Answered step by step

Verified Expert Solution

Question

1 Approved Answer

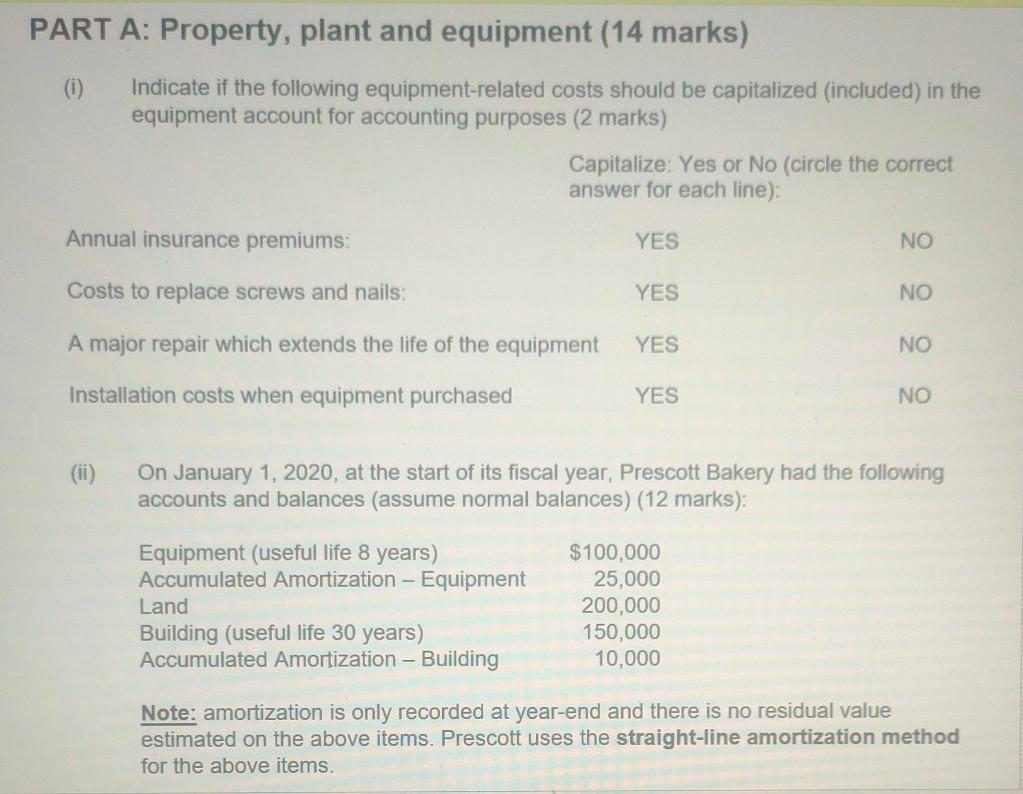

PART A: Property, plant and equipment (14 marks) Indicate if the following equipment-related costs should be capitalized (included) in the equipment account for accounting purposes

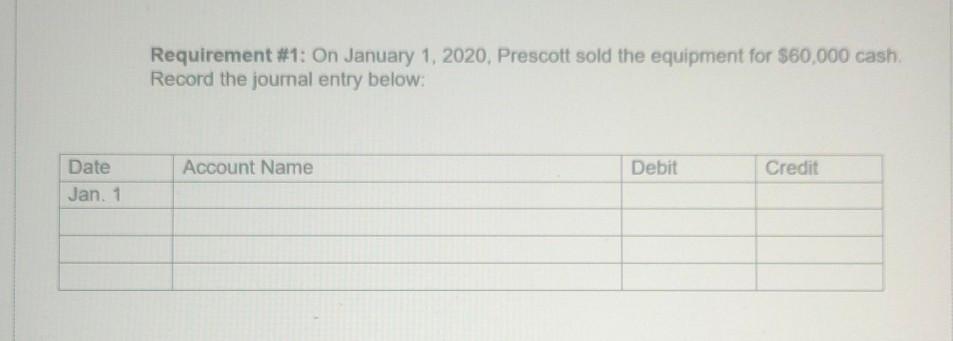

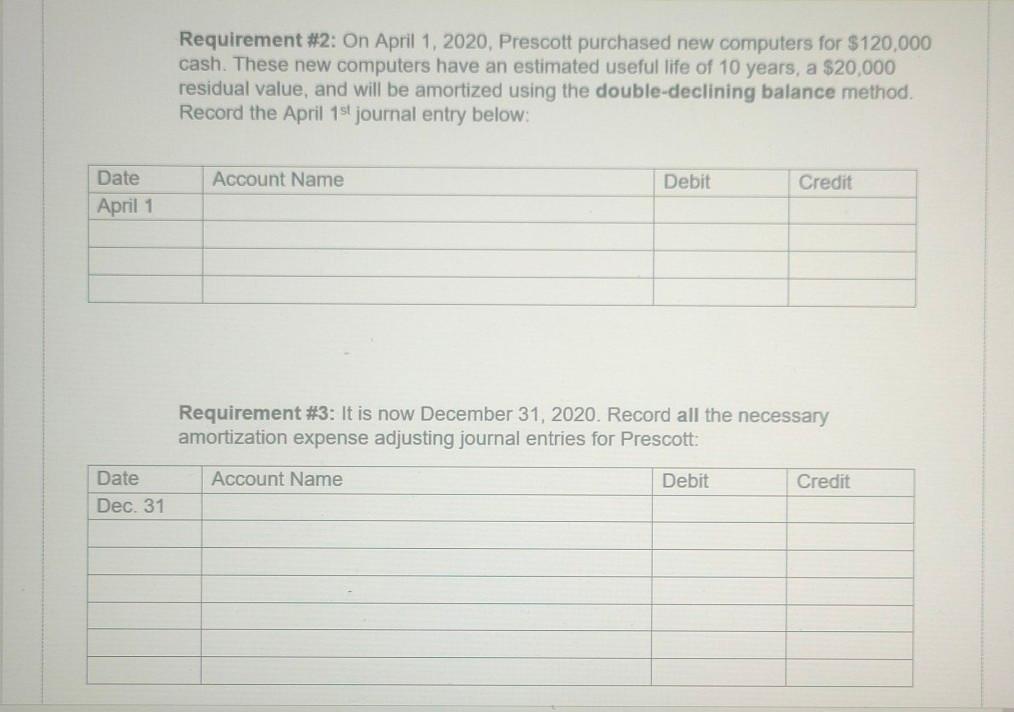

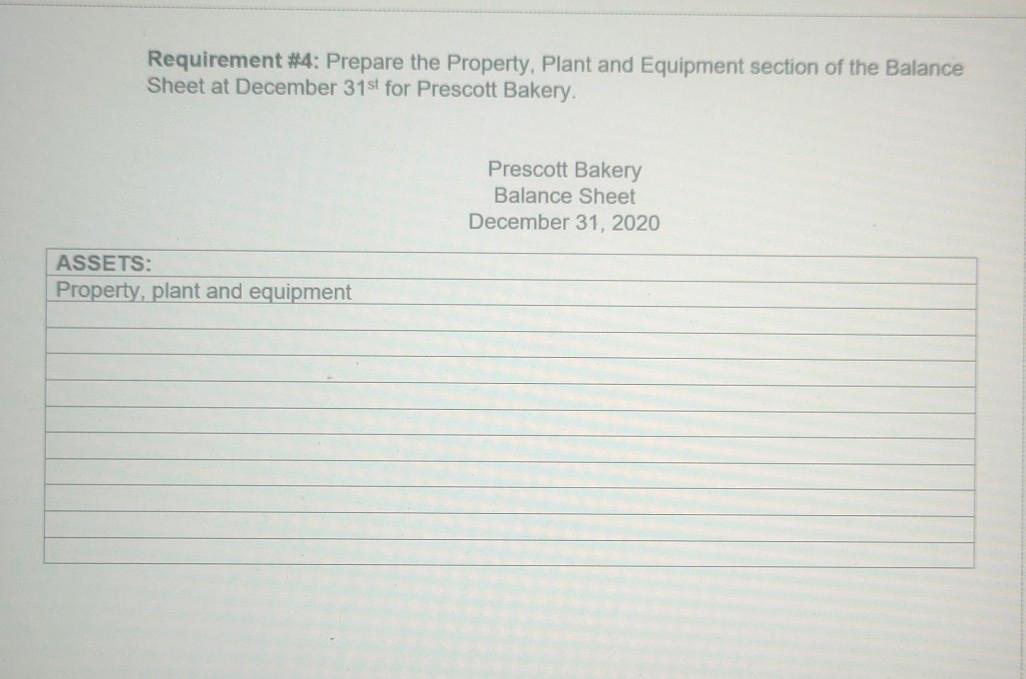

PART A: Property, plant and equipment (14 marks) Indicate if the following equipment-related costs should be capitalized (included) in the equipment account for accounting purposes (2 marks) Capitalize: Yes or No (circle the correct answer for each line): Annual insurance premiums: YES NO Costs to replace screws and nails: YES NO A major repair which extends the life of the equipment YES NO Installation costs when equipment purchased YES NO (ii) On January 1, 2020, at the start of its fiscal year, Prescott Bakery had the following accounts and balances (assume normal balances) (12 marks): Equipment (useful life 8 years) Accumulated Amortization - Equipment Land Building (useful life 30 years) Accumulated Amortization - Building $100,000 25,000 200,000 150,000 10,000 Note: amortization is only recorded at year-end and there is no residual value estimated on the above items. Prescott uses the straight-line amortization method for the above items. Requirement #1: On January 1, 2020, Prescott sold the equipment for $60,000 cash. Record the journal entry below: Account Name Debit Credit Date Jan. 1 Requirement #2: On April 1, 2020, Prescott purchased new computers for $120,000 cash. These new computers have an estimated useful life of 10 years, a $20,000 residual value, and will be amortized using the double-declining balance method. Record the April 1st journal entry below: Account Name Debit Credit Date April 1 Requirement #3: It is now December 31, 2020. Record all the necessary amortization expense adjusting journal entries for Prescott: Account Name Debit Credit Date Dec. 31 Requirement #4: Prepare the Property, Plant and Equipment section of the Balance Sheet at December 31st for Prescott Bakery. Prescott Bakery Balance Sheet December 31, 2020 ASSETS: Property, plant and equipment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started