Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B: Assignment Requirements Question 1. Transfer pricing Armando Corporation consists of two manufacturing divisions: Crater Division and Dollar Division. The Crater Division manufactures and

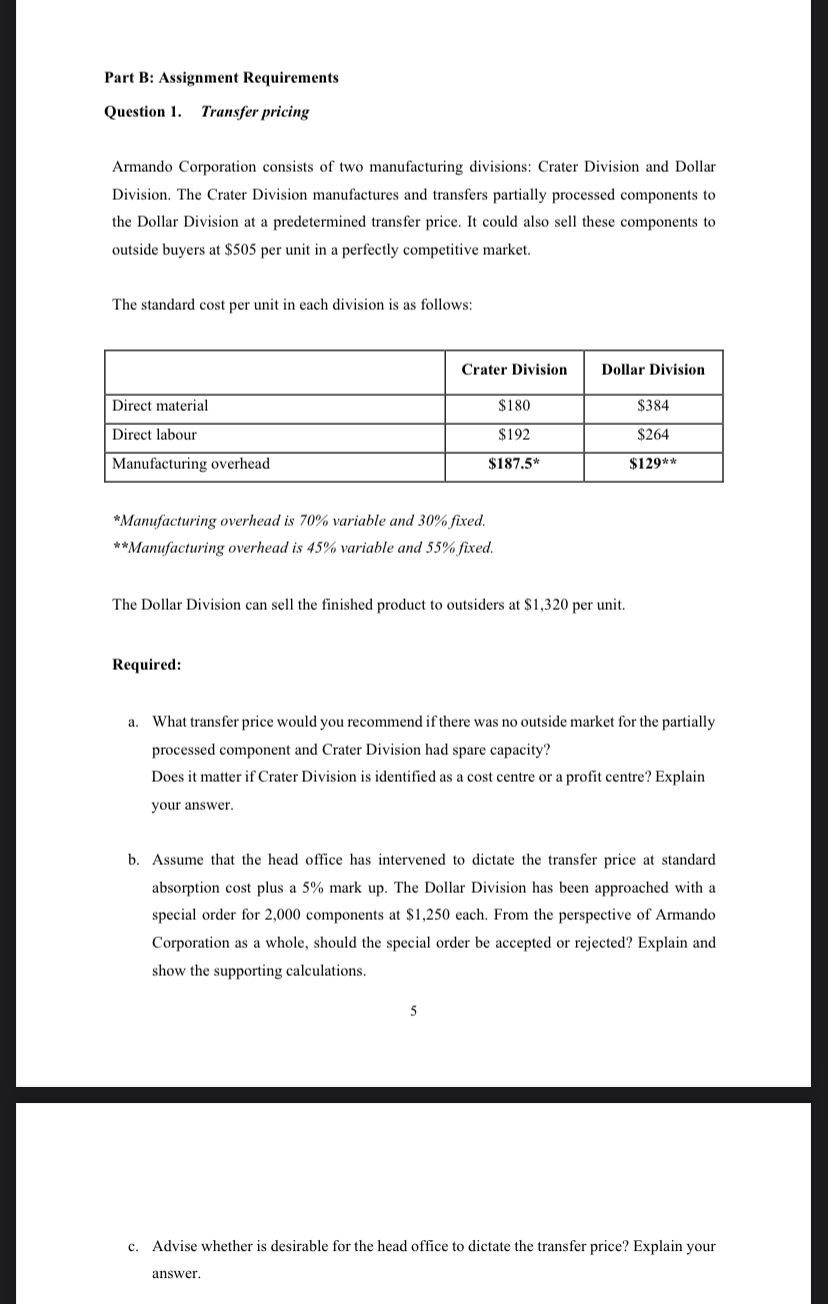

Part B: Assignment Requirements Question 1. Transfer pricing Armando Corporation consists of two manufacturing divisions: Crater Division and Dollar Division. The Crater Division manufactures and transfers partially processed components to the Dollar Division at a predetermined transfer price. It could also sell these components to outside buyers at $505 per unit in a perfectly competitive market. The standard cost per unit in each division is as follows: *Manufacturing overhead is 70% variable and 30% fixed. Manufacturing overhead is 45% variable and 55% fixed. The Dollar Division can sell the finished product to outsiders at $1,320 per unit. Required: a. What transfer price would you recommend if there was no outside market for the partially processed component and Crater Division had spare capacity? Does it matter if Crater Division is identified as a cost centre or a profit centre? Explain your answer. b. Assume that the head office has intervened to dictate the transfer price at standard absorption cost plus a 5% mark up. The Dollar Division has been approached with a special order for 2,000 components at $1,250 each. From the perspective of Armando Corporation as a whole, should the special order be accepted or rejected? Explain and show the supporting calculations. 5 c. Advise whether is desirable for the head office to dictate the transfer price? Explain your

Part B: Assignment Requirements Question 1. Transfer pricing Armando Corporation consists of two manufacturing divisions: Crater Division and Dollar Division. The Crater Division manufactures and transfers partially processed components to the Dollar Division at a predetermined transfer price. It could also sell these components to outside buyers at $505 per unit in a perfectly competitive market. The standard cost per unit in each division is as follows: *Manufacturing overhead is 70% variable and 30% fixed. Manufacturing overhead is 45% variable and 55% fixed. The Dollar Division can sell the finished product to outsiders at $1,320 per unit. Required: a. What transfer price would you recommend if there was no outside market for the partially processed component and Crater Division had spare capacity? Does it matter if Crater Division is identified as a cost centre or a profit centre? Explain your answer. b. Assume that the head office has intervened to dictate the transfer price at standard absorption cost plus a 5% mark up. The Dollar Division has been approached with a special order for 2,000 components at $1,250 each. From the perspective of Armando Corporation as a whole, should the special order be accepted or rejected? Explain and show the supporting calculations. 5 c. Advise whether is desirable for the head office to dictate the transfer price? Explain your Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started