Question

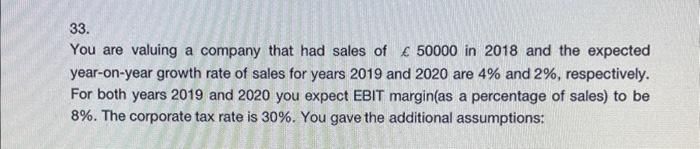

33. You are valuing a company that had sales of 50000 in 2018 and the expected year-on-year growth rate of sales for years 2019

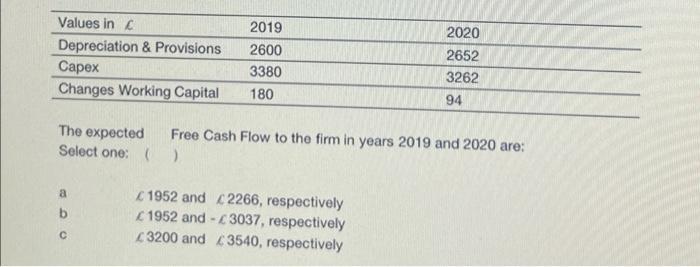

33. You are valuing a company that had sales of 50000 in 2018 and the expected year-on-year growth rate of sales for years 2019 and 2020 are 4% and 2%, respectively. For both years 2019 and 2020 you expect EBIT margin(as a percentage of sales) to be 8%. The corporate tax rate is 30%. You gave the additional assumptions: Values in C 2019 Depreciation & Provisions 2600 3380 180 Capex Changes Working Capital The expected Select one: () a 508 b Free Cash Flow to the firm in years 2019 and 2020 are: 1952 and 1952 and 3200 and 2020 2652 3262 94 2266, respectively 3037, respectively 3540, respectively

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamentals of Human Resource Management

Authors: Raymond Noe, John Hollenbeck, Barry Gerhart, Patrick Wright

6th edition

9781259303661, 9781259254451, 77718364, 1259303667, 1259254453, 978-0077718367

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App