Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part A The Young's Company uses a job-order costing system and a predetermined overhead rate based on direct labour hours (DLH). It identified the following

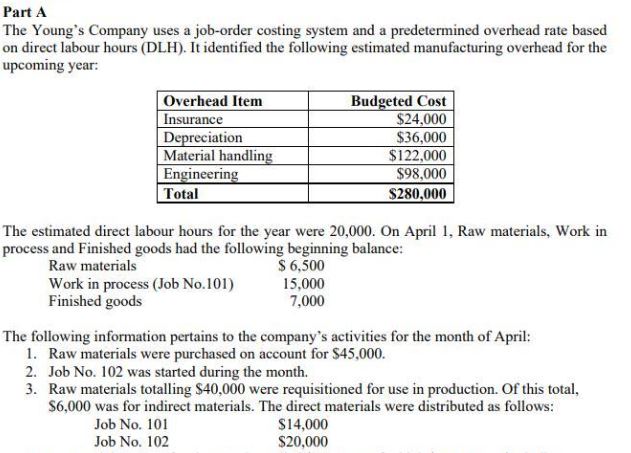

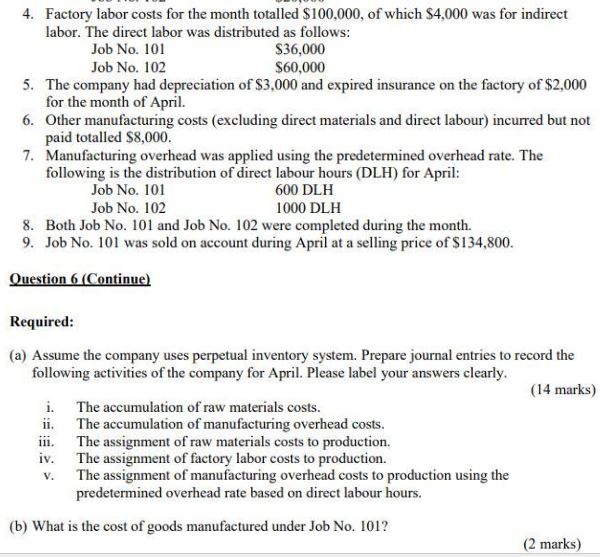

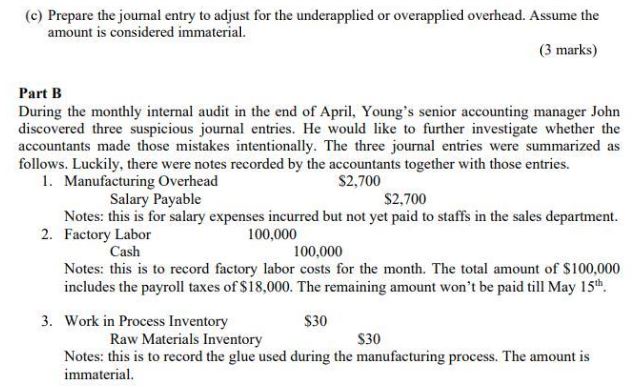

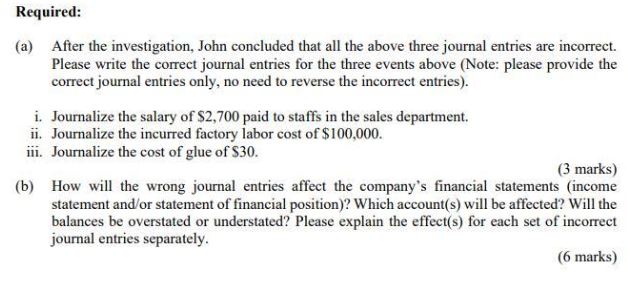

Part A The Young's Company uses a job-order costing system and a predetermined overhead rate based on direct labour hours (DLH). It identified the following estimated manufacturing overhead for the upcoming year: The estimated direct labour hours for the year were 20,000. On April 1, Raw materials, Work in process and Finished goods had the following beginning balance: The following information pertains to the company's activities for the month of April: 1. Raw materials were purchased on account for $45,000. 2. Job No. 102 was started during the month. 3. Raw materials totalling $40,000 were requisitioned for use in production. Of this total, $6,000 was for indirect materials. The direct materials were distributed as follows: \begin{tabular}{ll} Job No. 101 & $14,000 \\ Job No. 102 & $20,000 \end{tabular} 4. Factory labor costs for the month totalled $100,000, of which $4,000 was for indirect labor. The direct labor was distributed as follows: 5. The company had depreciation of $3,000 and expired insurance on the factory of $2,000 for the month of April. 6. Other manufacturing costs (excluding direct materials and direct labour) incurred but not paid totalled $8,000. 7. Manufacturing overhead was applied using the predetermined overhead rate. The following is the distribution of direct labour hours (DLH) for April: 8. Both Job No. 101 and Job No. 102 were completed during the month. 9. Job No. 101 was sold on account during April at a selling price of $134,800. Question 6(Continue) Required: (a) Assume the company uses perpetual inventory system. Prepare journal entries to record the following activities of the company for April. Please label your answers clearly. (14 marks) i. The accumulation of raw materials costs. ii. The accumulation of manufacturing overhead costs. iii. The assignment of raw materials costs to production. iv. The assignment of factory labor costs to production. v. The assignment of manufacturing overhead costs to production using the predetermined overhead rate based on direct labour hours. (b) What is the cost of goods manufactured under Job No. 101? (c) Prepare the journal entry to adjust for the underapplied or overapplied overhead. Assume the amount is considered immaterial. (3 marks) Part B During the monthly internal audit in the end of April, Young's senior accounting manager John discovered three suspicious journal entries. He would like to further investigate whether the accountants made those mistakes intentionally. The three journal entries were summarized as follows. Luckily, there were notes recorded by the accountants together with those entries. 1. Manufacturing Overhead $2,700 Salary Payable $2,700 Notes: this is for salary expenses incurred but not yet paid to staffs in the sales department. 2. 100,000 Factory Labor Cash 100,000 Notes: this is to record factory labor costs for the month. The total amount of $100,000 includes the payroll taxes of $18,000. The remaining amount won't be paid till May 15th. 3. Work in Process Inventory $30 Raw Materials Inventory $30 Notes: this is to record the glue used during the manufacturing process. The amount is immaterial. (a) After the investigation, John concluded that all the above three journal entries are incorrect. Please write the correct journal entries for the three events above (Note: please provide the correct journal entries only, no need to reverse the incorrect entries). i. Journalize the salary of $2,700 paid to staffs in the sales department. ii. Journalize the incurred factory labor cost of $100,000. iii. Journalize the cost of glue of $30. (3 marks) (b) How will the wrong journal entries affect the company's financial statements (income statement and/or statement of financial position)? Which account(s) will be affected? Will the balances be overstated or understated? Please explain the effect(s) for each set of incorrect journal entries separately. (6 marks)

Part A The Young's Company uses a job-order costing system and a predetermined overhead rate based on direct labour hours (DLH). It identified the following estimated manufacturing overhead for the upcoming year: The estimated direct labour hours for the year were 20,000. On April 1, Raw materials, Work in process and Finished goods had the following beginning balance: The following information pertains to the company's activities for the month of April: 1. Raw materials were purchased on account for $45,000. 2. Job No. 102 was started during the month. 3. Raw materials totalling $40,000 were requisitioned for use in production. Of this total, $6,000 was for indirect materials. The direct materials were distributed as follows: \begin{tabular}{ll} Job No. 101 & $14,000 \\ Job No. 102 & $20,000 \end{tabular} 4. Factory labor costs for the month totalled $100,000, of which $4,000 was for indirect labor. The direct labor was distributed as follows: 5. The company had depreciation of $3,000 and expired insurance on the factory of $2,000 for the month of April. 6. Other manufacturing costs (excluding direct materials and direct labour) incurred but not paid totalled $8,000. 7. Manufacturing overhead was applied using the predetermined overhead rate. The following is the distribution of direct labour hours (DLH) for April: 8. Both Job No. 101 and Job No. 102 were completed during the month. 9. Job No. 101 was sold on account during April at a selling price of $134,800. Question 6(Continue) Required: (a) Assume the company uses perpetual inventory system. Prepare journal entries to record the following activities of the company for April. Please label your answers clearly. (14 marks) i. The accumulation of raw materials costs. ii. The accumulation of manufacturing overhead costs. iii. The assignment of raw materials costs to production. iv. The assignment of factory labor costs to production. v. The assignment of manufacturing overhead costs to production using the predetermined overhead rate based on direct labour hours. (b) What is the cost of goods manufactured under Job No. 101? (c) Prepare the journal entry to adjust for the underapplied or overapplied overhead. Assume the amount is considered immaterial. (3 marks) Part B During the monthly internal audit in the end of April, Young's senior accounting manager John discovered three suspicious journal entries. He would like to further investigate whether the accountants made those mistakes intentionally. The three journal entries were summarized as follows. Luckily, there were notes recorded by the accountants together with those entries. 1. Manufacturing Overhead $2,700 Salary Payable $2,700 Notes: this is for salary expenses incurred but not yet paid to staffs in the sales department. 2. 100,000 Factory Labor Cash 100,000 Notes: this is to record factory labor costs for the month. The total amount of $100,000 includes the payroll taxes of $18,000. The remaining amount won't be paid till May 15th. 3. Work in Process Inventory $30 Raw Materials Inventory $30 Notes: this is to record the glue used during the manufacturing process. The amount is immaterial. (a) After the investigation, John concluded that all the above three journal entries are incorrect. Please write the correct journal entries for the three events above (Note: please provide the correct journal entries only, no need to reverse the incorrect entries). i. Journalize the salary of $2,700 paid to staffs in the sales department. ii. Journalize the incurred factory labor cost of $100,000. iii. Journalize the cost of glue of $30. (3 marks) (b) How will the wrong journal entries affect the company's financial statements (income statement and/or statement of financial position)? Which account(s) will be affected? Will the balances be overstated or understated? Please explain the effect(s) for each set of incorrect journal entries separately. (6 marks) Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started