Question

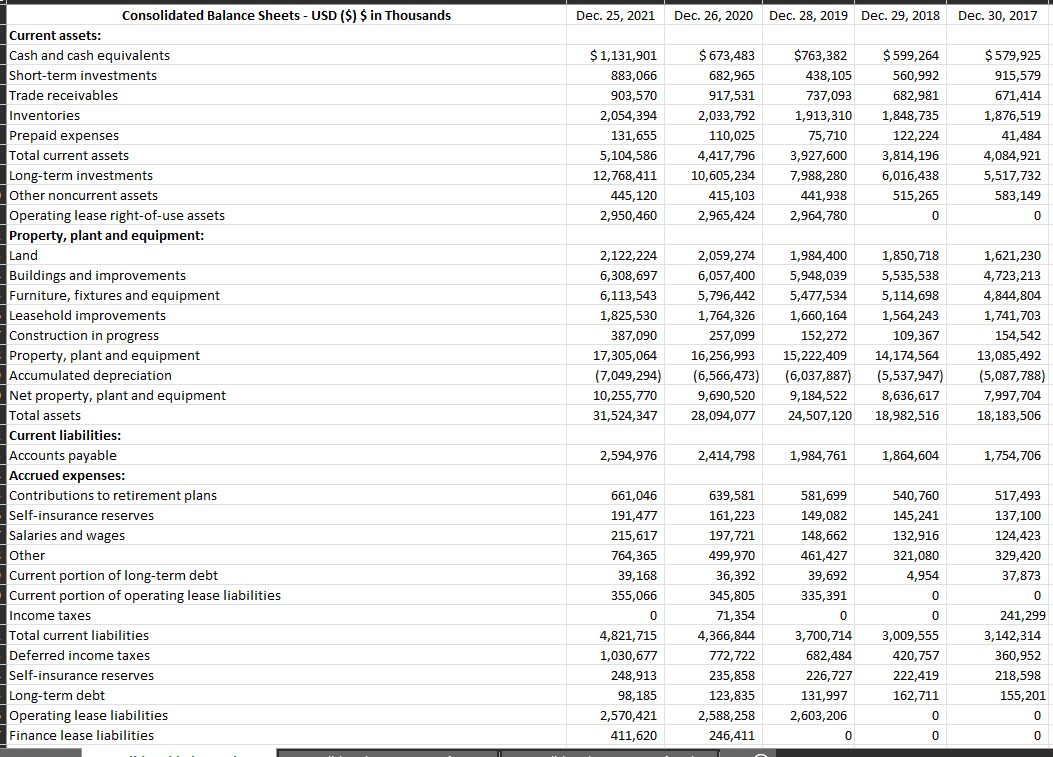

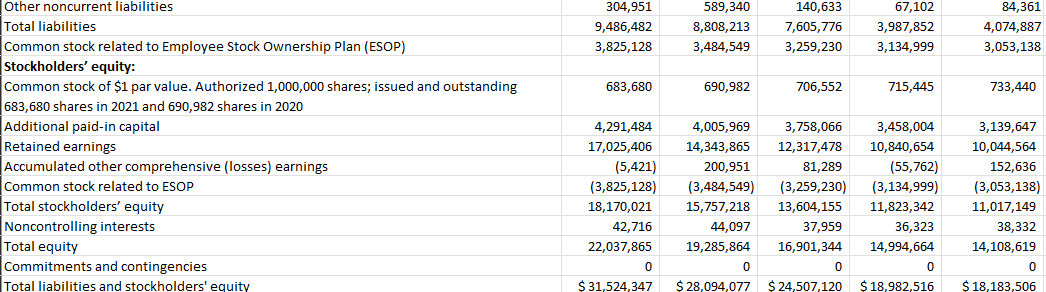

Part A2: make a five-year analysis of your company as follows: just need to calculate following anaysis from the attachement. first Two picture is Balance

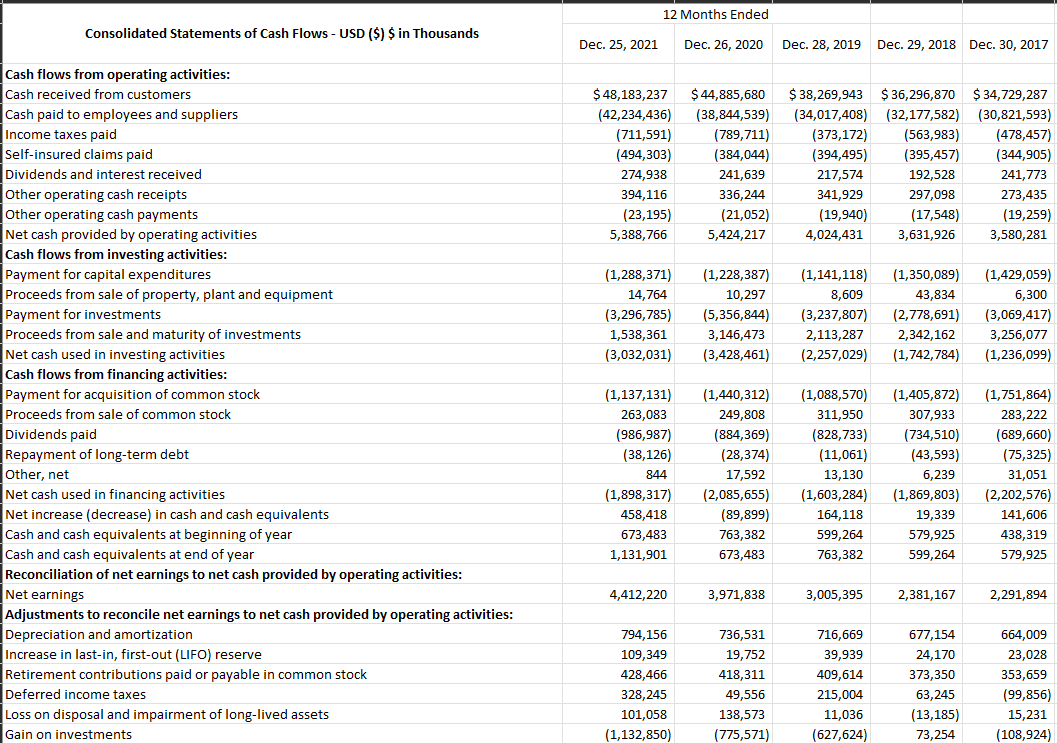

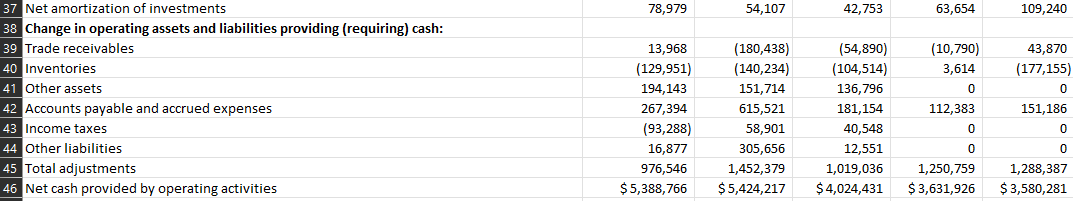

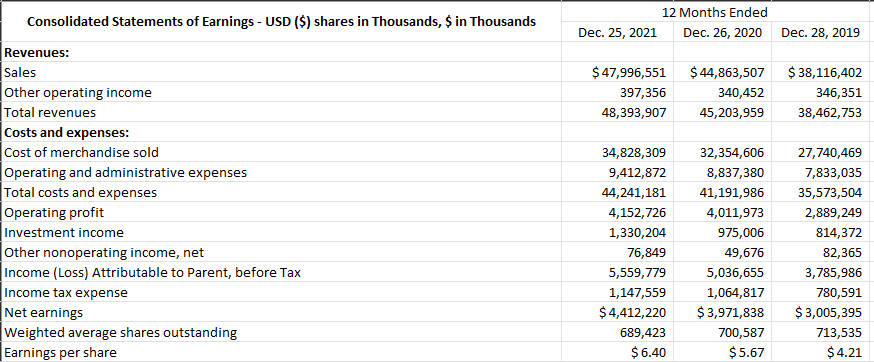

Part A2: make a five-year analysis of your company as follows: just need to calculate following anaysis from the attachement. first Two picture is Balance sheet, 3 and 4 is cash flow and 5th is earn statement

Vertical Analysis on the Balance Sheet and Income Statement (five years)

Horizontal Analysis on the Balance Sheet and Income statement (four years)

Determine Free Cash flow for each year. (Operating cash flow - Capital expenditures) You can get the capital expenditures from the statement of cash flows investing activities.

Compute the following ratios:

Return on equity (NI/Total Equity)

Return on assets (NI/Total Assets)

Profit Margin (NI/Total Sales)

Asset Turnover (Sales/Total Assets)

Accounts Receivable Turnover (Sales/Ending Net Accounts Receivable)

Average Collection Period (365 days of the year/Accounts Receivable Turnover)

Inventory Turnover (Cost of Goods Sold/Ending Inventory)

Days Sales in Inventory (365 days of the year/Inventory Turnover)

Current Ratio (Current Assets/Current Liabilities)

Quick ratio (any assets through Accounts Receivable/Current Liabilities)

Complete the financial analysis in an excel spreadsheet. Have different "sheets" in one workbook for IS (income statement) BS (balance sheet), CF (cash flow), and Ratios. The IS sheet should have the actual Income statement figures, but also another set of columns that have Vertical %, and then another set for the Horizontal Analysis % Change. The same for the Balance Sheet. The free cash flow calculation should be on the CF sheet. Make sure to label all years and calculations clearly.

Consolidated Statements of Cash Flows - USD (\$) \$ in Thousands 12 Months Ended Cash flows from operating activities: 37 Net amortization of investments 38 Change in operating assets and liabilities providing (requiring) cash: 39 Trade receivables 40 Inventories 41 Other assets 42 Accounts payable and accrued expenses 43 Income taxes 44 Other liabilities 45 Total adjustments 46 Net cash provided by operating activities Consolidated Statements of Cash Flows - USD (\$) \$ in Thousands 12 Months Ended Cash flows from operating activities: 37 Net amortization of investments 38 Change in operating assets and liabilities providing (requiring) cash: 39 Trade receivables 40 Inventories 41 Other assets 42 Accounts payable and accrued expenses 43 Income taxes 44 Other liabilities 45 Total adjustments 46 Net cash provided by operating activitiesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started