Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A) Part B) Part C) PLEASE LABEL EVERYTHING AS ASKED. THANKS! CROWN and PRINCE Crown & Prince are virtually identical companies, both companies began

Part A)  Part B)

Part B)  Part C)

Part C)

PLEASE LABEL EVERYTHING AS ASKED. THANKS!

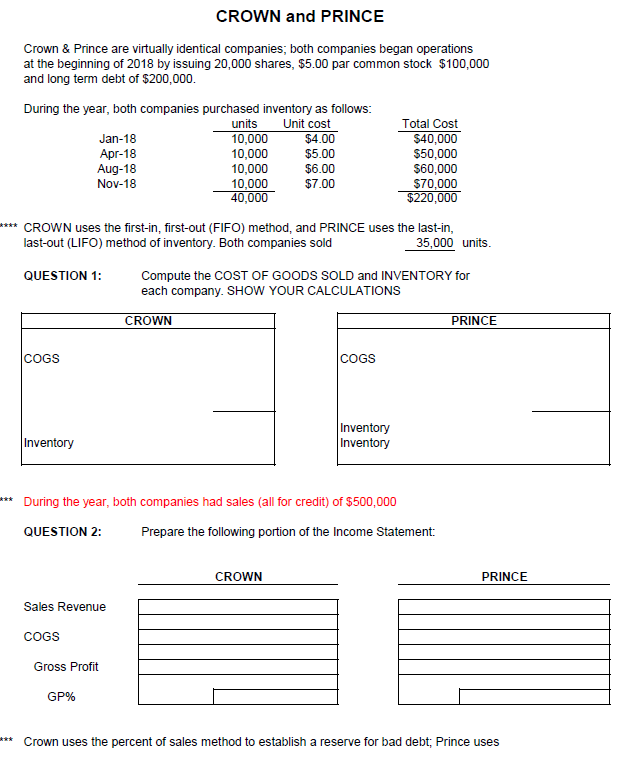

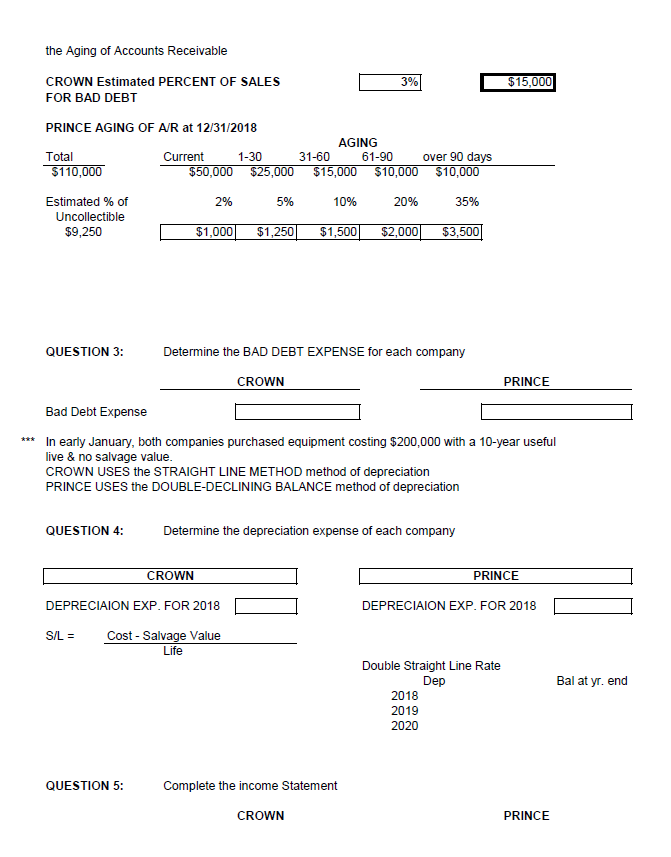

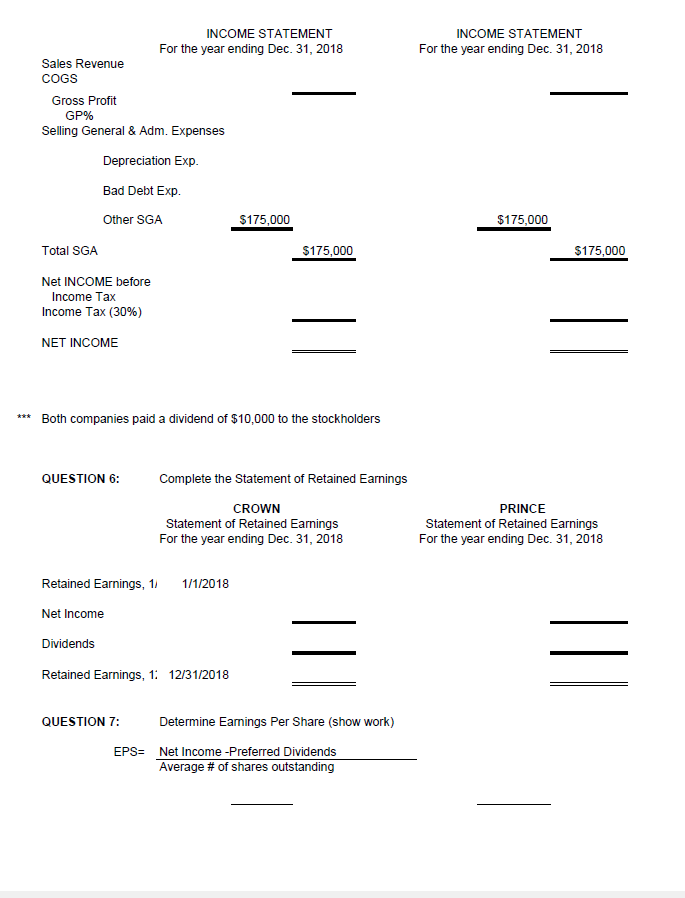

CROWN and PRINCE Crown & Prince are virtually identical companies, both companies began operations at the beginning of 2018 by issuing 20,000 shares, $5.00 par common stock $100,000 and long term debt of $200,000 During the year, both companies purchased inventory as follows Jan-18 Apr-18 Aug-18 Nov-18 units Unit cost 10,000 10,000 10,000 10,000 40,000 $4.00 $5.00 $6.00 $7.00 Total Cost $40,000 $50,000 $60,000 $70,000 $220,000 ****CROWN uses the first-in, first-out (FIFO) method, and PRINCE uses the last-in, last-out (LIFO) method of inventory. Both companies sold 35,000 units QUESTION 1: Compute the COST OF GOODS SOLD and INVENTORY for each company. SHOW YOUR CALCULATIONS CROWN PRINCE COGS COGS Inventory Inventory During the year, both companies had sales (all for credit) of $500,000 QUESTION 2: Prepare the following portion of the Income Statement: CROWN PRINCE Sales Revenue COGS Gross Profit GP% **Crown uses the percent of sales method to establish a reserve for bad debt, Prince uses the Aging of Accounts Receivable CROWN Estimated PERCENT OF SALES 3% $15,000 FOR BAD DEBT PRINCE AGING OF A/R at 12/31/2018 Total AGING Current 1 1-30 31-60 61-90 over 90 days $110,000 Estimated % of Uncollectible $9,250 2% 5% 10% 20% 35% $1,000$1,250$1,500$2,000$3,500 QUESTION 3: Determine the BAD DEBT EXPENSE for each company CROWN PRINCE Bad Debt Expense *In early January, both companies purchased equipment costing $200,000 with a 10-year useful live & no salvage value CROWN USES the STRAIGHT LINE METHOD method of depreciation PRINCE USES the DOUBLE-DECLINING BALANCE method of depreciation QUESTION 4: Determine the depreciation expense of each company CROWN PRINCE DEPRECIAION EXP. FOR 2018 DEPRECIAION EXP. FOR 2018 S/L = Cost Salvage Value Life Double Straight Line Rate Dep Bal at yr. end 2018 2019 2020 QUESTION 5: Complete the income Statement CROWN PRINCE INCOME STATEMENT INCOME STATEMENT For the year ending Dec. 31, 2018 For the year ending Dec. 31, 2018 Sales Revenue COGS Gross Profit GP% Selling General & Adm. Expenses Depreciation Exp Bad Debt Exp Other SGA 175,000 $175,000 Total SGA 175,000 175,000 Net INCOME before Income Tax Income Tax (30%) NET INCOME *Both companies paid a dividend of $10,000 to the stockholders QUESTION 6: Complete the Statement of Retained Eanings PRINCE CROWN Statement of Retained Earnings For the year ending Dec. 31, 2018 Statement of Retained Earnings For the year ending Dec. 31, 2018 Retained Earnings, 1 1/1/2018 Net Income Dividends Retained Earnings, 1 12/31/2018 QUESTION 7: Determine Eanings Per Share (show work) EPS= Net Income-Preferred Dividends Average # of shares outstandingStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started