Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A The following are transactions related to property, plant and equipment of Tulsi Sdn Bhd occurred during 2 0 2 3 : Required: Based

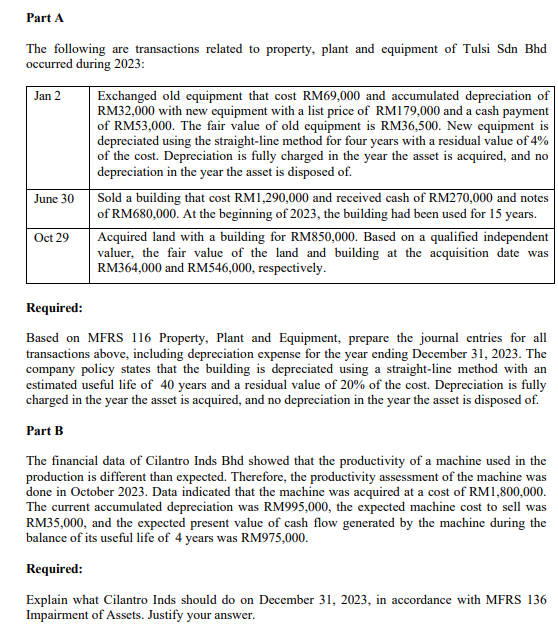

Part A

The following are transactions related to property, plant and equipment of Tulsi Sdn Bhd

occurred during :

Required:

Based on MFRS Property, Plant and Equipment, prepare the journal entries for all

transactions above, including depreciation expense for the year ending December The

company policy states that the building is depreciated using a straightline method with an

estimated useful life of years and a residual value of of the cost. Depreciation is fully

charged in the year the asset is acquired, and no depreciation in the year the asset is disposed of

Part B

The financial data of Cilantro Inds Bhd showed that the productivity of a machine used in the

production is different than expected. Therefore, the productivity assessment of the machine was

done in October Data indicated that the machine was acquired at a cost of RM

The current accumulated depreciation was RM the expected machine cost to sell was

RM and the expected present value of cash flow generated by the machine during the

balance of its useful life of years was RM

Required:

Explain what Cilantro Inds should do on December in accordance with MFRS

Impairment of Assets. Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started