Answered step by step

Verified Expert Solution

Question

1 Approved Answer

part b and c Zac ible by Exam Paper. Clicking your assessment using s), scan any handwritte as one single documen t. We recommend tha

part b and c

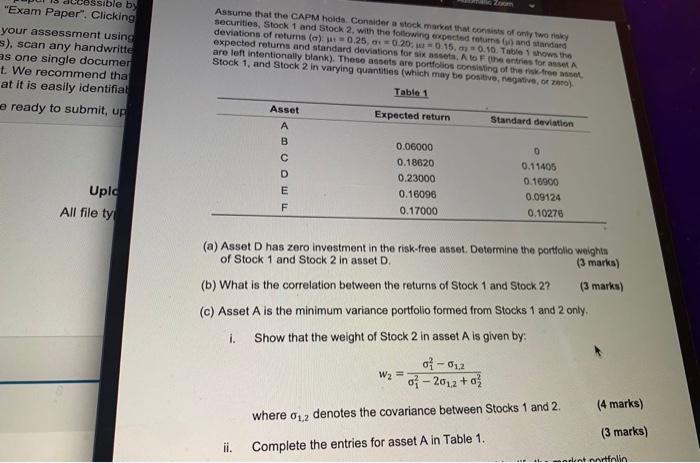

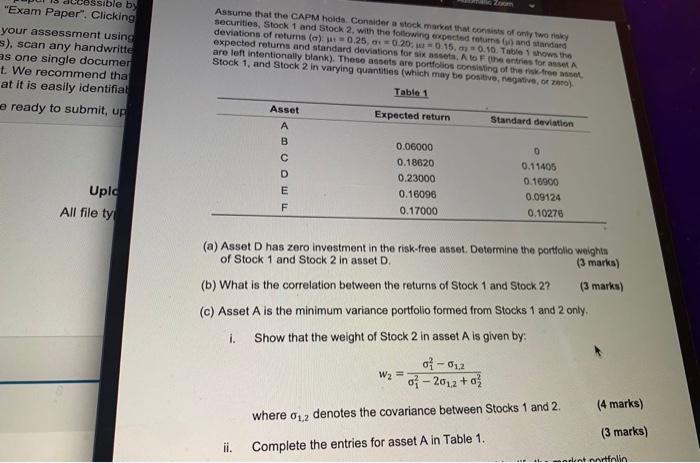

Zac ible by "Exam Paper. Clicking your assessment using s), scan any handwritte as one single documen t. We recommend tha at it is easily identifiat e ready to submit, up Assume that the CAPM hoids. Consider a stock market that consists of only two securities, Stock 1 and Stock 2. with the following expected returns and standard deviations of returns (a)=0.25, 0.20 0.15 0.10. Table 1 shows the expected returns and standard deviations for six seta. A to the entries for asse A are left intentionally blank). These assets are portfolios consisting of the risk-free, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, of zero) Table 1 Asset Expected return Standard deviation Oow 0.06000 0.18620 0.23000 0.16096 0.17000 Uplc All file ty 0 0.11405 0.16900 0.09124 0.10278 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only, i. Show that the weight of Stock 2 in asset A is given by: o-012 W2 = o-2012 +o (4 marks) where 01.2 denotes the covariance between Stocks 1 and 2 (3 marks) ii. Complete the entries for asset A in Table 1. dent mortfolin Zac ible by "Exam Paper. Clicking your assessment using s), scan any handwritte as one single documen t. We recommend tha at it is easily identifiat e ready to submit, up Assume that the CAPM hoids. Consider a stock market that consists of only two securities, Stock 1 and Stock 2. with the following expected returns and standard deviations of returns (a)=0.25, 0.20 0.15 0.10. Table 1 shows the expected returns and standard deviations for six seta. A to the entries for asse A are left intentionally blank). These assets are portfolios consisting of the risk-free, Stock 1, and Stock 2 in varying quantities (which may be positive, negative, of zero) Table 1 Asset Expected return Standard deviation Oow 0.06000 0.18620 0.23000 0.16096 0.17000 Uplc All file ty 0 0.11405 0.16900 0.09124 0.10278 (a) Asset D has zero investment in the risk-free asset. Determine the portfolio weights of Stock 1 and Stock 2 in asset D (3 marks) (b) What is the correlation between the returns of Stock 1 and Stock 2? (3 marks) (c) Asset A is the minimum variance portfolio formed from Stocks 1 and 2 only, i. Show that the weight of Stock 2 in asset A is given by: o-012 W2 = o-2012 +o (4 marks) where 01.2 denotes the covariance between Stocks 1 and 2 (3 marks) ii. Complete the entries for asset A in Table 1. dent mortfolin

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started