Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A: Prepare a reconciliation starting with the cash book balance and ending with the adjusted cash book balance as at 30 June 2020 Part

Part A: Prepare a reconciliation starting with the cash book balance and ending with the adjusted cash book balance as at 30 June 2020

Part B: Prepare the bank reconciliation starting with the bank statement balance and ending with the adjusted cash book balance as at 30 June 2020

Part C: Complete the journal entries required to be entered for the month ending 30 June 2020. Provide a narrative to each journal entry

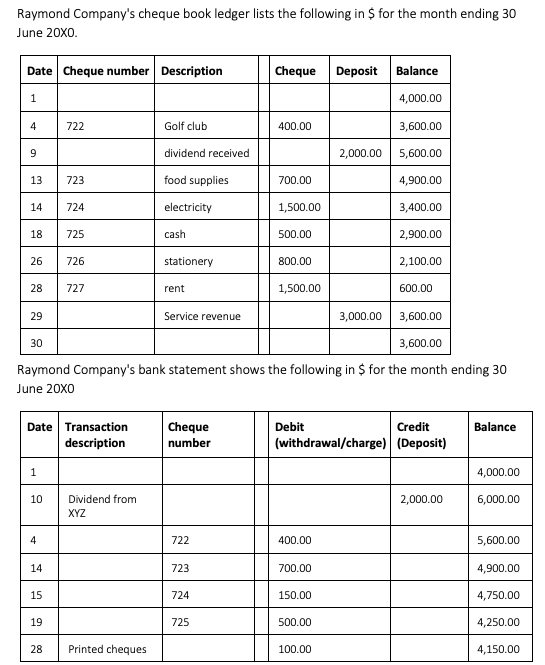

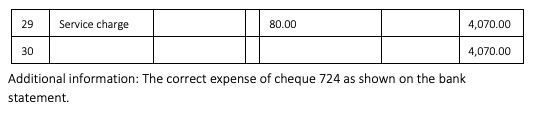

Raymond Company's cheque book ledger lists the following in $ for the month ending 30 June 2oxo. Date Cheque number Description Cheque Deposit Balance 1 4,000.00 4 722 400.00 3,600.00 9 Golf club dividend received food supplies electricity 2,000.00 5,600.00 4,900.00 13 723 700.00 14 724 1,500.00 3,400.00 18 725 cash 500.00 2,900.00 26 726 stationery 800.00 2,100.00 28 727 rent 1,500.00 600.00 29 30 Service revenue 3,000.00 3,600.00 3,600.00 Raymond Company's bank statement shows the following in $ for the month ending 30 June 20x0 Balance Date Transaction description Cheque number Debit Credit (withdrawal/charge) (Deposit) 1 4,000.00 10 2,000.00 6,000.00 Dividend from XYZ 4 722 400.00 5,600.00 14 723 700.00 4,900.00 15 724 150.00 4,750.00 19 725 500.00 4,250.00 28 Printed cheques 100.00 4,150.00 29 Service charge 80.00 4,070.00 30 4,070.00 Additional information: The correct expense of cheque 724 as shown on the bank statementStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started