Part A,B,C,D,E

Part A,B,C,D,E

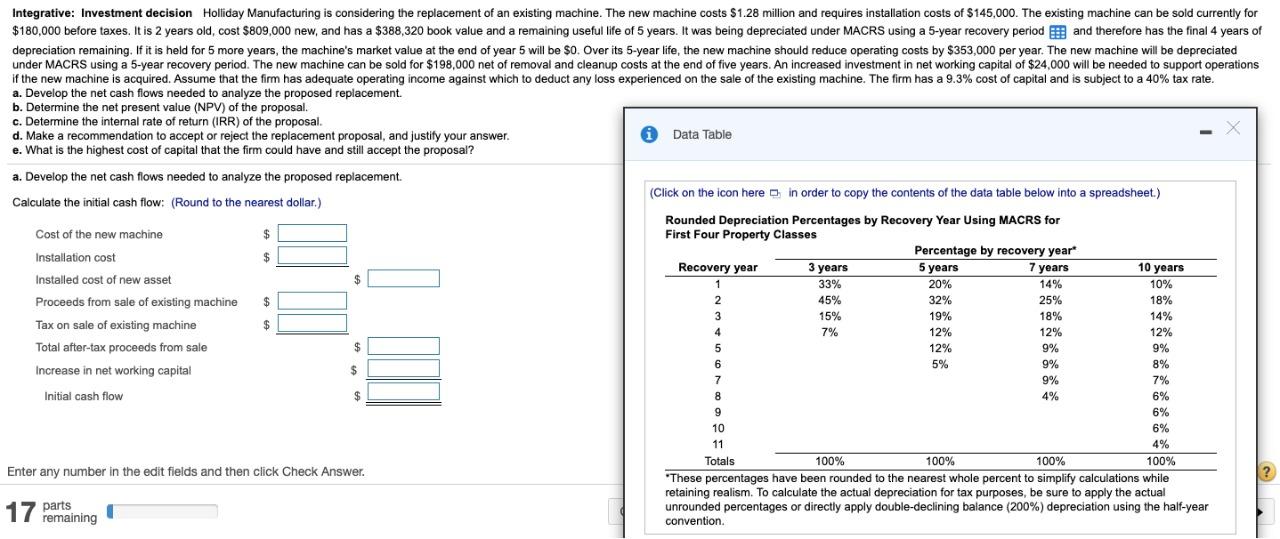

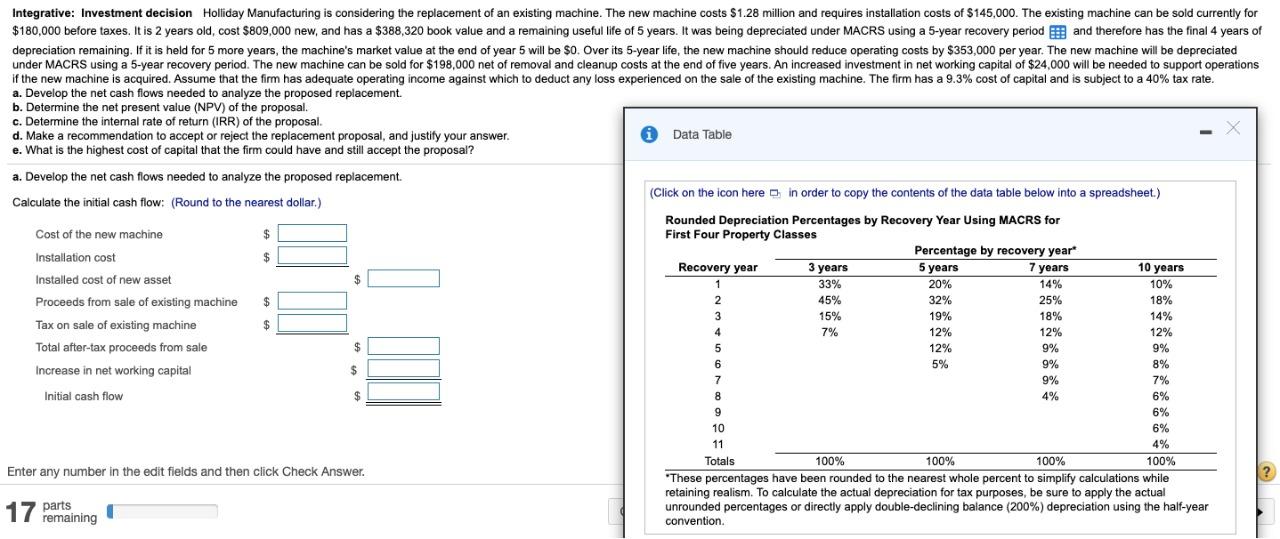

Integrative: Investment decision Holliday Manufacturing is considering the replacement of an existing machine. The new machine costs $1.28 million and requires installation costs of $145,000. The existing machine can be sold currently for $180,000 before taxes. It is 2 years old, cost $809,000 new, and has a $388,320 book value and a remaining useful life of 5 years. It was being depreciated under MACRS using a 5-year recovery period 6 and therefore has the final 4 years of depreciation remaining. If it is held for 5 more years, the machine's market value at the end of year 5 will be $0. Over its 5-year life, the new machine should reduce operating costs by $353,000 per year. The new machine will be depreciated under MACRS using a 5-year recovery period. The new machine can be sold for $198,000 net of removal and cleanup costs at the end of five years. An increased investment in net working capital of $24,000 will be needed to support operations if the new machine is acquired. Assume that the firm has adequate operating income against which to deduct any loss experienced on the sale of the existing machine. The firm has a 9.3% cost of capital and is subject to a 40% tax rate. a. Develop the net cash flows needed to analyze the proposed replacement. b. Determine the net present value (NPV) of the proposal. c. Determine the internal rate of return (IRR) of the proposal. d. Make a recommendation to accept or reject the replacement proposal, and justify your answer. Data Table e. What is the highest cost of capital that the firm could have and still accept the proposal? a. Develop the net cash flows needed to analyze the proposed replacement. Calculate the initial cash flow: (Round to the nearest dollar.) (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for Cost of the new machine $ First Four Property Classes Installation cost $ Percentage by recovery year Recovery year 3 years 5 years 7 years 10 years Installed cost of new asset 33% 20% 14% 10% Proceeds from sale of existing machine $ 2 45% 32% 25% 18% 15% Tax on sale of existing machine 3 19% 18% $ 14% 4 7% 12% 12% 12% Total after-tax proceeds from sale $ 5 12% 9% 9% Increase in net working capital 6 $ 5% 5 9% 8% 7 9% 7% Initial cash flow $ 8 4% 6% 6% 10 6% 11 4% Totals 100% 100% 100% 100% Enter any number in the edit fields and then click Check Answer. 'These percentages have been rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual parts unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention. 9

Part A,B,C,D,E

Part A,B,C,D,E