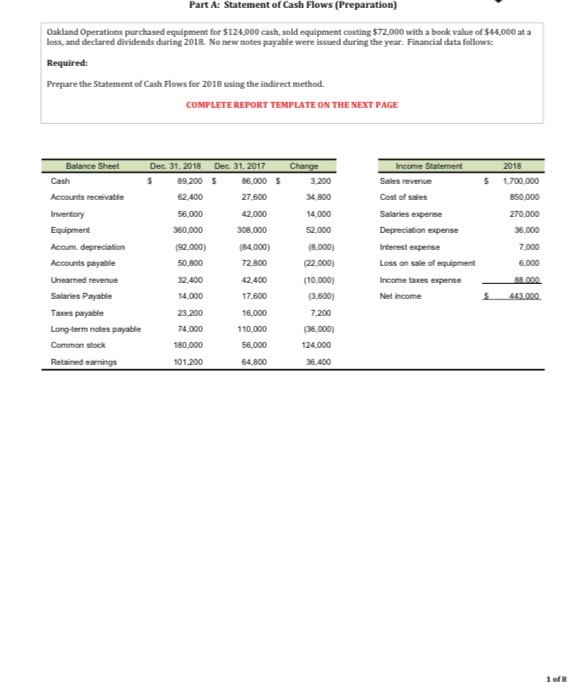

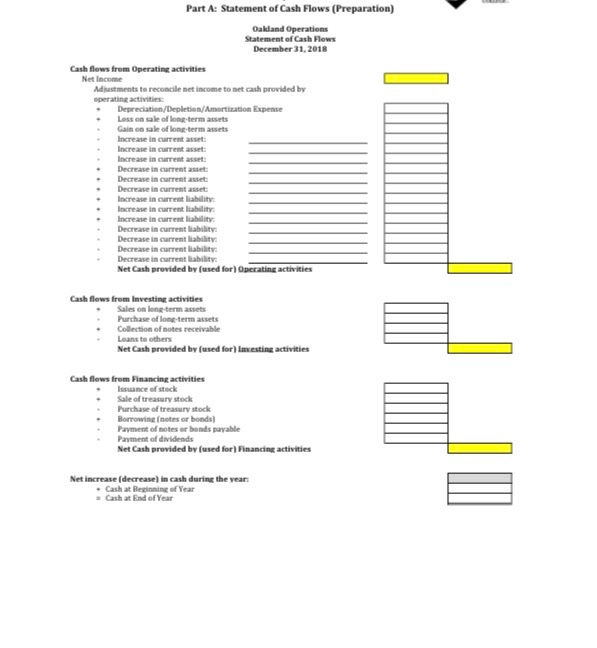

Part A: Statement of Cash Flows (Preparation) Oakland Operations purchased equipment for $124,000 cash, sold equipment casting $72,000 with a book value of 544,000 at a loss, and declared dividends during 2018. No new notes payable were issued during the year. Financial data follows: Required: Prepare the Statement of Cash Flows for 2018 using the indirect method. COMPLETE REPORT TEMPLATE ON THE NEXT PAGE Balance Sheet Cash 5 62.400 Accounts receivable Inventory Equipment Accum. depreciation Accounts payable Unearned revenue Salaries Payable Taxes payable Long-term notes payable Common stock Retained earnings Dec 31, 2018 Dec 31, 2017 $ 89.2005 86,000 $ 27.600 56,000 42,000 360,000 308,000 (92.000) (84.000) 50.800 72,800 32,400 42.400 14.000 17,600 23.200 16.000 74,000 110,000 180.000 56,000 101.200 64,800 Change 3.200 34.800 14,000 52,000 (8.000) (22.000) (10.000) (3.600) 7.200 (38.000) 124.000 35.400 Income Statement Sales revenue Cost of sales Salaries expense Depreciation expense Interest expense Loss on sale of equipment Income taxes expense Net income 2018 1.700.000 850.000 270,000 36.000 7,000 6.000 88.000 1 of Part A: Statement of Cash Flows (Preparation) Oakland Operations Statement of Cash Flows December 31, 2018 Cash flows from Operating activities Net Income Adjustments to reconcile net income to net cash provided by operating activities + Depreciation/Depletion/Amortization Expense Loss on sale of long-term assets Gain on sale of long-term assets Increase in current asset Increase in current asset: Increase in current asset: Decrease in current asset Decrease in current asset Decrease in current asset Increase in current liability Increase in current liability Increase in current liability Decrease in current liability Decrease in current liability Decrease in current liability Decrease in current liability Net Cash provided by (used for) Operating activities Cash flows from Investing activities Sales on long term assets Purchase of long-term assets Collection of notes receivable Leans to others Net Cash provided by (used for) Investing activities Cash flows from Financing activities Issuance of stock Sale of treasury stock Purchase of treasury stock Borrowing notes or bonds Payment of notes or bonds payable Net Cash provided by (used for) Financing activities Net increase (decrease in cash during the year - Cash at Beginning of Year - Cash at End of Year