PART A & PART B, QUESTION UPDATED

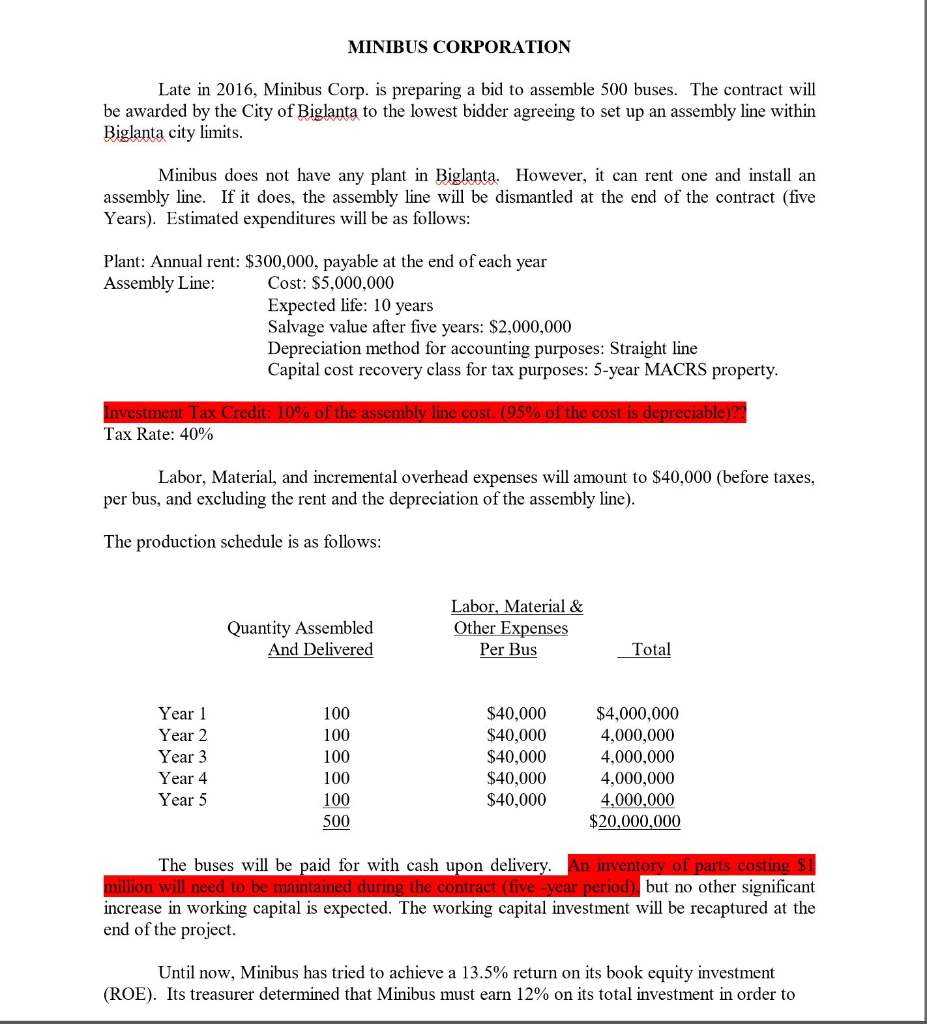

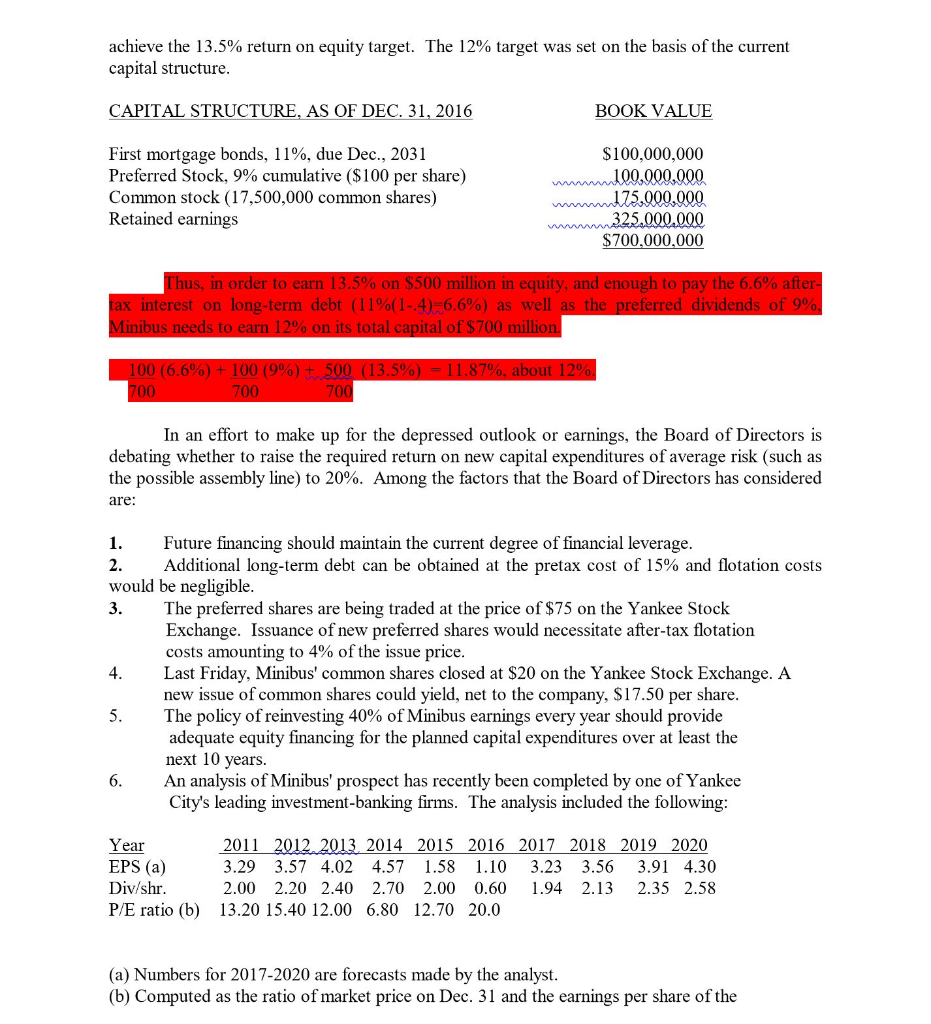

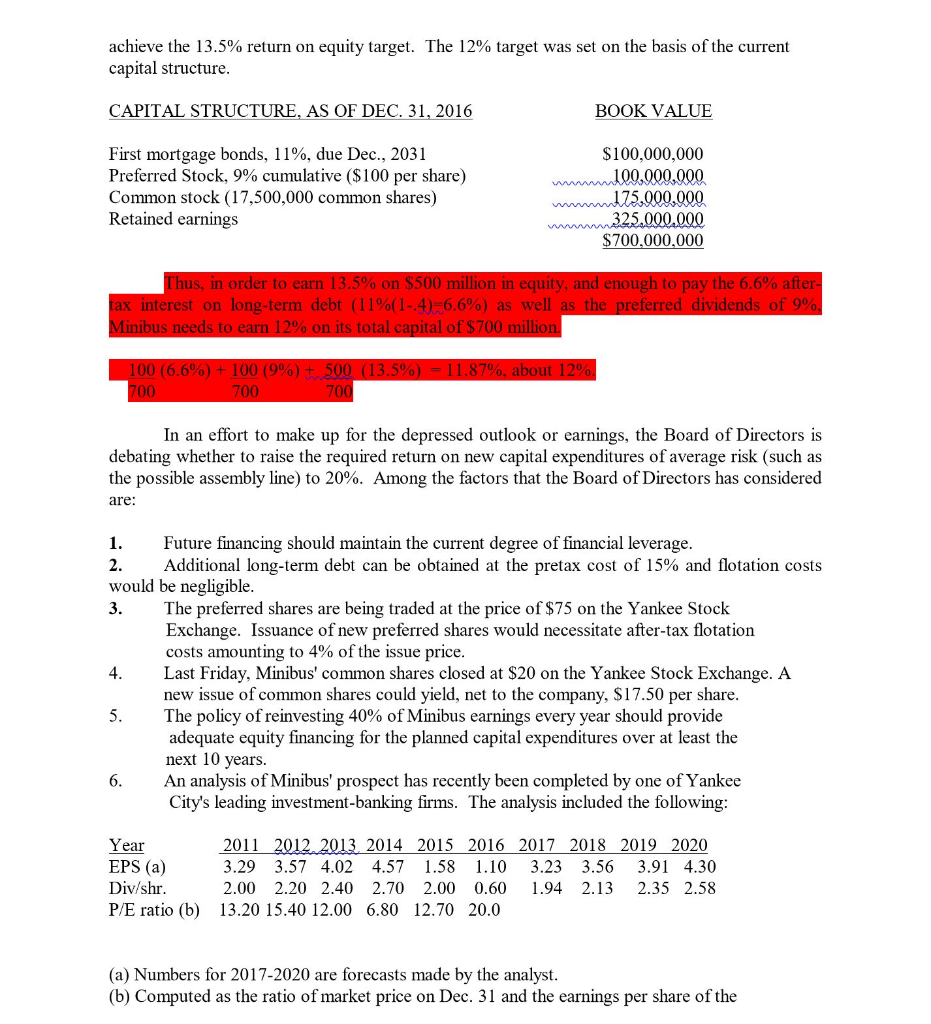

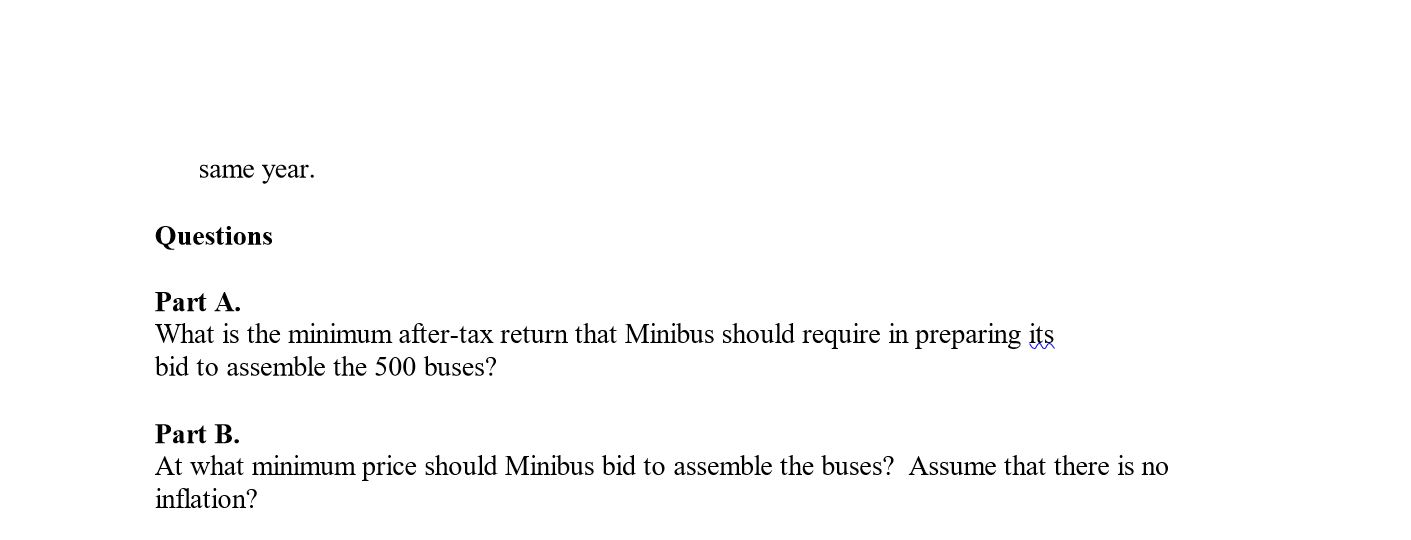

MINIBUS CORPORATION Late in 2016, Minibus Corp. is preparing a bid to assemble 500 buses. The contract will be awarded by the City of Biglanta to the lowest bidder agreeing to set up an assembly line within Biglanta city limits Minibus does not have any plant in Biglanta. However, it can rent one and install an assembly line. If it does, the assembly line will be dismantled at the end of the contract (five Years). Estimated expenditures will be as follows: Plant: Annual rent: $300,000, payable at the end of each year Assembly Line: Cost: $5,000,000 Expected life: 10 years Salvage value after five years: $2,000,000 Depreciation method for accounting purposes: Straight line Capital cost recovery class for tax purposes: 5-year MACRS property. Investment Tax Credit: 10% of the assembly line cost. (95% of the cost is depreciable)?? Tax Rate: 40% Labor, Material, and incremental overhead expenses will amount to $40,000 (before taxes, per bus, and excluding the rent and the depreciation of the assembly line). The production schedule is as follows: Quantity Assembled And Delivered Labor, Material & Other Expenses Per Bus Total Year 1 Year 2 Year 3 Year 4 Year 5 100 100 100 100 $40,000 $40,000 $40,000 $40,000 $40,000 $4,000,000 4,000,000 4,000,000 4,000,000 4,000,000 $20,000,000 100 500 The buses will be paid for with cash upon delivery. An inventory of parts costing $1 million will need to be maintained during the contract (five-year period), but no other significant increase in working capital is expected. The working capital investment will be recaptured at the end of the project. Until now, Minibus has tried to achieve a 13.5% return on its book equity investment (ROE). Its treasurer determined that Minibus must earn 12% on its total investment in order to achieve the 13.5% return on equity target. The 12% target was set on the basis of the current capital structure. CAPITAL STRUCTURE, AS OF DEC. 31, 2016 BOOK VALUE First mortgage bonds, 11%, due Dec., 2031 Preferred Stock, 9% cumulative ($100 per share) Common stock (17,500,000 common shares) Retained earnings m m $100,000,000 100.000.000 175.000.000 325.000.000 $700,000,000 Thus, in order to earn 13.5% on $500 million in equity, and enough to pay the 6.6% after- tax interest on long-term debt (11%(1-4)=6.6%) as well as the preferred dividends of 9%, Minibus needs to earn 12% on its total capital of $700 million. 100 (6.6%) + 100 (9%) + 500 (13.5%) = 11.87%, about 12%. 700 700 700 In an effort to make up for the depressed outlook or earnings, the Board of Directors is debating whether to raise the required return on new capital expenditures of average risk (such as the possible assembly line) to 20%. Among the factors that the Board of Directors has considered are: 1. Future financing should maintain the current degree of financial leverage. 2. Additional long-term debt can be obtained at the pretax cost of 15% and flotation costs would be negligible. 3. The preferred shares are being traded at the price of $75 on the Yankee Stock Exchange. Issuance of new preferred shares would necessitate after-tax flotation costs amounting to 4% of the issue price. Last Friday, Minibus' common shares closed at $20 on the Yankee Stock Exchange. A new issue of common shares could yield, net to the company, $17.50 per share. The policy of reinvesting 40% of Minibus earnings every year should provide adequate equity financing for the planned capital expenditures over at least the next 10 years. An analysis of Minibus' prospect has recently been completed by one of Yankee City's leading investment-banking firms. The analysis included the following: Year EPS (a) Div/shr. P/E ratio (b) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3.29 3.57 4.02 4.57 1.58 1.10 3.23 3.56 3.91 4.30 2.00 2.20 2.40 2.70 2.00 0.60 1.94 2.13 2.35 2.58 13.20 15.40 12.00 6.80 12.70 20.0 (a) Numbers for 2017-2020 are forecasts made by the analyst. (b) Computed as the ratio of market price on Dec. 31 and the earnings per share of the same year. Questions Part A. What is the minimum after-tax return that Minibus should require in preparing its bid to assemble the 500 buses? Part B. At what minimum price should Minibus bid to assemble the buses? Assume that there is no inflation? MINIBUS CORPORATION Late in 2016, Minibus Corp. is preparing a bid to assemble 500 buses. The contract will be awarded by the City of Biglanta to the lowest bidder agreeing to set up an assembly line within Biglanta city limits Minibus does not have any plant in Biglanta. However, it can rent one and install an assembly line. If it does, the assembly line will be dismantled at the end of the contract (five Years). Estimated expenditures will be as follows: Plant: Annual rent: $300,000, payable at the end of each year Assembly Line: Cost: $5,000,000 Expected life: 10 years Salvage value after five years: $2,000,000 Depreciation method for accounting purposes: Straight line Capital cost recovery class for tax purposes: 5-year MACRS property. Investment Tax Credit: 10% of the assembly line cost. (95% of the cost is depreciable)?? Tax Rate: 40% Labor, Material, and incremental overhead expenses will amount to $40,000 (before taxes, per bus, and excluding the rent and the depreciation of the assembly line). The production schedule is as follows: Quantity Assembled And Delivered Labor, Material & Other Expenses Per Bus Total Year 1 Year 2 Year 3 Year 4 Year 5 100 100 100 100 $40,000 $40,000 $40,000 $40,000 $40,000 $4,000,000 4,000,000 4,000,000 4,000,000 4,000,000 $20,000,000 100 500 The buses will be paid for with cash upon delivery. An inventory of parts costing $1 million will need to be maintained during the contract (five-year period), but no other significant increase in working capital is expected. The working capital investment will be recaptured at the end of the project. Until now, Minibus has tried to achieve a 13.5% return on its book equity investment (ROE). Its treasurer determined that Minibus must earn 12% on its total investment in order to achieve the 13.5% return on equity target. The 12% target was set on the basis of the current capital structure. CAPITAL STRUCTURE, AS OF DEC. 31, 2016 BOOK VALUE First mortgage bonds, 11%, due Dec., 2031 Preferred Stock, 9% cumulative ($100 per share) Common stock (17,500,000 common shares) Retained earnings m m $100,000,000 100.000.000 175.000.000 325.000.000 $700,000,000 Thus, in order to earn 13.5% on $500 million in equity, and enough to pay the 6.6% after- tax interest on long-term debt (11%(1-4)=6.6%) as well as the preferred dividends of 9%, Minibus needs to earn 12% on its total capital of $700 million. 100 (6.6%) + 100 (9%) + 500 (13.5%) = 11.87%, about 12%. 700 700 700 In an effort to make up for the depressed outlook or earnings, the Board of Directors is debating whether to raise the required return on new capital expenditures of average risk (such as the possible assembly line) to 20%. Among the factors that the Board of Directors has considered are: 1. Future financing should maintain the current degree of financial leverage. 2. Additional long-term debt can be obtained at the pretax cost of 15% and flotation costs would be negligible. 3. The preferred shares are being traded at the price of $75 on the Yankee Stock Exchange. Issuance of new preferred shares would necessitate after-tax flotation costs amounting to 4% of the issue price. Last Friday, Minibus' common shares closed at $20 on the Yankee Stock Exchange. A new issue of common shares could yield, net to the company, $17.50 per share. The policy of reinvesting 40% of Minibus earnings every year should provide adequate equity financing for the planned capital expenditures over at least the next 10 years. An analysis of Minibus' prospect has recently been completed by one of Yankee City's leading investment-banking firms. The analysis included the following: Year EPS (a) Div/shr. P/E ratio (b) 2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 3.29 3.57 4.02 4.57 1.58 1.10 3.23 3.56 3.91 4.30 2.00 2.20 2.40 2.70 2.00 0.60 1.94 2.13 2.35 2.58 13.20 15.40 12.00 6.80 12.70 20.0 (a) Numbers for 2017-2020 are forecasts made by the analyst. (b) Computed as the ratio of market price on Dec. 31 and the earnings per share of the same year. Questions Part A. What is the minimum after-tax return that Minibus should require in preparing its bid to assemble the 500 buses? Part B. At what minimum price should Minibus bid to assemble the buses? Assume that there is no inflation