Question

Part A Reflection You have been supplied with Global Motor Manufacturers Australia Pty Ltd. Accounting documents as part of an Audit Virtual Experience Program. *

Part A Reflection

You have been supplied with Global Motor Manufacturers Australia Pty Ltd. Accounting documents as part of an Audit Virtual Experience Program.

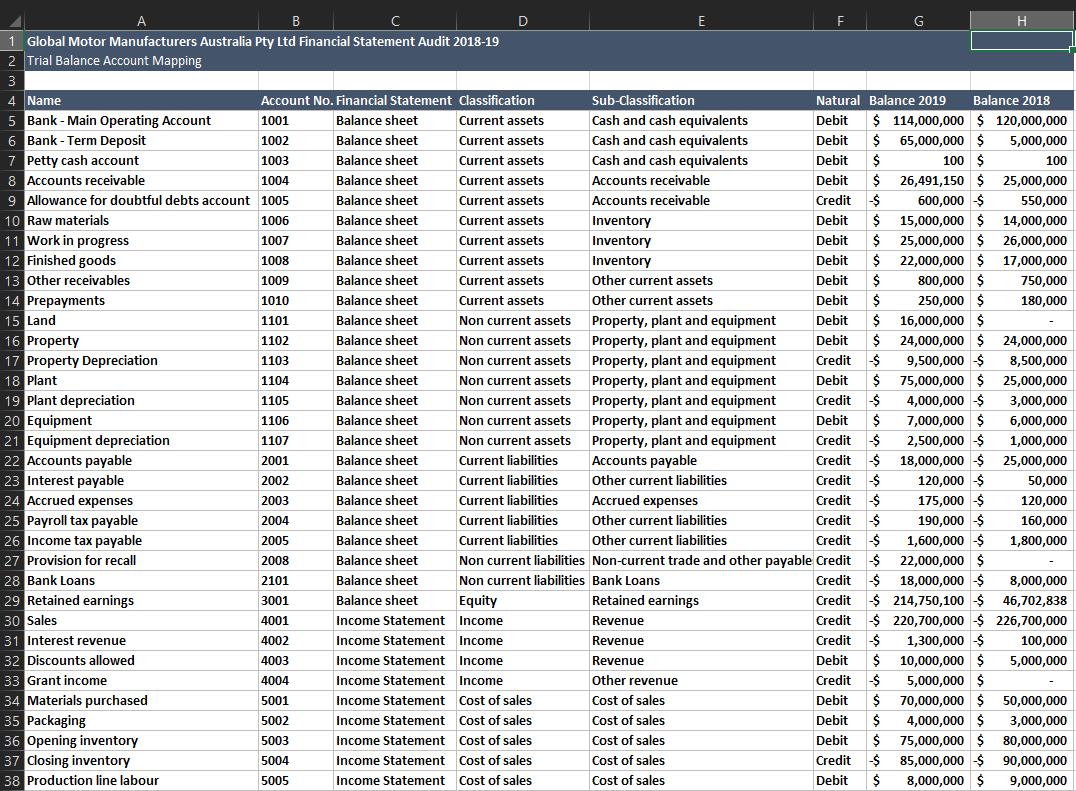

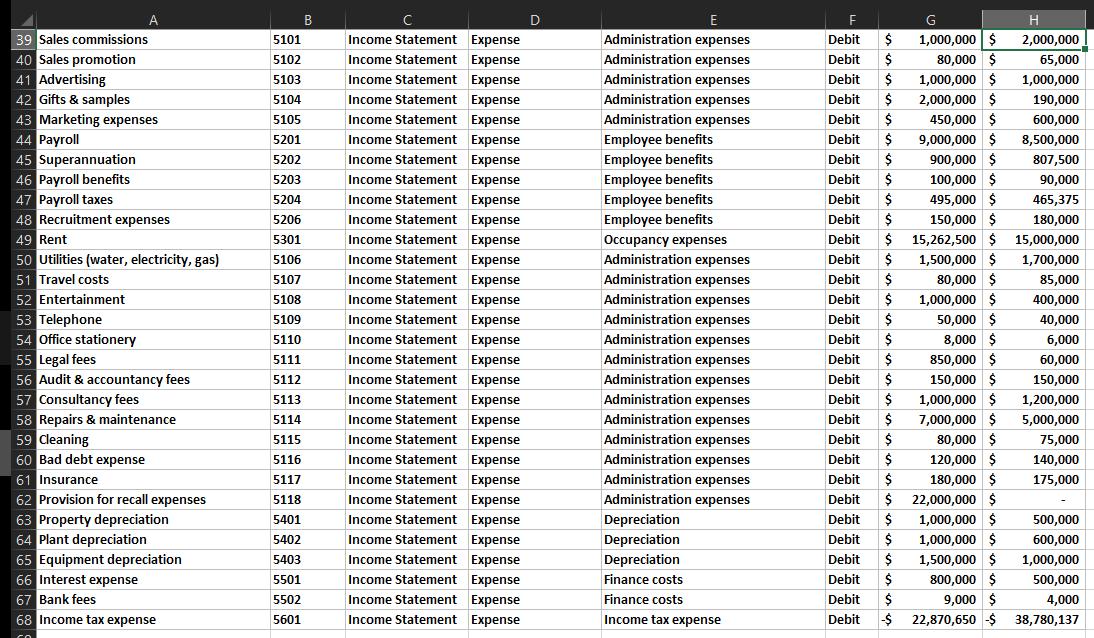

* Trial Balance (Appendix A)

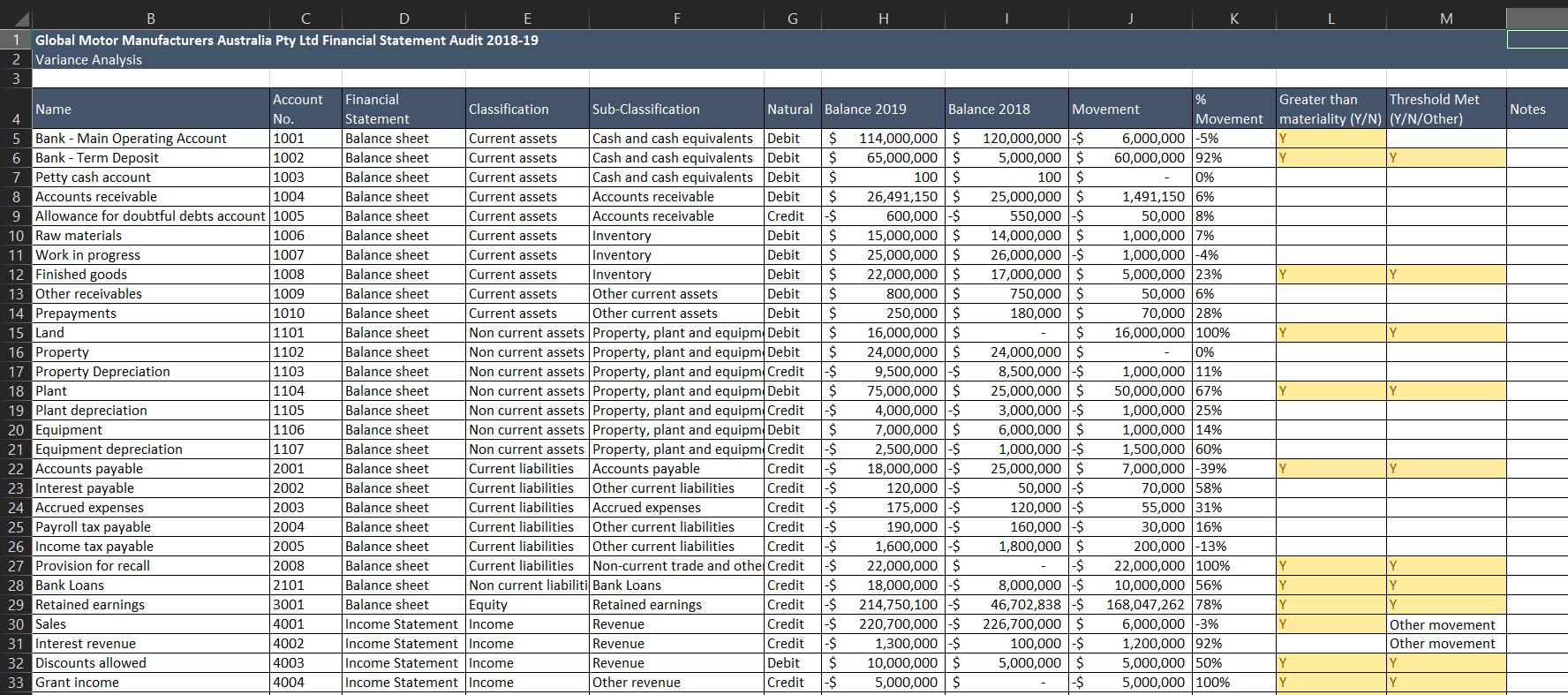

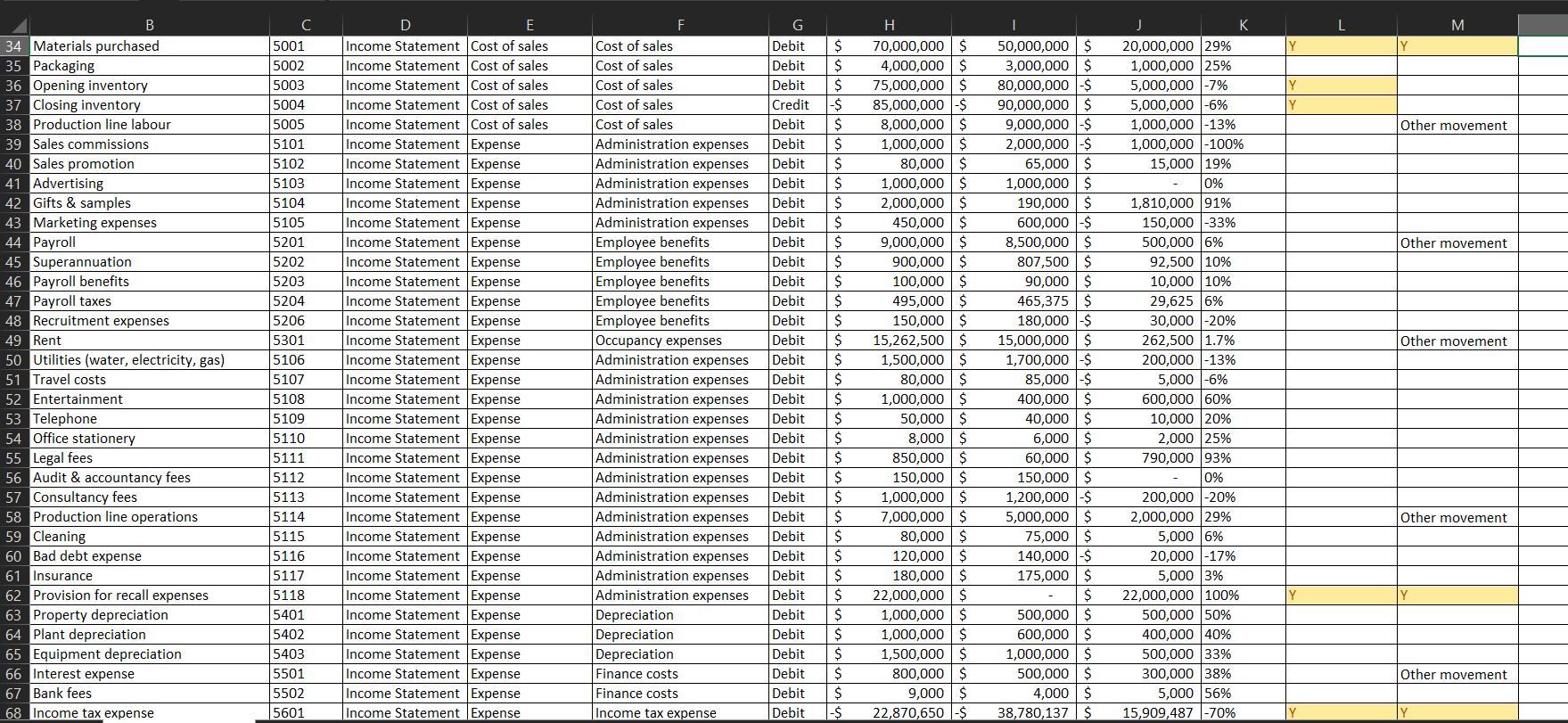

* Variance Analysis (Appendix B)

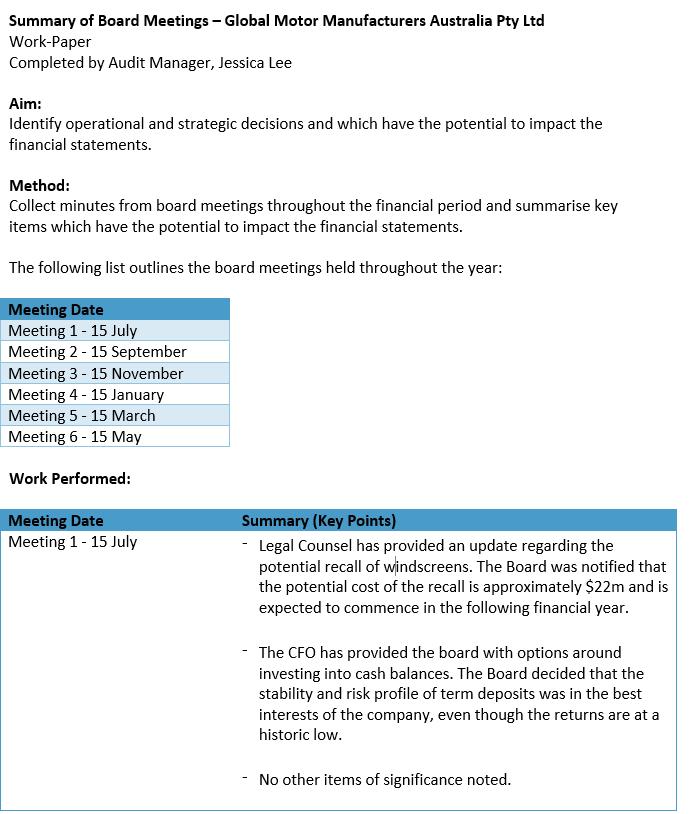

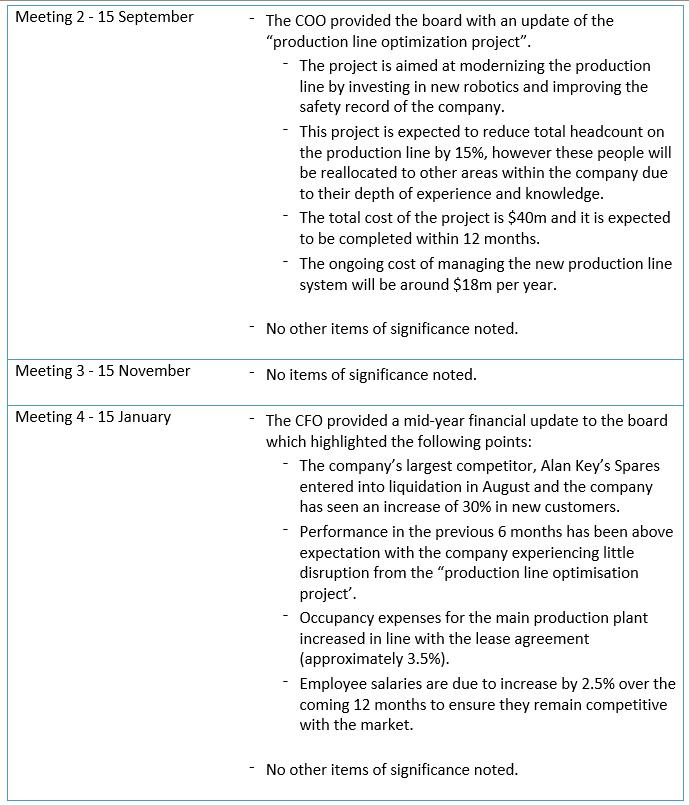

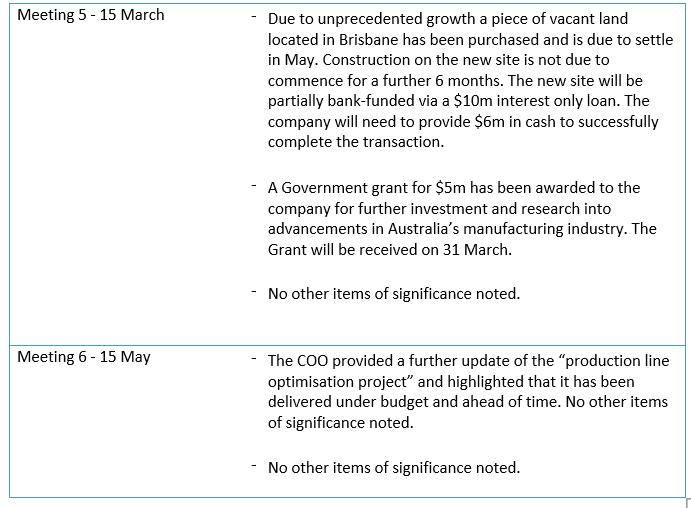

* Meeting Minutes (Appendix C)

Write a reflective essay (700 words) about your experience analysing the appendices, addressing three key questions:

- Comment on the auditor’s techniques/approaches to the risk assessment phase of the audit.

- What did you learn from the program about the risk assessment phase of an audit?

- Suggest techniques/approaches/areas where the auditor could do better with the risk assessment phase? You address this question by referring to the learning materials and at least two academic articles on the risk assessment.

Please use an essay format for your discussion. Textbooks such as Moroney, et al. (2020), or websites do not qualify as an academic article. APA 6th is required with an appropriate reference list.

APPENDIX A - TRIAL BALANCE, MAPPING (PART A)

APPENDIX B – VARIANCE ANALYSIS (PART A)

APPENDIX C – MEETING MINUTES (PART A)

D H 1 Global Motor Manufacturers Australia Pty Ltd Financial Statement Audit 2018-19 2 Trial Balance Account Mapping 4 Name 5 Bank - Main Operating Account 6 Bank - Term Deposit 7 Petty cash account Account No. Financial Statement Classification Sub-Classification Natural Balance 2019 Balance 2018 1001 Balance sheet Current assets Debit $ 114,000,000 $ 120,000,000 Cash and cash equivalents Cash and cash equivalents Cash and cash equivalents 65,000,000 $ $ 1002 Balance sheet Current assets Debit 5,000,000 1003 Balance sheet Current assets Debit 100 $ 100 8 Accounts receivable 9 Allowance for doubtful debts account 1005 10 Raw materials 11 Work in progress 12 Finished goods 13 Other receivables 14 Prepayments 15 Land 16 Property 17 Property Depreciation 18 Plant 19 Plant depreciation 20 Equipment 21 Equipment depreciation 22 Accounts payable 23 Interest payable 24 Accrued expenses 25 Payroll tax payable 26 Income tax payable 27 Provision for recall 28 Bank Loans 29 Retained earnings 30 Sales 31 Interest revenue 1004 Balance sheet Current assets Accounts receivable Debit 26,491,150 $ 25,000,000 600,000 -$ 15,000,000 $ Balance sheet Current assets Accounts receivable Credit 550,000 1006 Balance sheet Current assets Inventory Debit 14,000,000 1007 Balance sheet Current assets Inventory Debit $ 25,000,000 $ 26,000,000 1008 Balance sheet Current assets Inventory Debit $ 22,000,000 $ 17,000,000 1009 Balance sheet Current assets Other current assets Debit 2$ 800,000 $ 750,000 1010 Balance sheet Current assets Other current assets Debit 250,000 $ 180,000 Property, plant and equipment Property, plant and equipment Property, plant and equipment Property, plant and equipment 1101 Balance sheet Non current assets Debit $ 16,000,000 $ 24,000,000 $ -$ 1102 Balance sheet Non current assets Debit 24,000,000 1103 Balance sheet Non current assets Credit 9,500,000 -$ 8,500,000 1104 Balance sheet Non current assets Debit 2$ 75,000,000 $ 25,000,000 1105 Balance sheet Non current assets Property, plant and equipment Credit -$ 4,000,000 -$ 3,000,000 Property, plant and equipment Property, plant and equipment Accounts payable 7,000,000 $ -$ 1106 Balance sheet Non current assets Debit 6,000,000 2,500,000 -$ 18,000,000 -$ 1107 Balance sheet Non current assets Credit 1,000,000 2001 Balance sheet Current liabilities Credit -$ 25,000,000 2002 Balance sheet Current liabilities Other current liabilities Credit -$ 120,000 -$ 50,000 2003 Balance sheet Current liabilities Accrued expenses Credit -$ 175,000 -$ 120,000 2004 Balance sheet Current liabilities Other current liabilities Credit -$ 190,000 -$ 160,000 2005 Balance sheet Current liabilities Other current liabilities Credit -$ 1,600,000 -$ 1,800,000 2008 Balance sheet Non current liabilities Non-current trade and other payable Credit -$ 22,000,000 $ 2101 Balance sheet Non current liabilities Bank Loans Credit 18,000,000 -$ 8,000,000 3001 Balance sheet Equity Retained earnings Credit 214,750,100 -$ 46,702,838 4001 Income Statement Income Revenue Credit -$ 220,700,000 -$ 226,700,000 4002 Income Statement Income Revenue Credit 1,300,000 -$ 100,000 32 Discounts allowed 33 Grant income 34 Materials purchased 35 Packaging 36 Opening inventory 37 Closing inventory 38 Production line labour 4003 Income Statement Income Revenue Debit 10,000,000 $ 5,000,000 4004 Income Statement Income Other revenue Credit -$ 5,000,000 $ 5001 Income Statement Cost of sales Cost of sales Debit $ 70,000,000 $ 50,000,000 4,000,000 $ 75,000,000 $ 5002 Income Statement Cost of sales Cost of sales Debit $ 3,000,000 5003 Income Statement Cost of sales Cost of sales Debit 80,000,000 5004 Income Statement Cost of sales Cost of sales Credit -$ 85,000,000 -$ 90,000,000 5005 Income Statement Cost of sales Cost of sales Debit 2$ 8,000,000 %24 9,000,000

Step by Step Solution

3.36 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Title A Reflective Analysis of the Risk Assessment Phase in the Audit of Global Motor Manufacturers Australia Pty Ltd Introduction The audit process is a critical component of ensuring the integrity o...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started