Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A Part B Part C Please label your answers and make sure to round them properly. Thanks so much for the help!!! Pharoah Real

Part A

Part B

Part C

Please label your answers and make sure to round them properly. Thanks so much for the help!!!

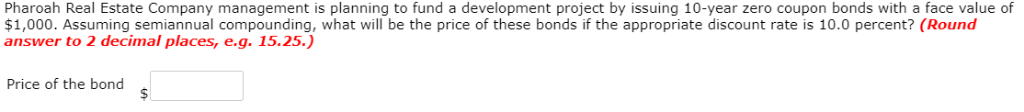

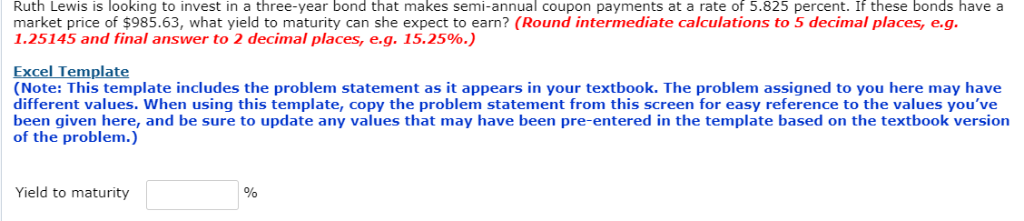

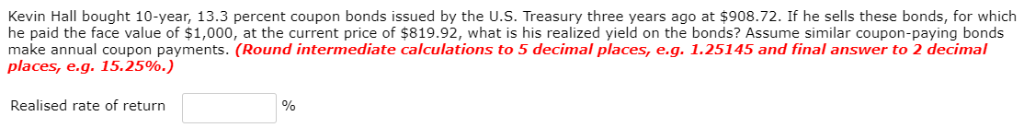

Pharoah Real Estate Company management is planning to fund a development project by issuing 10-year zero coupon bonds with a face value of $1,000. Assuming semiannual compounding, what will be the price of these bonds if the appropriate discount rate is 10.0 percent? (Round answer to 2 decimal places, e.g. 15.25.) Price of the bond s Ruth Lewis is looking to invest in a three-year bond that makes semi-annual coupon payments at a rate of 5.825 percent. If these bonds have a market price of $985.63, what yield to maturity can she expect to earn? (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and final answer to 2 decimal places, eg. 15.25%.) Excel Template (Note: This template includes the problem statement as it appears in your textbook. The problem assigned to you here may have different values. When using this template, copy the problem statement from this screen for easy reference to the values you've been given here, and be sure to update any values that may have been pre-entered in the template based on the textbook version of the problem.) Yield to maturity Kevin Hall bought 10-year, 13.3 percent coupon bonds issued by the U.S. Treasury three years ago at $908.72. If he sells these bonds, for which he paid the face value of $1,000, at the current price of $819.92, what is his realized yield on the bonds? Assume similar coupon-paying bonds make annual coupon payments. (Round intermediate calculations to 5 decimal places, e.g. 1.25145 and final answer to 2 decimal places, eg. 15.25%.) Realised rate of returnStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started