Answered step by step

Verified Expert Solution

Question

1 Approved Answer

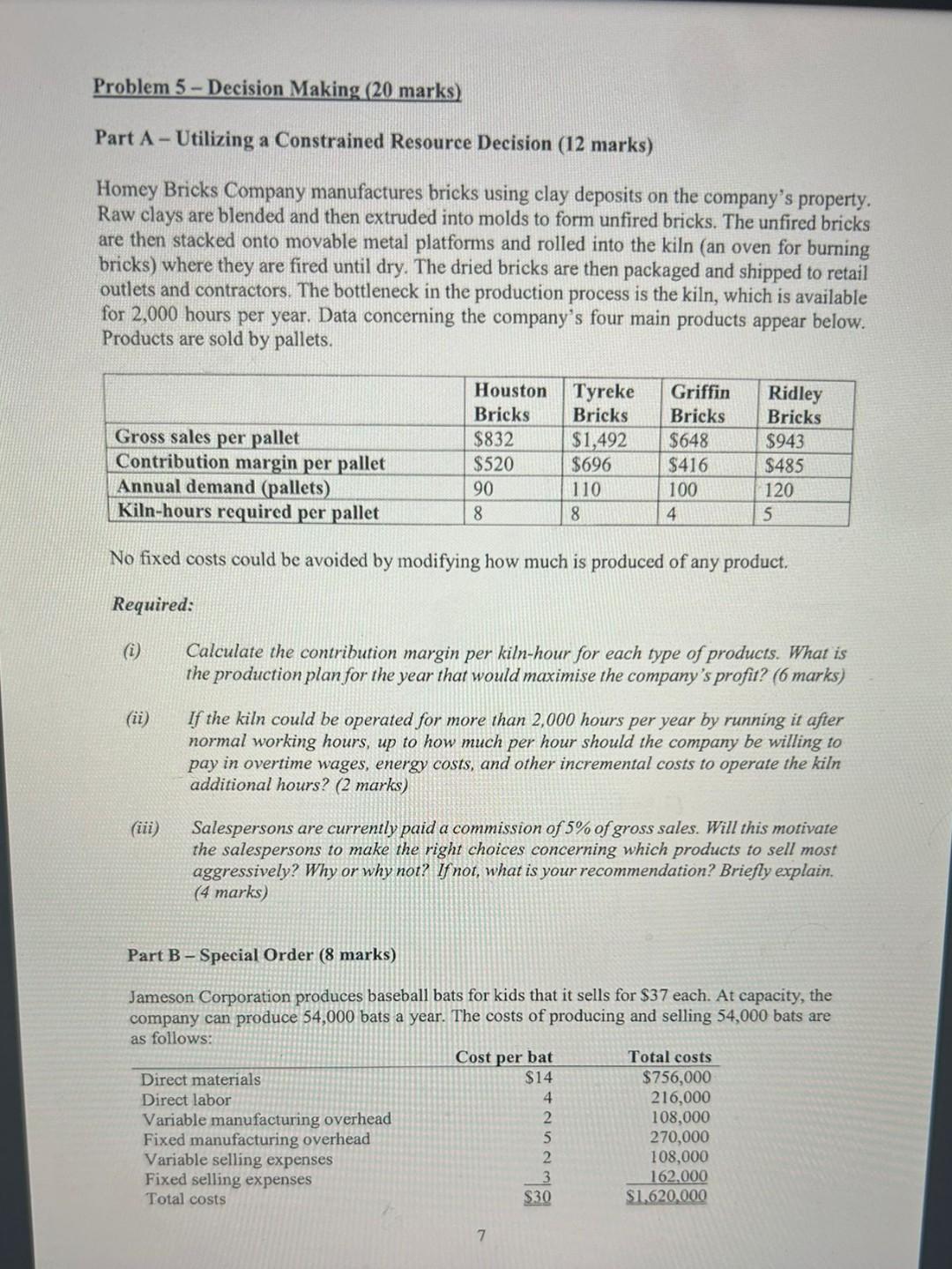

Part A - Utilizing a Constrained Resource Decision (12 marks) Homey Bricks Company manufactures bricks using clay deposits on the company's property. Raw clays are

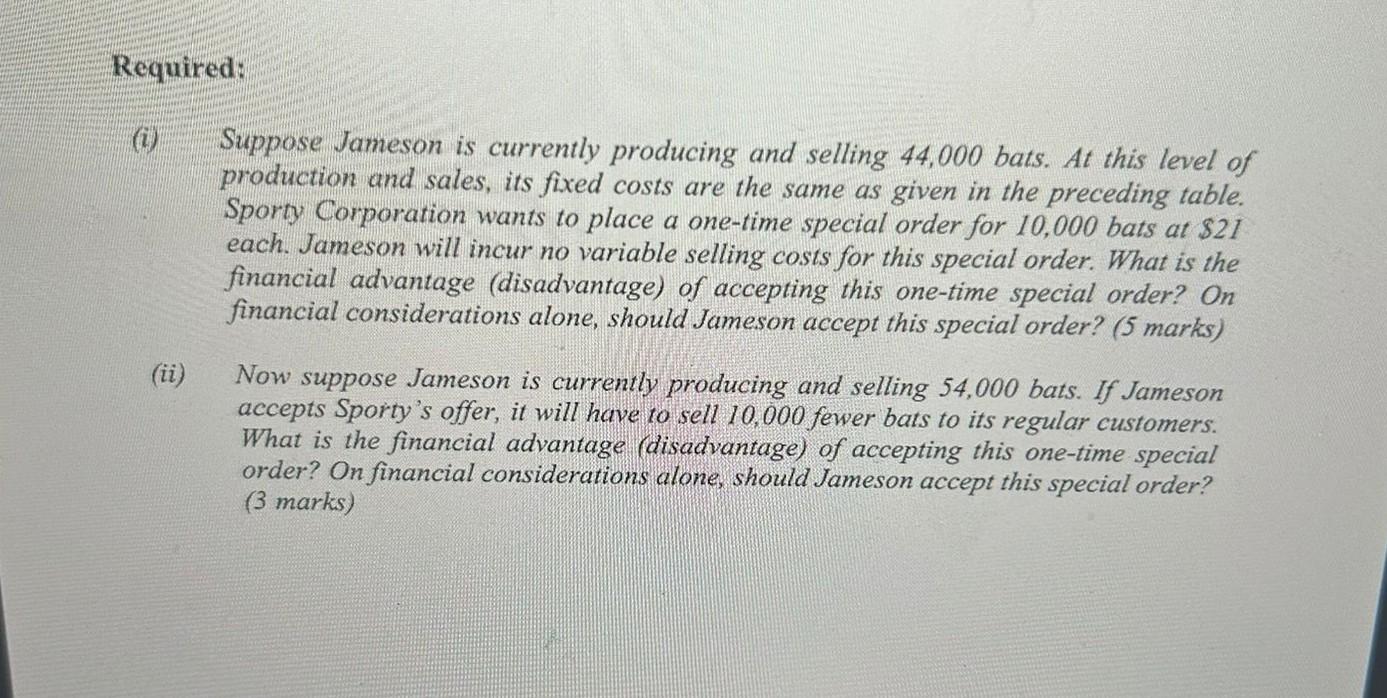

Part A - Utilizing a Constrained Resource Decision (12 marks) Homey Bricks Company manufactures bricks using clay deposits on the company's property. Raw clays are blended and then extruded into molds to form unfired bricks. The unfired bricks are then stacked onto movable metal platforms and rolled into the kiln (an oven for burning bricks) where they are fired until dry. The dried bricks are then packaged and shipped to retail outlets and contractors. The bottleneck in the production process is the kiln, which is available for 2,000 hours per year. Data concerning the company's four main products appear below. Products are sold by pallets. No fixed costs could be avoided by modifying how much is produced of any product. Required: (i) Calculate the contribution margin per kiln-hour for each type of products. What is the production plan for the year that would maximise the company's profit? (6 marks) (ii) If the kiln could be operated for more than 2,000 hours per year by running it after normal working hours, up to how much per hour should the company be willing to pay in overtime wages, energy costs, and other incremental costs to operate the kiln additional hours? (2 marks) (iii) Salespersons are currently paid a commission of 5% of gross sales. Will this motivate the salespersons to make the right choices concerning which products to sell most aggressively? Why or why not? If not, what is your recommendation? Briefly explain, (4 marks) Part B - Special Order (8 marks) Jameson Corporation produces baseball bats for kids that it sells for $37 each. At capacity, the company can produce 54,000 bats a year. The costs of producing and selling 54,000 bats are as follows: (i) Suppose Jameson is currently producing and selling 44,000 bats. At this level of production and sales, its fixed costs are the same as given in the preceding table. Sporty Corporation wants to place a one-time special order for 10,000 bats at $21 each. Jameson will incur no variable selling costs for this special order. What is the financial advantage (disadvantage) of accepting this one-time special order? On financial considerations alone, should Jameson accept this special order? (5 marks) (ii) Now suppose Jameson is currently producing and selling 54,000 bats. If Jameson accepts Sporty's offer, it will have to sell 10,000 fewer bats to its regular customers. What is the financial advantage (disadvantage) of accepting this one-time special order? On financial considerations alone, should Jameson accept this special order

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started