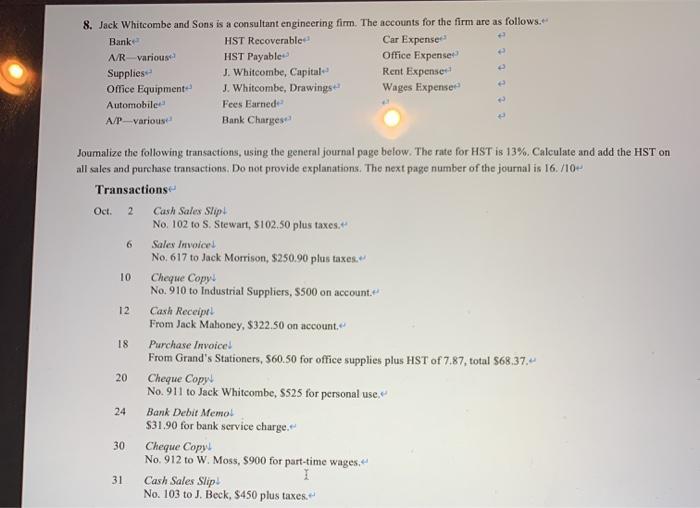

Question: 8. Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank Car Expense HST Recoverable HST

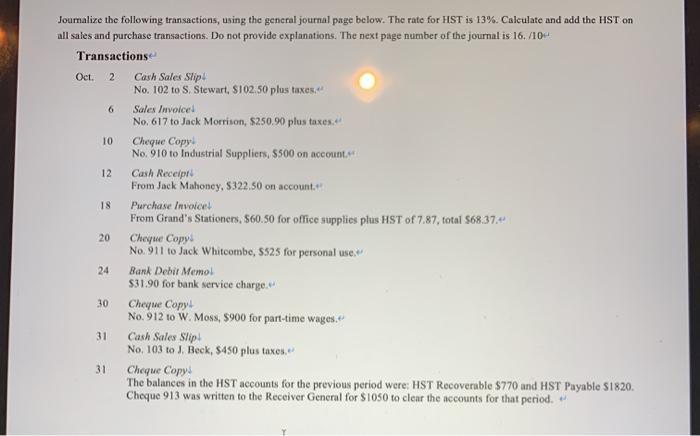

8. Jack Whitcombe and Sons is a consultant engineering firm. The accounts for the firm are as follows. Bank Car Expense HST Recoverable HST Payable J. Whitcombe, Capital J. Whitcombe, Drawings Fees Earned Bank Charges Office Expenser Rent Expense Wages Expenser A/R-various Supplies Ofice Equipment Automobile A/P various Journalize the following transactions, using the general journal page below. The rate for HST is 13%. Calculate and add the HST on all sales and purchase transactions. Do not provide explanations. The next page number of the journal is 16. /10 Transactions Cash Sales Slipi No. 102 to S. Stewart, S102.50 plus taxes. Oct. 2 Sales Invoicel No. 617 to Jack Morrison, $250.90 plus taxes. 10 Cheque Copys No. 910 to Industrial Suppliers, $500 on account. Cash Receipt From Jack Mahoney, $322.50 on account. 12 18 Purchase Invoicel From Grand's Stationers, S60.50 for office supplies plus HST of 7.87, total $68.37, Cheque Copy No. 911 to Jack Whitecombe, $525 for personal use, 20 24 Bank Debit Memol $31.90 for bank service charge. 30 Cheque Copy! No. 912 to W. Moss, $900 for part-time wages. Cash Sales Slip. No. 103 to J. Beck, $450 plus taxes. 31 Jounalize the following transactions, using the general journal page below. The rate for HST is 13%. Calculate and add the HST on all sales and purchase transactions. Do not provide explanations. The next page number of the journal is 16. /10 Transactions Oc. Cash Sales Slipi No. 102 to S. Stewart, S102.50 plus taxes, Sales Invoice No. 617 to Jack Morrison, $250,90 plus taxes. 10 Cheque Copy No. 910 to Industrial Suppliers, $500 on acecount Cash Receipti From Jack Mahoney, $322.50 on account. 12 18 Purchase Invoicel From Grand's Stationers, $60.50 for office supplies plus HST of 7.87, total $68.37.4+ 20 Cheque Copyi No. 911 to Jack Whitcombe, $525 for personal use. 24 Bank Debit Memol $31.90 for bank service charge. 30 Cheque Copyi No. 912 to W. Moss, S900 for part-time wages. 31 Cash Sales Slip. No. 103 to J. Beck, $450 plus taxes. 31 Cheque Copys The balances in the HST accounts for the previous period were: HST Recoverable $770 and HST Payable S1820. Cheque 913 was written to the Receiver General for $1050 to clear the accounts for that period. GENERAL JOURNAL PAGE DATE PARTICULARS P.R. DEBIT CREDIT

Step by Step Solution

3.59 Rating (156 Votes )

There are 3 Steps involved in it

To journalize these transactions we need to calculate the HST Harmonized Sales Tax at 13 and then make entries in the general journal Heres how each t... View full answer

Get step-by-step solutions from verified subject matter experts