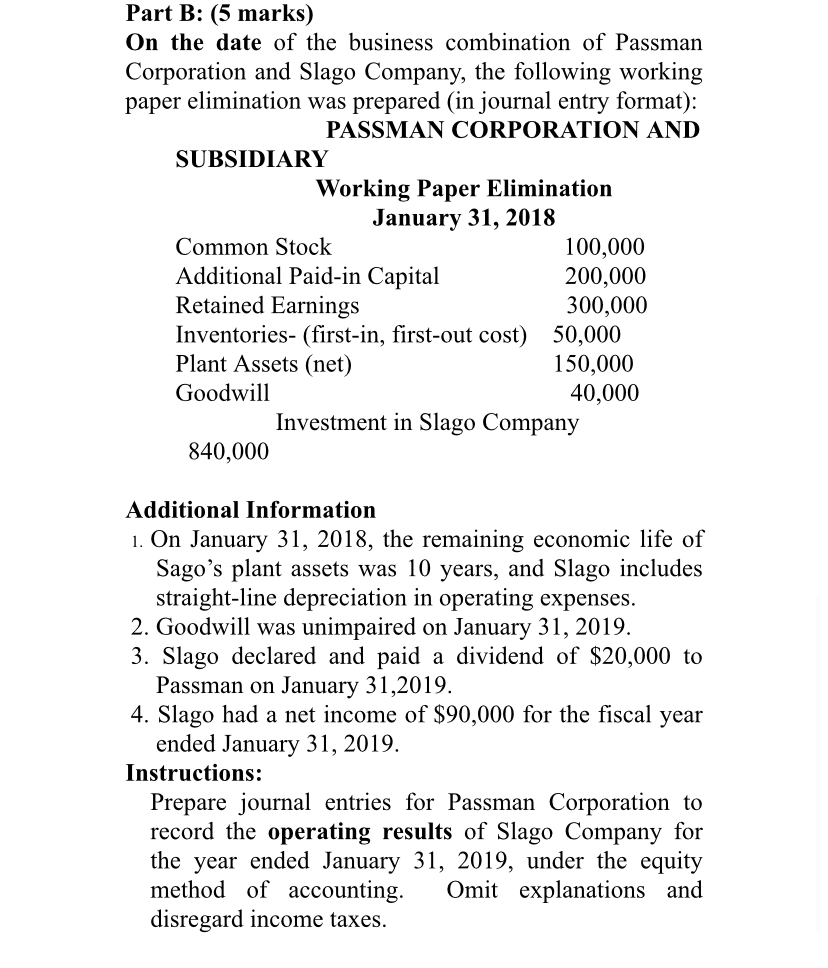

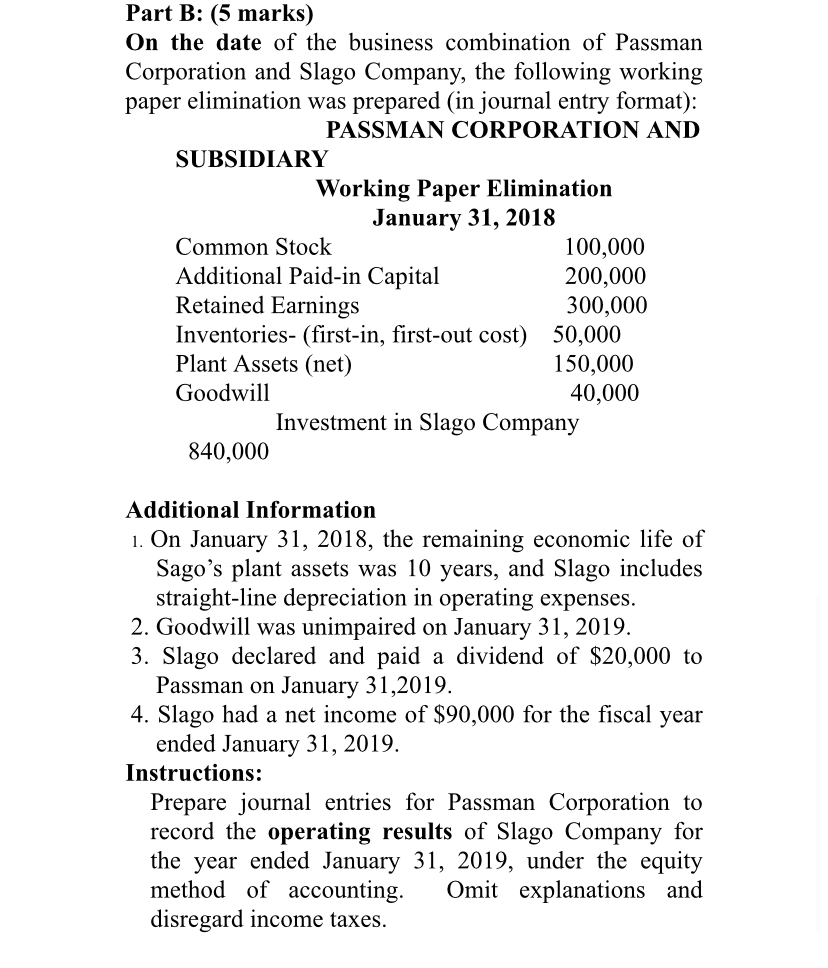

Part B: (5 marks) On the date of the business combination of Passman Corporation and Slago Company, the following working paper elimination was prepared (in journal entry format): PASSMAN CORPORATION AND SUBSIDIARY Working Paper Elimination January 31, 2018 Common Stock 100,000 Additional Paid-in Capital 200,000 Retained Earnings 300,000 Inventories- (first-in, first-out cost) 50,000 Plant Assets (net) 150,000 Goodwill 40,000 Investment in Slago Company 840,000 Additional Information 1. On January 31, 2018, the remaining economic life of Sago's plant assets was 10 years, and Slago includes straight-line depreciation in operating expenses. 2. Goodwill was unimpaired on January 31, 2019. 3. Slago declared and paid a dividend of $20,000 to Passman on January 31,2019. 4. Slago had a net income of $90,000 for the fiscal year ended January 31, 2019. Instructions: Prepare journal entries for Passman Corporation to record the operating results of Slago Company for the year ended January 31, 2019, under the equity method of accounting. Omit explanations and disregard income taxes. Part B: (5 marks) On the date of the business combination of Passman Corporation and Slago Company, the following working paper elimination was prepared (in journal entry format): PASSMAN CORPORATION AND SUBSIDIARY Working Paper Elimination January 31, 2018 Common Stock 100,000 Additional Paid-in Capital 200,000 Retained Earnings 300,000 Inventories- (first-in, first-out cost) 50,000 Plant Assets (net) 150,000 Goodwill 40,000 Investment in Slago Company 840,000 Additional Information 1. On January 31, 2018, the remaining economic life of Sago's plant assets was 10 years, and Slago includes straight-line depreciation in operating expenses. 2. Goodwill was unimpaired on January 31, 2019. 3. Slago declared and paid a dividend of $20,000 to Passman on January 31,2019. 4. Slago had a net income of $90,000 for the fiscal year ended January 31, 2019. Instructions: Prepare journal entries for Passman Corporation to record the operating results of Slago Company for the year ended January 31, 2019, under the equity method of accounting. Omit explanations and disregard income taxes