Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PART A: PART B: Please do January-March More info a. Stately Corporation pays for 55% of its direct materials purchases in the month of purchase

PART A:

PART B: Please do January-March

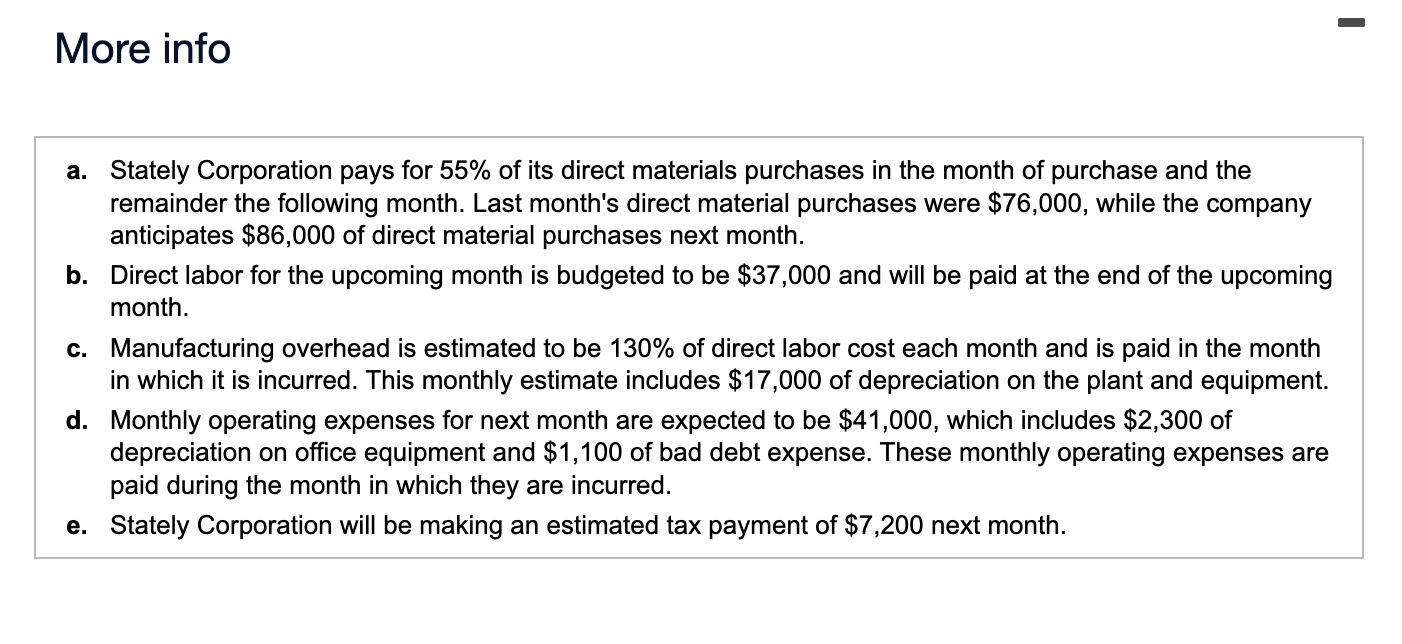

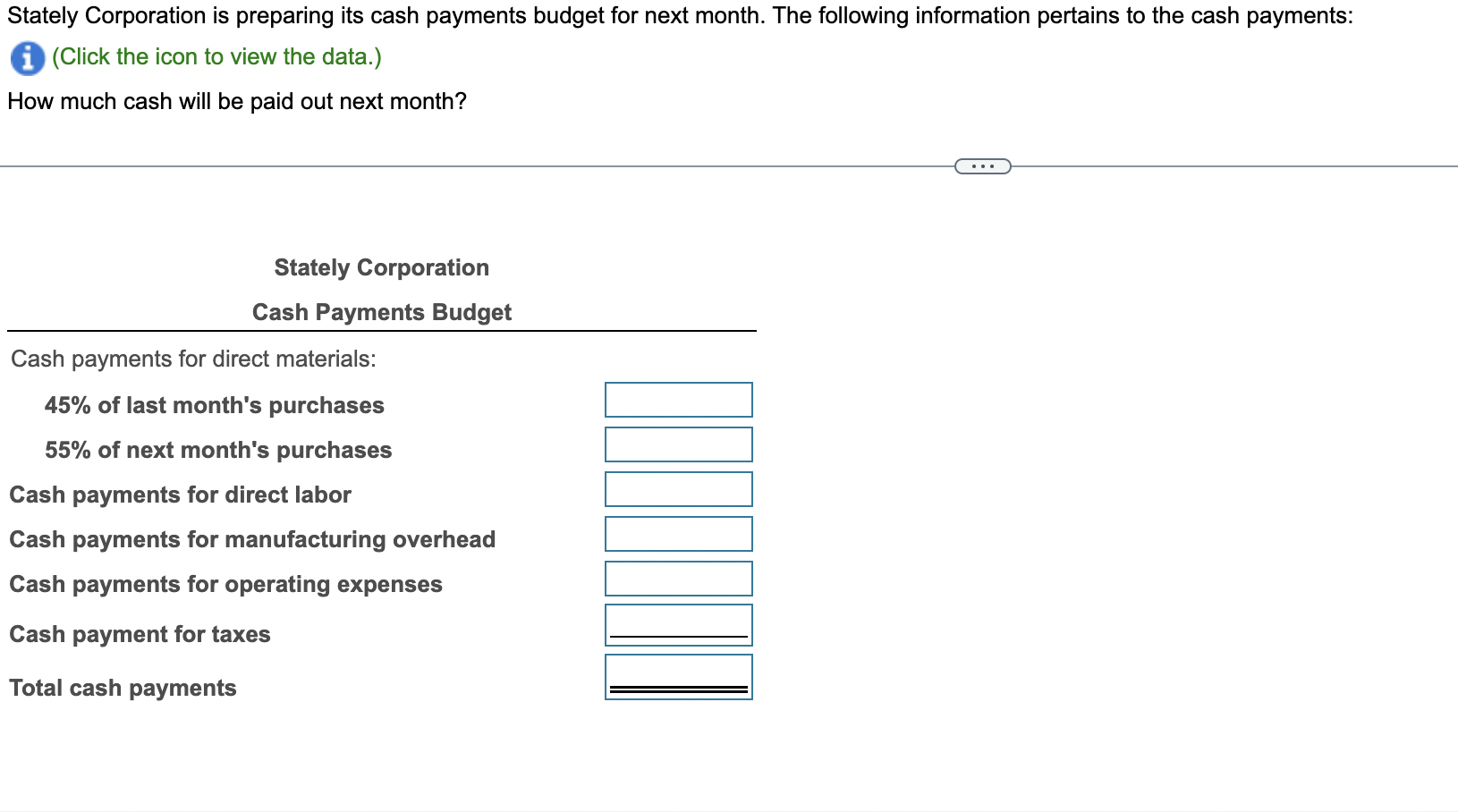

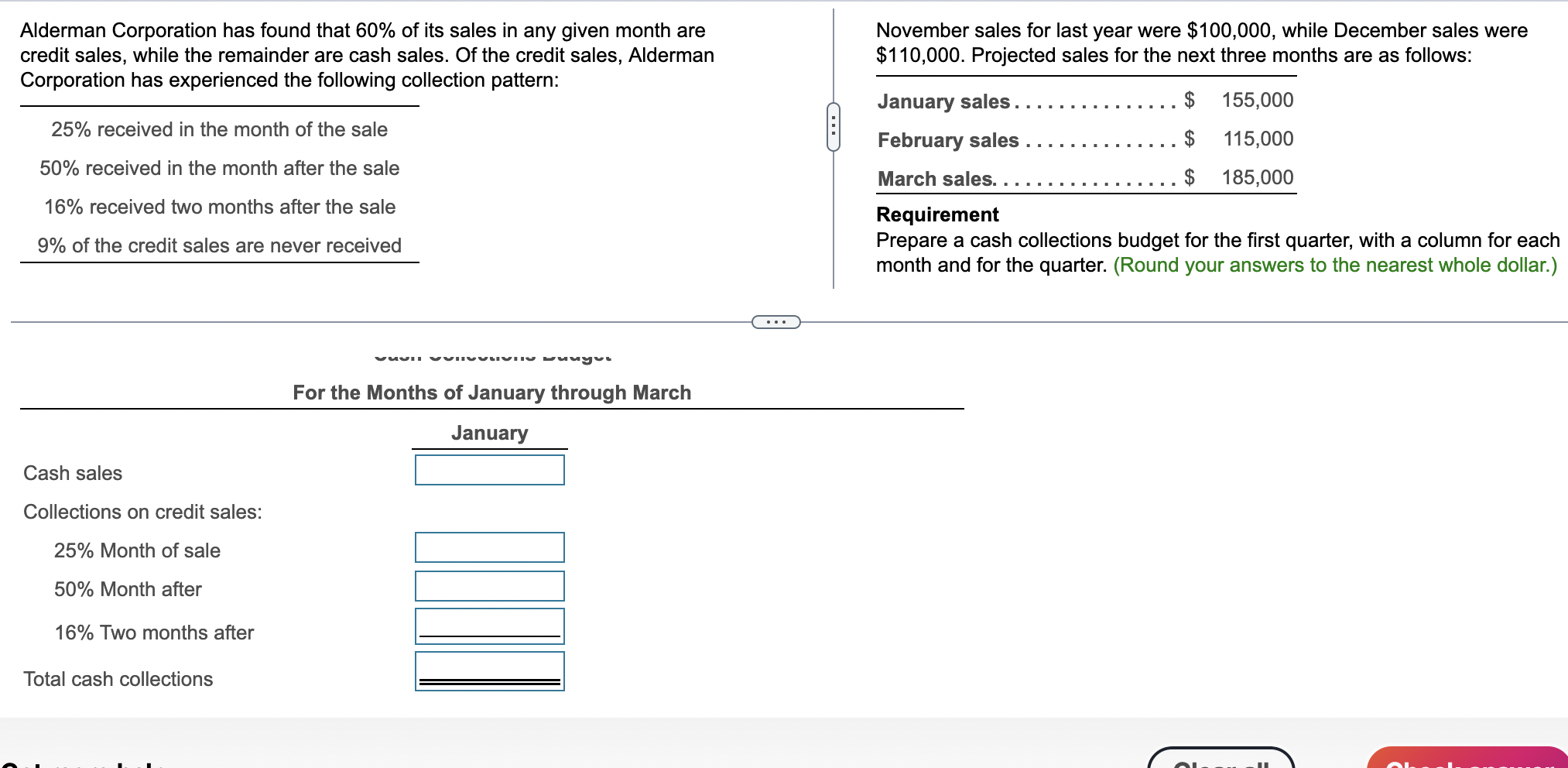

More info a. Stately Corporation pays for 55% of its direct materials purchases in the month of purchase and the remainder the following month. Last month's direct material purchases were $76,000, while the company anticipates $86,000 of direct material purchases next month. b. Direct labor for the upcoming month is budgeted to be $37,000 and will be paid at the end of the upcoming month. c. Manufacturing overhead is estimated to be 130% of direct labor cost each month and is paid in the month in which it is incurred. This monthly estimate includes $17,000 of depreciation on the plant and equipment. d. Monthly operating expenses for next month are expected to be $41,000, which includes $2,300 of depreciation on office equipment and $1,100 of bad debt expense. These monthly operating expenses are paid during the month in which they are incurred. e. Stately Corporation will be making an estimated tax payment of $7,200 next month. Stately Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: (Click the icon to view the data.) How much cash will be paid out next month? Alderman Corporation has found that 60% of its sales in any given month are November sales for last year were $100,000, while December sales were credit sales, while the remainder are cash sales. Of the credit sales, Alderman $110,000. Projected sales for the next three months are as follows: Corporation has experienced the following collection pattern: January sales.............\$ 155,000 \begin{tabular}{c} \hline 25% received in the month of the sale \\ 50% received in the month after the sale \\ 16% received two months after the sale \\ 9% of the credit sales are never received \\ \hline \end{tabular} February sales ........... \$ 115,000 RequirementMarchsales.............$185,000 Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.) For the Months of January through March Cash sales Collections on credit sales: 25% Month of sale 50% Month after 16% Two months after Total cash collections

More info a. Stately Corporation pays for 55% of its direct materials purchases in the month of purchase and the remainder the following month. Last month's direct material purchases were $76,000, while the company anticipates $86,000 of direct material purchases next month. b. Direct labor for the upcoming month is budgeted to be $37,000 and will be paid at the end of the upcoming month. c. Manufacturing overhead is estimated to be 130% of direct labor cost each month and is paid in the month in which it is incurred. This monthly estimate includes $17,000 of depreciation on the plant and equipment. d. Monthly operating expenses for next month are expected to be $41,000, which includes $2,300 of depreciation on office equipment and $1,100 of bad debt expense. These monthly operating expenses are paid during the month in which they are incurred. e. Stately Corporation will be making an estimated tax payment of $7,200 next month. Stately Corporation is preparing its cash payments budget for next month. The following information pertains to the cash payments: (Click the icon to view the data.) How much cash will be paid out next month? Alderman Corporation has found that 60% of its sales in any given month are November sales for last year were $100,000, while December sales were credit sales, while the remainder are cash sales. Of the credit sales, Alderman $110,000. Projected sales for the next three months are as follows: Corporation has experienced the following collection pattern: January sales.............\$ 155,000 \begin{tabular}{c} \hline 25% received in the month of the sale \\ 50% received in the month after the sale \\ 16% received two months after the sale \\ 9% of the credit sales are never received \\ \hline \end{tabular} February sales ........... \$ 115,000 RequirementMarchsales.............$185,000 Prepare a cash collections budget for the first quarter, with a column for each month and for the quarter. (Round your answers to the nearest whole dollar.) For the Months of January through March Cash sales Collections on credit sales: 25% Month of sale 50% Month after 16% Two months after Total cash collections Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started