Answered step by step

Verified Expert Solution

Question

1 Approved Answer

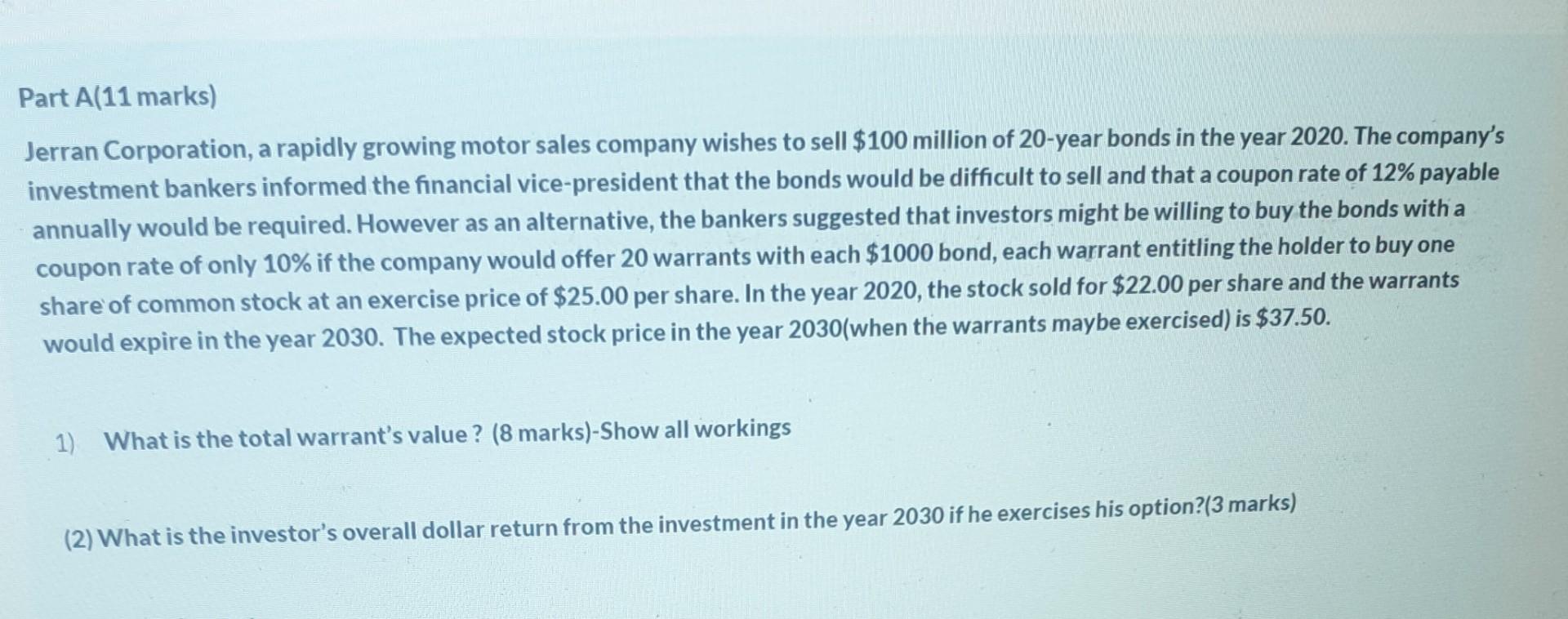

Part A(11 marks) Jerran Corporation, a rapidly growing motor sales company wishes to sell $ 100 million of 20-year bonds in the year 2020. The

Part A(11 marks) Jerran Corporation, a rapidly growing motor sales company wishes to sell $ 100 million of 20-year bonds in the year 2020. The company's investment bankers informed the financial vice-president that the bonds would be difficult to sell and that a coupon rate of 12% payable annually would be required. However as an alternative, the bankers suggested that investors might be willing to buy the bonds with a coupon rate of only 10% if the company would offer 20 warrants with each $1000 bond, each warrant entitling the holder to buy one share of common stock at an exercise price of $25.00 per share. In the year 2020, the stock sold for $22.00 per share and the warrants would expire in the year 2030. The expected stock price in the year 2030(when the warrants maybe exercised) is $37.50. 1) What is the total warrant's value ? (8 marks)-Show all workings (2) What is the investor's overall dollar return from the investment in the year 2030 if he exercises his option

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started