Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Sadia has been managing her gym business for a year. On 1 November 2018 she opened a business bank account and paid in 50,000

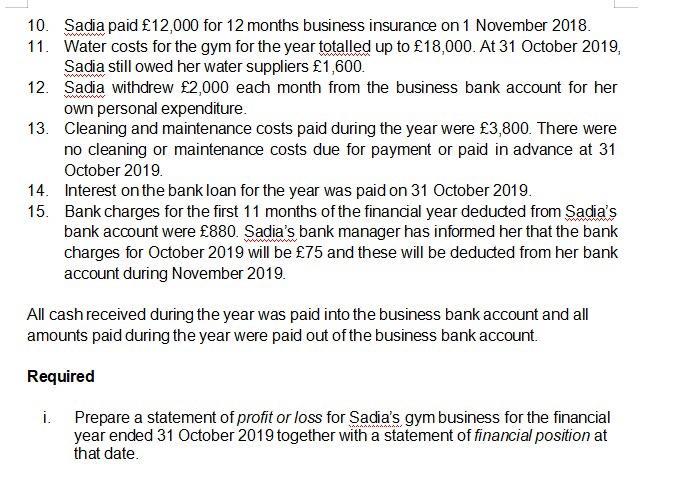

Sadia has been managing her gym business for a year. On 1 November 2018 she opened a business bank account and paid in 50,000 of her own money. The bank provided her with a 5 year loan of 50,000 which was paid into this account on the same day. The loan carries an interest rate of 5% and is repayable in fuil on 31 October 2023. The following transactions took place during the financial year ended 31 October 2019 1. Cash received from gym memberships totalled up to 240,000. Of this 240,000 received, 12,000 relates to membership subscriptions for the financial year ended 31 October 2020. Cash received from non-member daily visitors to the gym during the year was 30,000. 3. 2. Sadia paid rent on the gym of 24,000 and local business taxes of 13,000. Rent paid was for the 10 months November 2018 to August 2019 while the local business taxes paid covered the amounts payable for the 13 months to 30 November 2019. 4. The gym has a bar serving, snacks, light meals and drinks. Cash received from bar sales inthe year to 31 October 2019 totalled up to 60,000. Sadia's purchases of food and drink for sale at the bar added up to a total of 26,000 for the year. At 31 October 2019, Sadia still owed her food and drink suppliers 3,750. At 31 October 2019, Sada counted up and valued the drinks and food left in the bar at that date. This inventory had a cost of 2,200. Sadia employed various members of staff during the year, paying them a total of 51,000. At 31 October 2019, Sadia still owed her staff 1,000 in wages and salaries for services provided in the last week of the financial year. 7. Heating and lighting bills paid from the start of November 2018 to the end of August 2019 totalled up to 7,500. Sadia estimates that a further 1,500 of heating and lighting was used during September and October 2019 which has not yet been paid for. 8. Sadia paid 200,000 to acquire equipment for her gym at the start of November 2018. Sadia estimates that this gym equipment will have a useful life of 4 years and will have a resale value of 40,000 at the end of those 4 years. in addition, Sadia paid equipment rentals of 40,000 throughout the year to hire additional equipment for use in the gym. These equipment rentals covered the cost of equipment hire for the period 1 November 2018 to 31 January 2020. 5. 6. 9. 10. Sadia paid 12,000 for 12 months business insurance on 1 November 2018. 11. Water costs for the gym for the year totalled up to 18,000. At 31 October 2019, Sadia still owed her water suppliers 1,600. 12. Sadia withdrew 2,000 each month from the business bank account for her own personal expenditure. 13. Cleaning and maintenance costs paid during the year were 3,800. There were no cleaning or maintenance costs due for payment or paid in advance at 31 October 2019. 14. Interest on the bank loan for the year was paid on 31 October 2019. 15. Bank charges for the first 11 months of the financial year deducted from Sadia's bank account were 880. Sadia's bank manager has informed her that the bank charges for October 2019 will be 75 and these will be deducted from her bank account during November 2019. All cash received during the year was paid into the business bank account and all amounts paid during the year were paid out of the business bank account. Required i. Prepare a statement of profit or loss for Sadia's gym business for the financial year ended 31 October 2019 together with a statement of financial position at that date.

Step by Step Solution

★★★★★

3.42 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

Statement of Profit or Loss for Sadias gym business for the year ended 31 October 2019 Particulars Amount Amount Service Revenue From Gym Members 240000 Less Gym Membership Fees Received in Advance 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started