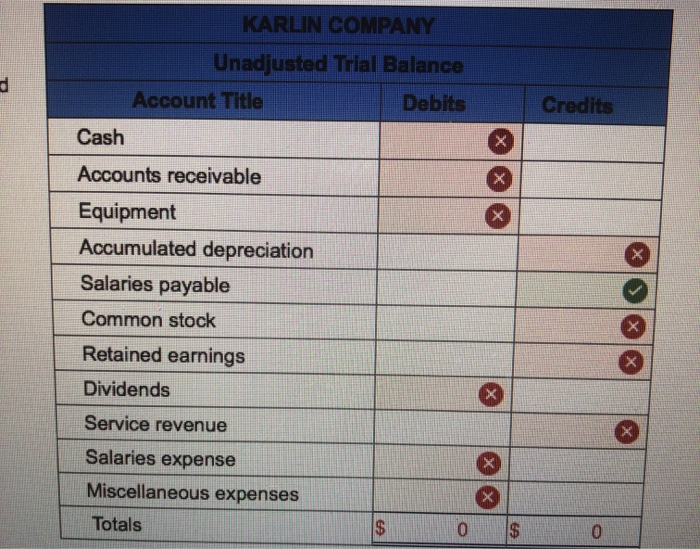

The general ledger of the Karlin Company, a consulting company, at January 1, 2021, contained the following account balances: Credits Debit 30,200 15,500 26,000 5 awarded Account Title Cash Accounts receivable Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Total ored 7,800 8,750 46,500 8,650 71,700 71,700 The following is a summary of the transactions for the year: a. Service revenue, $124,000, of which $37,200 was on account and the balance was received in cash. b. Collected on accounts receivable, $25,300. c. Issued shares of common stock in exchange for $13,500 in cash. d. Pald salaries, $45,250 (of which $8,750 was for salaries payable at the end of the prior year). e. Paid miscellaneous expense for various items, $24,400. f. Purchased equipment for $16,000 in cash. 9. Paid $3,000 in cash dividends to shareholders. 1. Accrued salaries at year-end amounted to $905. 2. Depreciation for the year on the equipment is $2,600. Required: 2., 5, & 8. Prepare the summary, adjusting and closing entries for each of the transactions listed, 3. Post the transactions, adjusting and closing entries into the appropriate t-accounts. Prepare the summary, adjusting and closing entries for each of the transactions listed. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) NO Transaction General Journal Dobit Credit 1 a. Cash Accounts receivable Sales revenue 86,800 37,200 124,000 2 b. 25,300 Cash Accounts receivable 25,300 3 C. Cash 13,500 Common stock 13,500 4 d. Salarios expense Salaries payable Cash 36,500 8,750 45,250 5 0. 24,400 Miscellaneous expense Cash 24,400 6 1. 16,000 Equipment Cash 16,000 7 9 3,000 Retained earnings Cash 3,000 8 h. Salaries expense Salaries payable 905 O 905 9 i. Depreciation expense Accumulated depreciation 3,000 3,000 10 j Sales revenue Accounts receivable 124,000 124,000 11 k. 64,805 Accounts receivable Salaries expense Miscellaneous expense Depreciation expense 37,405 24,400 3,000 12 Accounts receivable Retained earings 3,000 3,000 Post the transactions, adjusting and closing entries into the appropriate t-accounts. (Enter the letter of th column next to the amount.) Cash 30,200 Accounts Receivable 15,500 Beg. bal. Beg. bal. End, bal. 30,200 End. bal. 15,500 Equipment 26,000 Accumulated Depreciation 7,800 Beg. bal. Beg. bal. End, bal. 26,000 End. bal. 7,800 Common Stock Salaries Payable 8,750 Beg. bal. Beg. bal. 46,500 x End. bal. 8,750 End, bal 46,500 Dividends Retained Earnings 8,650 Beg. bal. Beg. bal. 0 End. bal. 8,650 End. bal. Service Revenue Miscellaneous expense Beg. bal. 0 Beg. bal. 0 End. bal. End. bal. Salaries Expense Depreciation Expense 0 Beg. bal. Beg. bal. x X End. bal. End. bal. KARLIN COMPANY Unadjusted Trial Balance Account Title Debits d Credits Cash X Accounts receivable X X Equipment Accumulated depreciation Salaries payable Common stock Retained earnings Dividends X Service revenue Salaries expense Miscellaneous expenses X Totals FA 0 $ 0