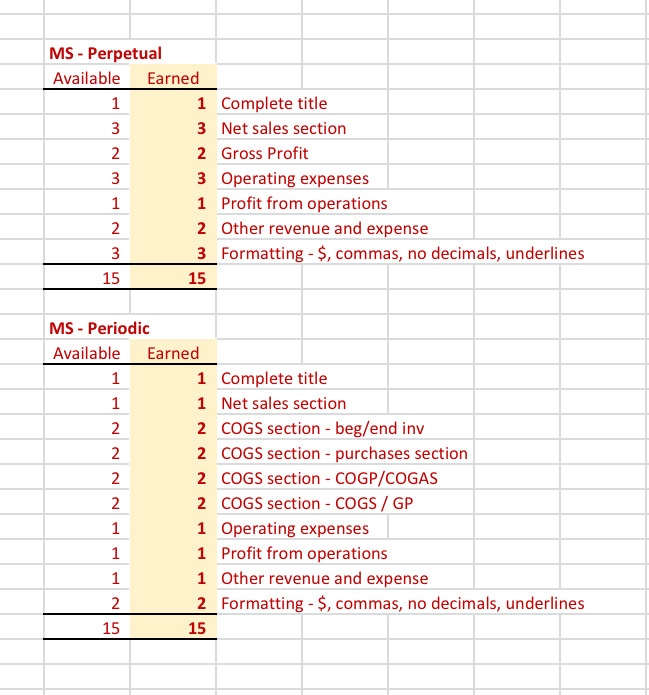

part A- Prepare a multi-step income statements under each of the 2 inventory systems

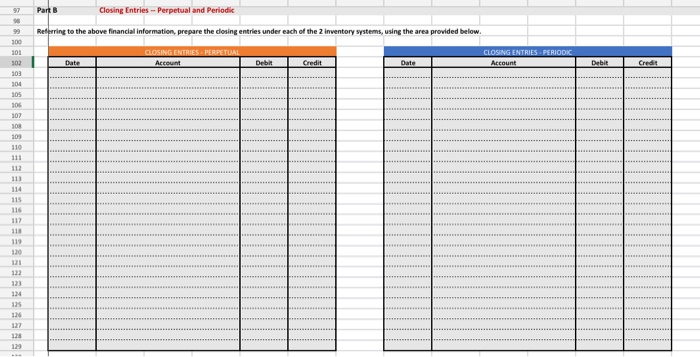

part B- Referring to the above financial information, prepare the closing entries under each of thr 2 inventory systems

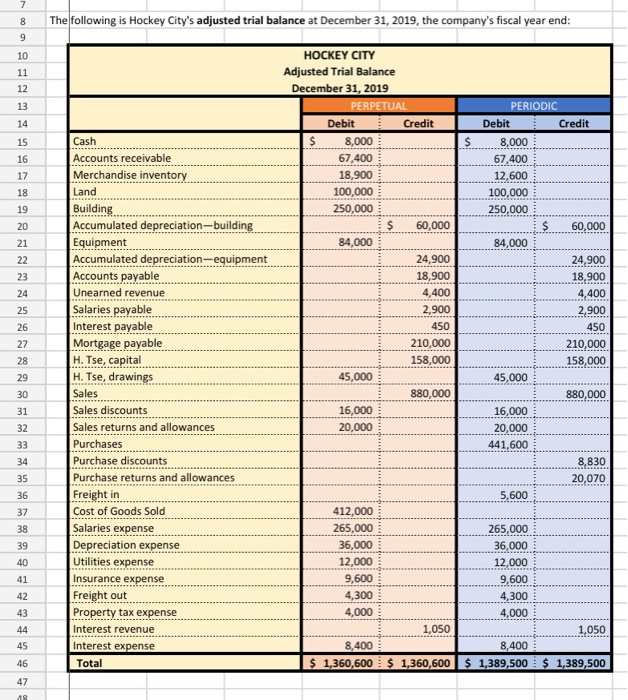

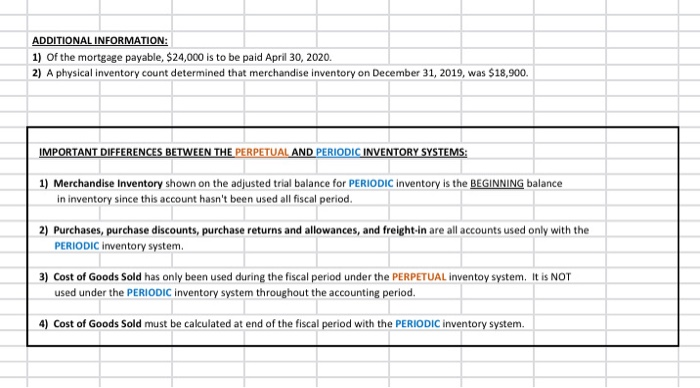

8 The following is Hockey City's adjusted trial balance at December 31, 2019, the company's fiscal year end: PERIODIC Debit Credit ... 8,000 18,900 67,400 12,600 100,000 250,000 $ 60,000 84,000 24,900 HOCKEY CITY Adjusted Trial Balance December 31, 2019 PERPETUAL Debit Credit Cash 8,000 Accounts receivable 67,400 Merchandise inventory Land 100,000 Building 250,000 Accumulated depreciation-building 60.000 Equipment 84,000 Accumulated depreciation--equipment ....... Accounts payable 18,900 Unearned revenue 4,400 Salaries payable 2,900 Interest payable 450 Mortgage payable H. Tse, capital 158,000 H. Tse, drawings 45,000 Sales 880,000 Sales discounts 16,000 Sales returns and allowances 20,000 Purchases Purchase discounts Purchase returns and allowances Freight in Cost of Goods Sold 412,000 Salaries expense 265,000 Depreciation expense 36,000 Utilities expense 12,000 Insurance expense 9,600 Freight out 4,300 Property tax expense 4,000 Interest revenue Interest expense Total $ 1,360,600 $ 1,360,600 24,900 18,900 4,400 2,900 450 210,000 158,000 210,000 45,000 880,000 16,000 20,000 441,600 8,830 20,070 5,600 265,000 36,000 12,000 9,600 4,300 4,000 050 400 8,400 $ 1,389,500 $ 1,389,500 ADDITIONAL INFORMATION: 1) of the mortgage payable, $24,000 is to be paid April 30, 2020. 2) A physical inventory count determined that merchandise inventory on December 31, 2019, was $18,900. IMPORTANT DIFFERENCES BETWEEN THE PERPETUAL AND PERIODIC INVENTORY SYSTEMS: 1) Merchandise Inventory shown on the adjusted trial balance for PERIODIC Inventory is the BEGINNING balance in inventory since this account hasn't been used all fiscal period. 2) Purchases, purchase discounts, purchase returns and allowances, and freight-in are all accounts used only with the PERIODIC inventory system. 3) Cost of Goods Sold has only been used during the fiscal period under the PERPETUAL inventoy system. It is NOT used under the PERIODIC inventory system throughout the accounting period. 4) Cost of Goods Sold must be calculated at end of the fiscal period with the PERIODIC inventory system. MS - Perpetual Available Earned 1 Complete title 3 Net sales section 2 Gross Profit 3 Operating expenses 1 Profit from operations 2 Other revenue and expense 3 3 Formatting - $, commas, no decimals, underlines 15 NWNW MS - Periodic Available Earned 1 Complete title 1 Net sales section 2 COGS section - beg/end inv 2 COGS section - purchases section 2 COGS section - COGP/COGAS 2 COGS section - COGS / GP 1 Operating expenses 1 Profit from operations 1 Other revenue and expense 2 Formatting - $, commas, no decimals, underlines GNPANNNN MULTI-STEP PERPETU M ISTEP. PERO Closing Entries - Perpetual and Periodic 88 89 Referring to the above financial information, prepare the closing entries under each of the inventory systems, using the area provided below CLOSING ENTRIES. PERIODIC