Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B 2 eBook Print Question 3 Partially correct Mark. 15.00 out of 46.00 P Flat Gestion Reformulating Allowance for Doubtful Accounts MGM International operates

Part B

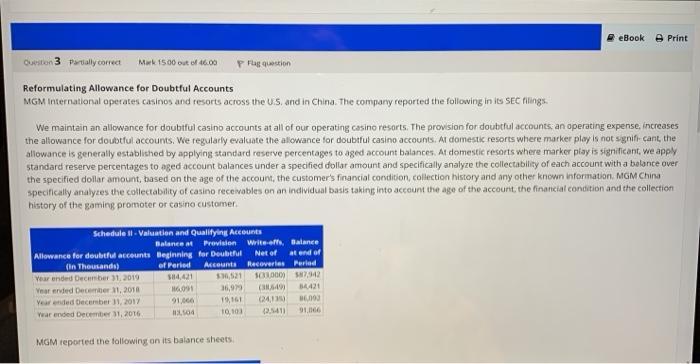

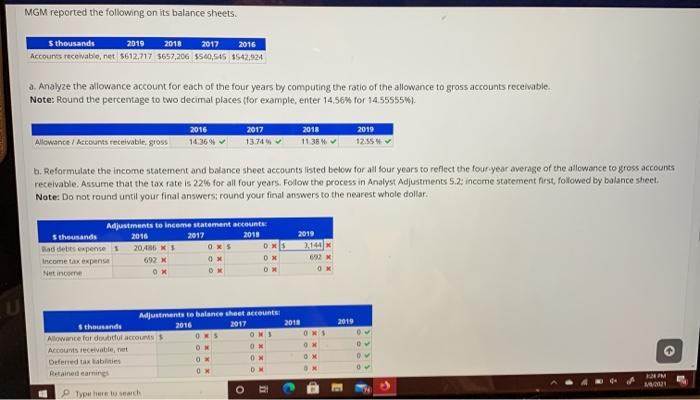

2 eBook Print Question 3 Partially correct Mark. 15.00 out of 46.00 P Flat Gestion Reformulating Allowance for Doubtful Accounts MGM International operates casinos and resorts across the U.S. and in China. The company reported the following in its SEC filings. We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. Al domestic resorts where marker play is not significant, the allowance is generally established by applying standard reserve percentages to aged account balances. At domestic resorts where marker play is significant, we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition collection history and any other known information, MGM China specifically analyzes the collectability of casino recewables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer. Schedule Valuation and Qualifying Account Balance Prevision Writeets, Balance Allowance for doubtful accounts Beginning for Debt Net of at end of (in Thousands) ef Perled Accounts Recoveries Period Year ended December 11, 2019 584421 S521 SO100057942 Year ended December 11, 2018 6091 36,99 40 3442 Year ended December 11, 2017 91.866 0413 Yar ended December 31, 2016 11.04 10.103 2.1411 91.06 MGM reported the following on its balance sheets MGM reported the following on its balance sheets. 2016 S thousands 2019 2018 2017 Accounts recewable, net $612,717 5657,206 $540,545 $542,924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to grass accounts receivable Note: Round the percentage to two decimal places (for example, enter 14.56% for 14.555554). 2016 14369 2017 13.74 2018 11384 2019 12.55 Allowance / Accounts receivable, gross b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four year average of the allowance to gross accounts receivable. Assume that the tax rate is 22% for all four years. Follow the process in Analyst Adjustments 5.2; income statement first, followed by balance sheet Note: Do not round until your final answers; round your final answers to the nearest whole dollar Adjustments to Income statement accounts: sthousands 2016 2017 2011 Rad debes expenses 20/36 KS OXS DNS Income tax expense 692 X ON OX Net income OX OM 2019 3.144 62 2018 2019 0 Adjustments to balance sheet accounts sthousands 2016 2017 Allowance for debut accounts OS ON Accounts receivable et OM OM Deferred tax labies O Retained earning OW DM ONS OW 0 OM OM M Type here to search 2 eBook Print Question 3 Partially correct Mark. 15.00 out of 46.00 P Flat Gestion Reformulating Allowance for Doubtful Accounts MGM International operates casinos and resorts across the U.S. and in China. The company reported the following in its SEC filings. We maintain an allowance for doubtful casino accounts at all of our operating casino resorts. The provision for doubtful accounts an operating expense, increases the allowance for doubtful accounts. We regularly evaluate the allowance for doubtful casino accounts. Al domestic resorts where marker play is not significant, the allowance is generally established by applying standard reserve percentages to aged account balances. At domestic resorts where marker play is significant, we apply standard reserve percentages to aged account balances under a specified dollar amount and specifically analyze the collectability of each account with a balance over the specified dollar amount, based on the age of the account, the customer's financial condition collection history and any other known information, MGM China specifically analyzes the collectability of casino recewables on an individual basis taking into account the age of the account, the financial condition and the collection history of the gaming promoter or casino customer. Schedule Valuation and Qualifying Account Balance Prevision Writeets, Balance Allowance for doubtful accounts Beginning for Debt Net of at end of (in Thousands) ef Perled Accounts Recoveries Period Year ended December 11, 2019 584421 S521 SO100057942 Year ended December 11, 2018 6091 36,99 40 3442 Year ended December 11, 2017 91.866 0413 Yar ended December 31, 2016 11.04 10.103 2.1411 91.06 MGM reported the following on its balance sheets MGM reported the following on its balance sheets. 2016 S thousands 2019 2018 2017 Accounts recewable, net $612,717 5657,206 $540,545 $542,924 a. Analyze the allowance account for each of the four years by computing the ratio of the allowance to grass accounts receivable Note: Round the percentage to two decimal places (for example, enter 14.56% for 14.555554). 2016 14369 2017 13.74 2018 11384 2019 12.55 Allowance / Accounts receivable, gross b. Reformulate the income statement and balance sheet accounts listed below for all four years to reflect the four year average of the allowance to gross accounts receivable. Assume that the tax rate is 22% for all four years. Follow the process in Analyst Adjustments 5.2; income statement first, followed by balance sheet Note: Do not round until your final answers; round your final answers to the nearest whole dollar Adjustments to Income statement accounts: sthousands 2016 2017 2011 Rad debes expenses 20/36 KS OXS DNS Income tax expense 692 X ON OX Net income OX OM 2019 3.144 62 2018 2019 0 Adjustments to balance sheet accounts sthousands 2016 2017 Allowance for debut accounts OS ON Accounts receivable et OM OM Deferred tax labies O Retained earning OW DM ONS OW 0 OM OM M Type here to search Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started