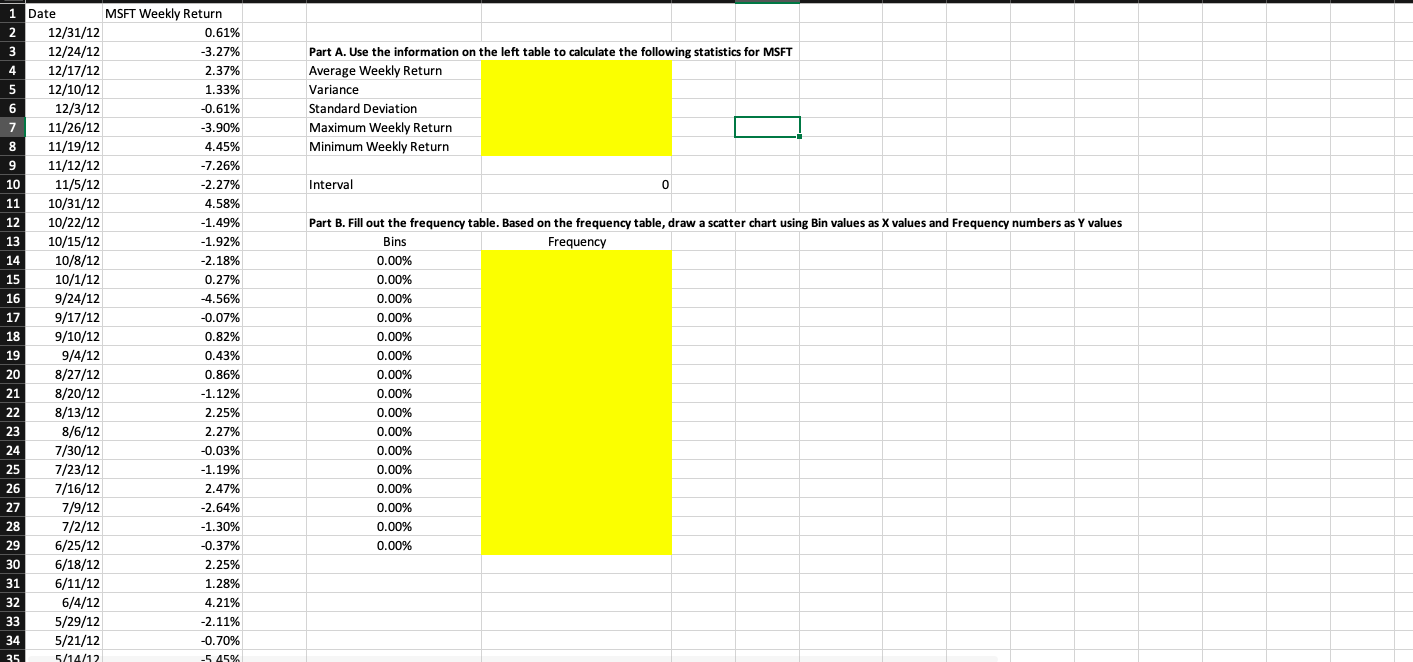

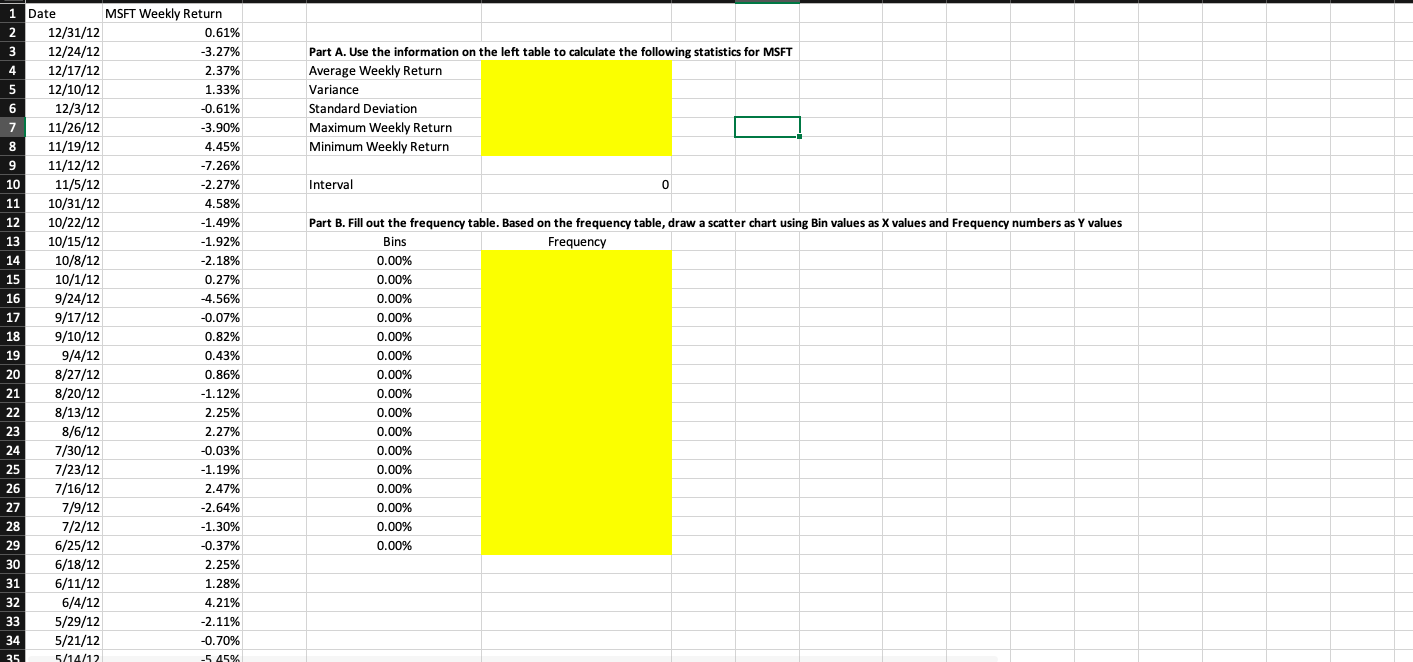

. Part A. Use the information on the left table to calculate the following statistics for MSFT Average Weekly Return Variance Standard Deviation Maximum Weekly Return Minimum Weekly Return Interval 0 1 Date MSFT Weekly Return 2 2 12/31/12 0.61% 3 3 12/24/12 -3.27% 4 4 12/17/12 2.37% 5 12/10/12 1.33% 6 12/3/12 -0.61% 7 11/26/12 -3.90% 8 11/19/12 4.45% 9 9 11/12/12 -7.26% 10 11/5/12 -2.27% 11 10/31/12 4.58% 12 10/22/12 -1.49% 13 10/15/12 -1.92% 14 10/8/12 -2.18% 15 10/1/12 0.27% 16 9/24/12 -4.56% 17 9/17/12 -0.07% 18 9/10/12 0.82% 19 9/4/12 0.43% 20 8/27/12 0.86% 21 8/20/12 -1.12% 22 8/13/12 2.25% 23 8/6/12 2.27% 24 7/30/12 -0.03% 25 7/23/12 -1.19% 26 7/16/12 2.47% 27 7/9/12 -2.64% 28 7/2/12 -1.30% 29 6/25/12 -0.37% 30 6/18/12 2.25% 31 6/11/12 1.28% 32 6/4/12 4.21% 33 5/29/12 -2.11% 34 5/21/12 -0.70% 25 5/14/12 -5 45% Part B. Fill out the frequency table. Based on the frequency table, draw a scatter chart using Bin values as X values and Frequency numbers as Y values Bins Frequency 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% . Part A. Use the information on the left table to calculate the following statistics for MSFT Average Weekly Return Variance Standard Deviation Maximum Weekly Return Minimum Weekly Return Interval 0 1 Date MSFT Weekly Return 2 2 12/31/12 0.61% 3 3 12/24/12 -3.27% 4 4 12/17/12 2.37% 5 12/10/12 1.33% 6 12/3/12 -0.61% 7 11/26/12 -3.90% 8 11/19/12 4.45% 9 9 11/12/12 -7.26% 10 11/5/12 -2.27% 11 10/31/12 4.58% 12 10/22/12 -1.49% 13 10/15/12 -1.92% 14 10/8/12 -2.18% 15 10/1/12 0.27% 16 9/24/12 -4.56% 17 9/17/12 -0.07% 18 9/10/12 0.82% 19 9/4/12 0.43% 20 8/27/12 0.86% 21 8/20/12 -1.12% 22 8/13/12 2.25% 23 8/6/12 2.27% 24 7/30/12 -0.03% 25 7/23/12 -1.19% 26 7/16/12 2.47% 27 7/9/12 -2.64% 28 7/2/12 -1.30% 29 6/25/12 -0.37% 30 6/18/12 2.25% 31 6/11/12 1.28% 32 6/4/12 4.21% 33 5/29/12 -2.11% 34 5/21/12 -0.70% 25 5/14/12 -5 45% Part B. Fill out the frequency table. Based on the frequency table, draw a scatter chart using Bin values as X values and Frequency numbers as Y values Bins Frequency 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00% 0.00%