Part A. post information form the journals in part 2 to the general journal ledger and the accounts receivable and accounts payable subsidiary ledgers.

Part B. Prepare the march 31 trial balance, schedule of accounts receiveable and schedule of accounts payable

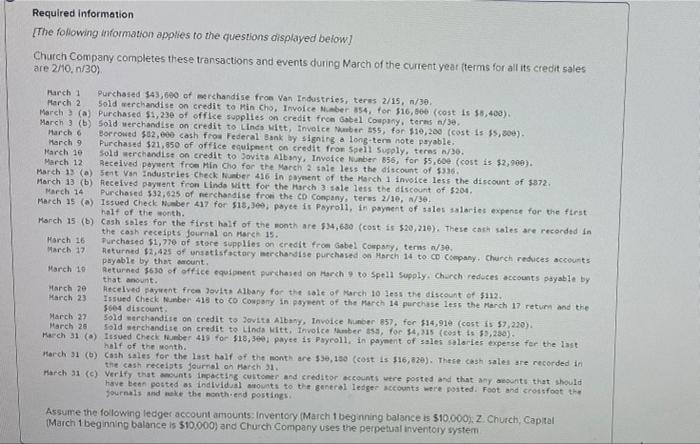

Me Sata Suo Check Required information The following fomson esto mesto obyed below! Church Company cometes retractions and events durg Math the current ore 20.20 Purchase 14. March tawarchandiselt toit (a) Purchase or Harch (b) darchandisert Litt, tvoro. March $2.0 feet March had so fly / malt March 10 Sed rhandierato, 10 19.) Horch 12 for the the Harch 1(a) a testes Check out the March 1(h) sed ett ale to March based 3.2 from the March 1(a) Cube 411518. all of the of the wath Mar 15 (cu for the first hall there 10,11). The catheter 11.710 ore create or 19 Ned 1,45 of story merchant ther w that arch Se of techto Sell that ch Becer y for sale Hot tec 18 ct there the 13 Bedretto A. I, for 14 March 20 Lederhand credit tott, fort is March (4) Choral power forum at the Parth) Cash te the last hatte months. These therewital h 11 Verity and that Nivell de use the other Assure the following or conventory March 510.0001.. Church Mach 1 beginning balance $10,000 and Chura Company este perpetutorial Required information The following information applies to the questions displayed below) Church Company completes these transactions and events during March of the current year terms for all its credit sales are 2/10,n/30) March 1 Purchased 143,600 of merchandise from Van Industries, teres 2/15, 1/30 March 2 Sold werchandise on credit to Hin Cho, Invoice Number 854, for $16,860 (cost is $8,400) March 3 (a) Purchased $1,230 of office supplies on credit from Gabel Company, terns n/30 March 3 (b) sold werchandise on credit to Linda Mitt, Invoice Maber 155, for $10,200 (cost is $5,000) March 6 Borrowed $62,600 cash froe Federal Bank by signing a long-term note payable. March 9 Purchased $21,850 of office equipment on credit from Speil Supply, terns /30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for 55,600 (cost is $2,900) March 12 Received payment from Min Cho for the March 2 sole less the discount of $336. March 13 (a) Sent Van Industries Check vumber 416 in paynent of the March 1 invoice less the discount of $372 March 13 (b) Received payment from Linda Mitt for the March 3 sale less the discount of $204. March 24 Purchased $32,625 of merchandise from the CD Company. teres 2/10, 1/30 March 15 (a) Issued Check Number 417 for $13,390, payee is Payroli, in paynent of sales salaries expense for the first half of the wonth. March 15 (5) Cash Soles for the first half of the month are $4,630 (cost 15 $20,210). These cash sales are recorded in the cash receipts Journal on March 15. March 16 Purchased $1,770 of store supplies on credit from Gabel Company, terns w/30 March 17 Returned $2,425 of unsatisfactory merchandise purchased on March 14 to co Company, Church reduces accounts payable by that wount. March 10 Returned 5630 of office equipment purchased on March 9 to Spell Supply Church reduces accounts payable by that amount. March 2e Received payment free Jovits Albany for the tale of March 10 less the discount of $112. March 23 Issued Check Number 418 to co Company in payment of the March 14 purchase less the March 17 return and the $604 discount March 27 Sold werchandise on credit to Jovita Albany, Invoice Number 857, for $14,910 (cost is $2,220) March 20 Sold merchandise on credit to Linda Mitt, Invoicember 15, for $4,315 (cost is $5,280). March 31 (a) Issued Check Number 419 for $18,300 payer is Payroll, in payment of sales salaries expense for the last half of the month. March 31 (6) Cash sales for the last half of the month are 530,150 (cost is $16,620). These cash sales are recorded in the cash receists Journal on March 31. March 31 (c) Verify that amounts inpacting customer and creditor accounts were posted and that any amounts that should have been posted as Individual mounts to the general ledger accounts were posted. Foot and crossfoot the Journals and make the month and postings Assume the following ledger account amounts: Inventory (March 1 beginning balance is $10,000).Z. Church, Capital March 1 beginning balance is $10,000) and Church Company uses the perpetual inventory system Me Sata Suo Check Required information The following fomson esto mesto obyed below! Church Company cometes retractions and events durg Math the current ore 20.20 Purchase 14. March tawarchandiselt toit (a) Purchase or Harch (b) darchandisert Litt, tvoro. March $2.0 feet March had so fly / malt March 10 Sed rhandierato, 10 19.) Horch 12 for the the Harch 1(a) a testes Check out the March 1(h) sed ett ale to March based 3.2 from the March 1(a) Cube 411518. all of the of the wath Mar 15 (cu for the first hall there 10,11). The catheter 11.710 ore create or 19 Ned 1,45 of story merchant ther w that arch Se of techto Sell that ch Becer y for sale Hot tec 18 ct there the 13 Bedretto A. I, for 14 March 20 Lederhand credit tott, fort is March (4) Choral power forum at the Parth) Cash te the last hatte months. These therewital h 11 Verity and that Nivell de use the other Assure the following or conventory March 510.0001.. Church Mach 1 beginning balance $10,000 and Chura Company este perpetutorial Required information The following information applies to the questions displayed below) Church Company completes these transactions and events during March of the current year terms for all its credit sales are 2/10,n/30) March 1 Purchased 143,600 of merchandise from Van Industries, teres 2/15, 1/30 March 2 Sold werchandise on credit to Hin Cho, Invoice Number 854, for $16,860 (cost is $8,400) March 3 (a) Purchased $1,230 of office supplies on credit from Gabel Company, terns n/30 March 3 (b) sold werchandise on credit to Linda Mitt, Invoice Maber 155, for $10,200 (cost is $5,000) March 6 Borrowed $62,600 cash froe Federal Bank by signing a long-term note payable. March 9 Purchased $21,850 of office equipment on credit from Speil Supply, terns /30. March 10 Sold merchandise on credit to Jovita Albany, Invoice Number 856, for 55,600 (cost is $2,900) March 12 Received payment from Min Cho for the March 2 sole less the discount of $336. March 13 (a) Sent Van Industries Check vumber 416 in paynent of the March 1 invoice less the discount of $372 March 13 (b) Received payment from Linda Mitt for the March 3 sale less the discount of $204. March 24 Purchased $32,625 of merchandise from the CD Company. teres 2/10, 1/30 March 15 (a) Issued Check Number 417 for $13,390, payee is Payroli, in paynent of sales salaries expense for the first half of the wonth. March 15 (5) Cash Soles for the first half of the month are $4,630 (cost 15 $20,210). These cash sales are recorded in the cash receipts Journal on March 15. March 16 Purchased $1,770 of store supplies on credit from Gabel Company, terns w/30 March 17 Returned $2,425 of unsatisfactory merchandise purchased on March 14 to co Company, Church reduces accounts payable by that wount. March 10 Returned 5630 of office equipment purchased on March 9 to Spell Supply Church reduces accounts payable by that amount. March 2e Received payment free Jovits Albany for the tale of March 10 less the discount of $112. March 23 Issued Check Number 418 to co Company in payment of the March 14 purchase less the March 17 return and the $604 discount March 27 Sold werchandise on credit to Jovita Albany, Invoice Number 857, for $14,910 (cost is $2,220) March 20 Sold merchandise on credit to Linda Mitt, Invoicember 15, for $4,315 (cost is $5,280). March 31 (a) Issued Check Number 419 for $18,300 payer is Payroll, in payment of sales salaries expense for the last half of the month. March 31 (6) Cash sales for the last half of the month are 530,150 (cost is $16,620). These cash sales are recorded in the cash receists Journal on March 31. March 31 (c) Verify that amounts inpacting customer and creditor accounts were posted and that any amounts that should have been posted as Individual mounts to the general ledger accounts were posted. Foot and crossfoot the Journals and make the month and postings Assume the following ledger account amounts: Inventory (March 1 beginning balance is $10,000).Z. Church, Capital March 1 beginning balance is $10,000) and Church Company uses the perpetual inventory system