Answered step by step

Verified Expert Solution

Question

1 Approved Answer

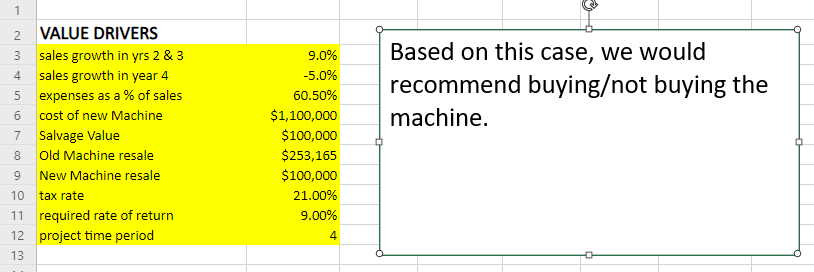

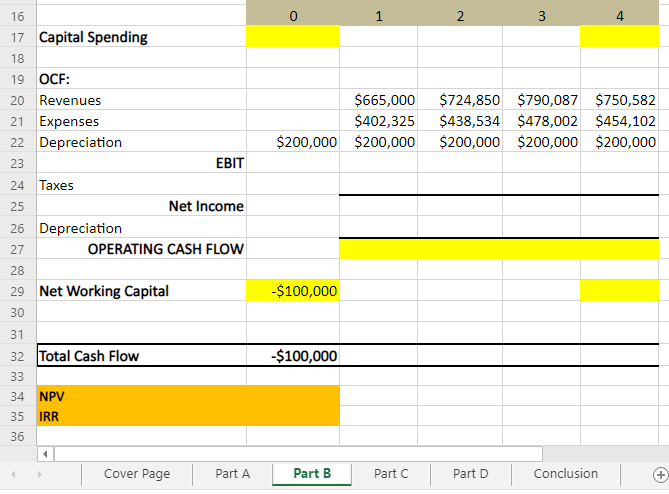

Part B: Best Case evaluation Assume Sales Growth in Years 2 & 3 are 9% instead of 8.5% (Year 4s projections remain a sales decline

Part B: Best Case evaluation

Assume Sales Growth in Years 2 & 3 are 9% instead of 8.5% (Year 4s projections remain a sales decline of 5%). Also assume costs are 60.5% of sales instead of 60.75%.

Note: Your company has determined that this scenario has a 5% chance of occurring.

I need Excel formula.

1 2 3 4 Based on this case, we would recommend buyingot buying the machine. 5 6 7 VALUE DRIVERS sales growth in yrs 2 & 3 sales growth in year 4 expenses as a % of sales cost of new Machine Salvage Value Old Machine resale New Machine resale 10 tax rate 11 required rate of return 12 project time period 13 9.0% -5.0% 60.50% $1,100,000 $100,000 $253,165 $100,000 21.00% 9.00% 4 8 9 0 1 2 3 4 $665,000 $402,325 $200,000 $200,000 $724,850 $790,087 $750,582 $438,534 $478,002 $454,102 $200,000 $200,000 $200,000 16 17 Capital Spending 18 19 OCF: 20 Revenues 21 Expenses 22 Depreciation 23 EBIT 24 Taxes 25 Net Income 26 Depreciation 27 OPERATING CASH FLOW 28 29 Net Working Capital 30 31 32 Total Cash Flow 33 $100,000 $100,000 34 NPV 35 IRR 36 Cover Page Part A Part B Partc | Part D Conclusion +Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started