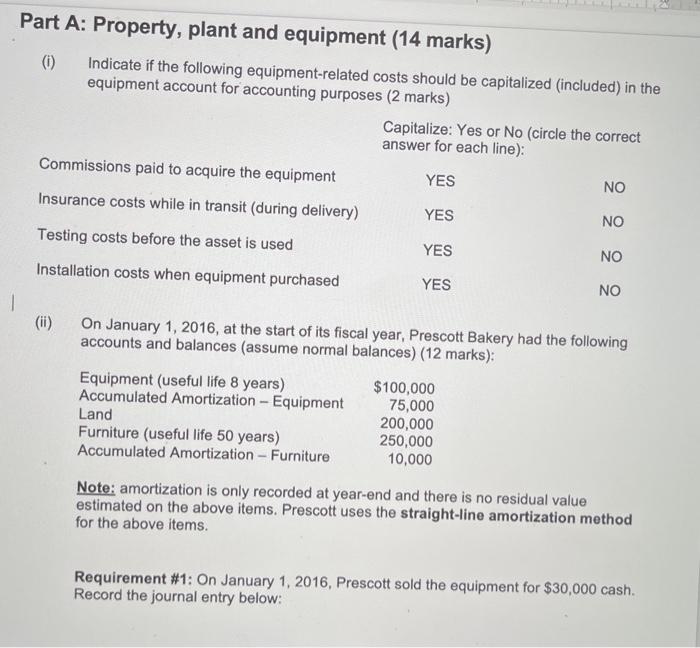

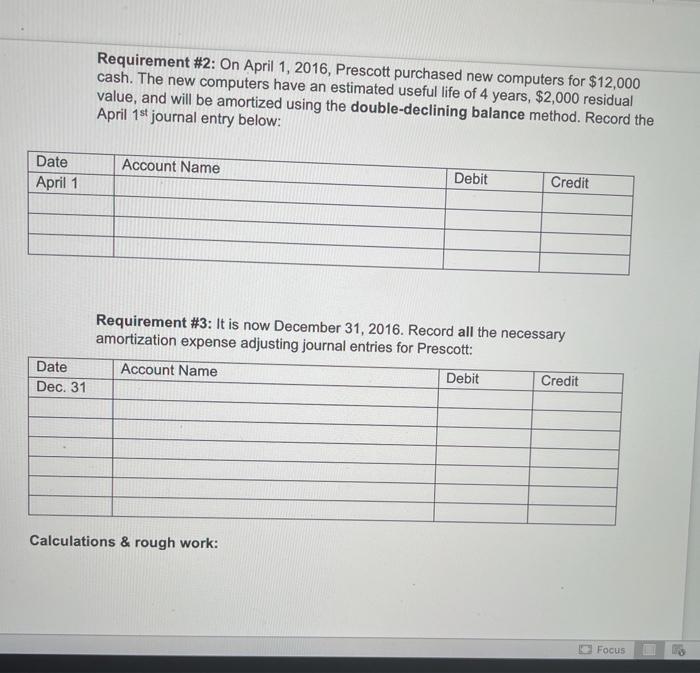

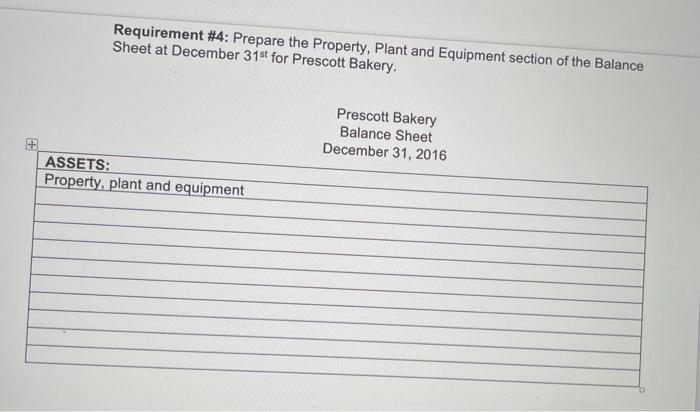

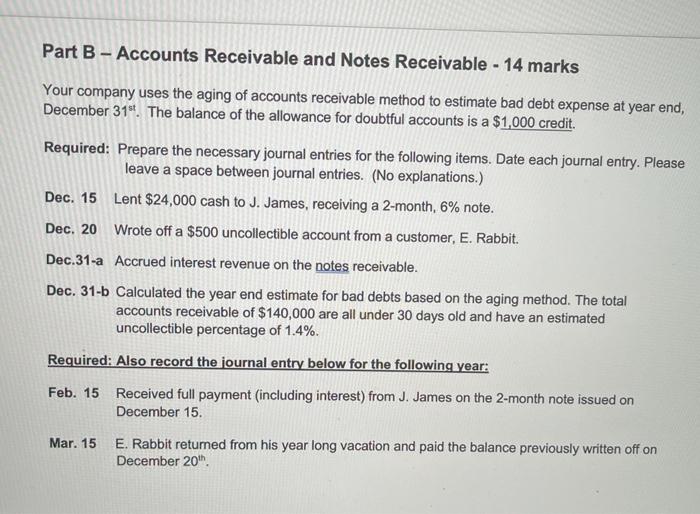

Part A: Property, plant and equipment (14 marks) (0) Indicate if the following equipment-related costs should be capitalized (included) in the equipment account for accounting purposes (2 marks) Capitalize: Yes or No (circle the correct answer for each line): Commissions paid to acquire the equipment YES NO Insurance costs while in transit (during delivery) YES NO Testing costs before the asset is used YES NO Installation costs when equipment purchased YES NO On January 1, 2016, at the start of its fiscal year, Prescott Bakery had the following accounts and balances (assume normal balances) (12 marks): Equipment (useful life 8 years) $100,000 Accumulated Amortization - Equipment 75,000 Land 200,000 Furniture (useful life 50 years) 250,000 Accumulated Amortization - Furniture 10,000 Note: amortization is only recorded at year-end and there is no residual value estimated on the above items. Prescott uses the straight-line amortization method for the above items. Requirement #1: On January 1, 2016, Prescott sold the equipment for $30,000 cash. Record the journal entry below: Requirement #2: On April 1, 2016, Prescott purchased new computers for $12,000 cash. The new computers have an estimated useful life of 4 years, $2,000 residual value, and will be amortized using the double-declining balance method. Record the April 1st journal entry below: Date Account Name April 1 Debit Credit Requirement #3: It is now December 31, 2016. Record all the necessary amortization expense adjusting journal entries for Prescott: Account Name Debit Credit Date Dec. 31 Calculations & rough work: Focus Requirement #4: Prepare the Property, Plant and Equipment section of the Balance Sheet at December 31st for Prescott Bakery. Prescott Bakery Balance Sheet December 31, 2016 ASSETS: Property, plant and equipment Part B Accounts Receivable and Notes Receivable - 14 marks Your company uses the aging of accounts receivable method to estimate bad debt expense at year end, December 316. The balance of the allowance for doubtful accounts is a $1,000 credit. Required: Prepare the necessary journal entries for the following items. Date each journal entry. Please leave a space between journal entries. (No explanations.) Dec. 15 Lent $24,000 cash to J. James, receiving a 2-month, 6% note. Dec. 20 Wrote off a $500 uncollectible account from a customer, E. Rabbit. Dec.31-a Accrued interest revenue on the notes receivable. Dec. 31-b Calculated the year end estimate for bad debts based on the aging method. The total accounts receivable of $140,000 are all under 30 days old and have an estimated uncollectible percentage of 1.4%. Required: Also record the journal entry below for the following year: Feb. 15 Received full payment (including interest) from J. James on the 2-month note issued on December 15. Mar. 15 E. Rabbit returned from his year long vacation and paid the balance previously written off on December 20th