part A&B

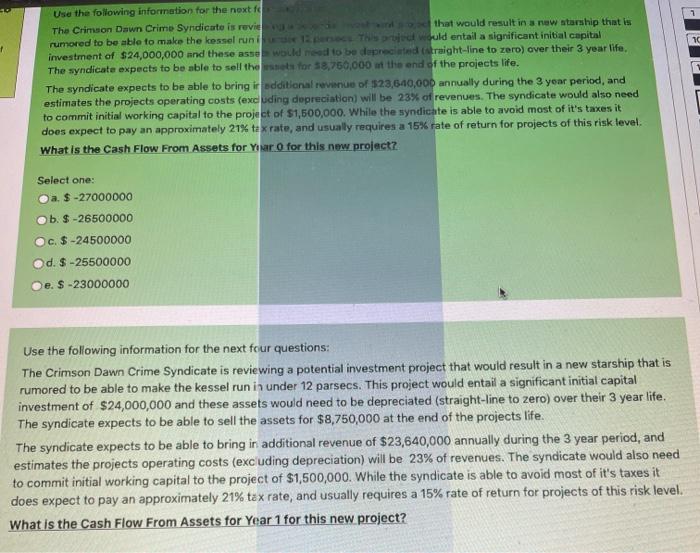

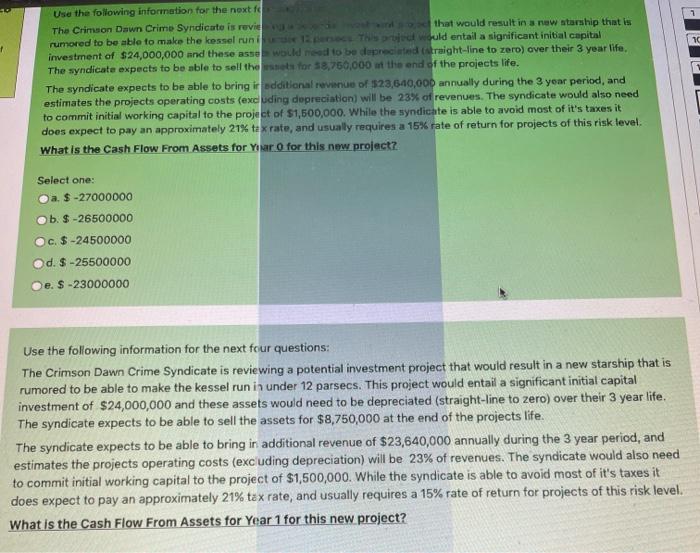

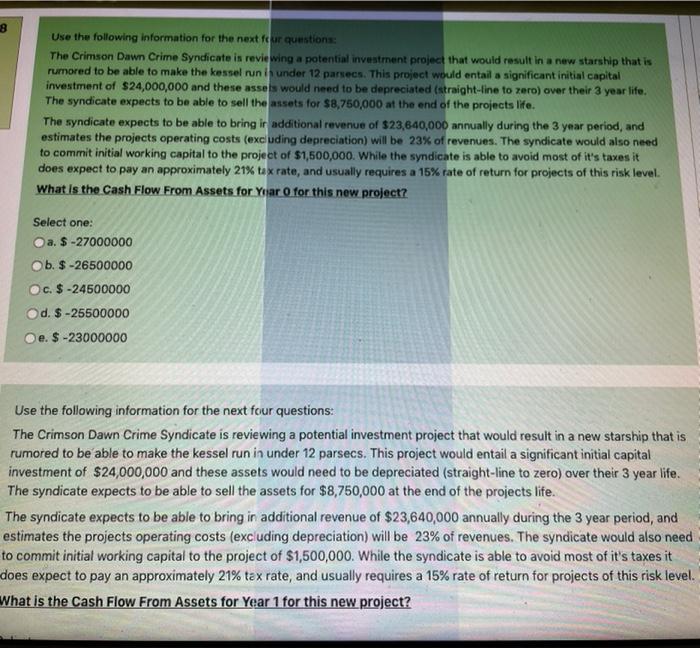

1 Use the following information for the next The Crimson Dawn Crime Syndicate is review that would result in a new starship that is rumored to be able to make the kessel runi This pret would entail a significant initial capital investment of $24,000,000 and these asse would need to be deprecated straight-line to zero) over their 3 year life, The syndicate expects to be able to sell there for $8,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $23,840,000 annually during the 3 year period, and estimates the projects operating costs (exc uding depreciation will be 23% of revenues. The syndicate would also need to commit initial working capital to the project of $1,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 21% tax rate, and usually requires a 15% rate of return for projects of this risk level What is the Cash Flow From Assets for Your O for this new project? Select one: a $ -27000000 b. $ -26500000 c. $-24500000 d. $ -25500000 e. S-23000000 Use the following information for the next four questions: The Crimson Dawn Crime Syndicate is reviewing a potential investment project that would result in a new starship that is rumored to be able to make the kessel run in under 12 parsecs. This project would entail a significant initial capital investment of $24,000,000 and these assets would need to be depreciated (straight-line to zero) over their 3 year life. The syndicate expects to be able to sell the assets for $8,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $23,640,000 annually during the 3 year period, and estimates the projects operating costs (excluding depreciation) will be 23% of revenues. The syndicate would also need to commit initial working capital to the project of $1,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 21% tax rate, and usually requires a 15% rate of return for projects of this risk level. What is the Cash Flow From Assets for Year 1 for this new project? 8 Use the following information for the next four questions: The Crimson Dawn Crime Syndicate in reviewing a potential investment project that would result in a new starship that is rumored to be able to make the kessel run is under 12 parsecs. This project would entail a significant initial capital investment of $24,000,000 and these assets would need to be depreciated (straight-line to zero) over their 3 year life. The syndicate expects to be able to sell the assets for $8,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $23,640,000 annually during the 3 year period, and estimates the projects operating costs (excluding depreciation) will be 23% of revenues. The syndicate would also need to commit initial working capital to the project of $1,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 21% tax rate, and usually requires a 15% rate of return for projects of this risk level. What is the Cash Flow From Assets for Yoar o for this new project? Select one: a. $ -27000000 Ob. $-26500000 c. $ -24500000 d. $ -25500000 e. $-23000000 Use the following information for the next four questions: The Crimson Dawn Crime Syndicate is reviewing a potential investment project that would result in a new starship that is rumored to be able to make the kessel run in under 12 parsecs. This project would entail a significant initial capital investment of $24,000,000 and these assets would need to be depreciated (straight-line to zero) over their 3 year life. The syndicate expects to be able to sell the assets for $8,750,000 at the end of the projects life. The syndicate expects to be able to bring in additional revenue of $23,640,000 annually during the 3 year period, and estimates the projects operating costs (excluding depreciation) will be 23% of revenues. The syndicate would also need to commit initial working capital to the project of $1,500,000. While the syndicate is able to avoid most of it's taxes it does expect to pay an approximately 21% tax rate, and usually requires a 15% rate of return for projects of this risk level. What is the Cash Flow From Assets for Year 1 for this new project