Answered step by step

Verified Expert Solution

Question

1 Approved Answer

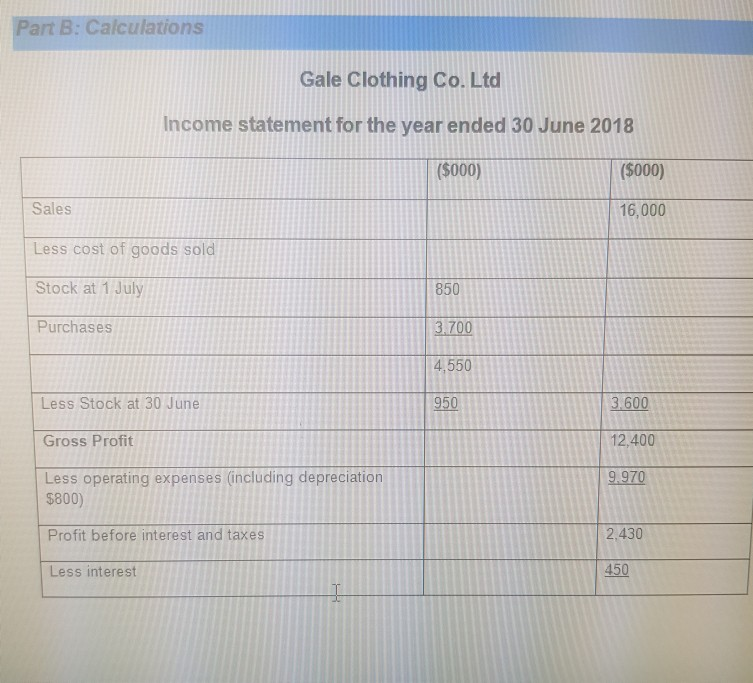

Part B: Calculations Gale Clothing Co.Ltd Income statement for the year ended 30 June 2018 ($000) ($000) Sales 16,000 Less cost of goods sold Stock

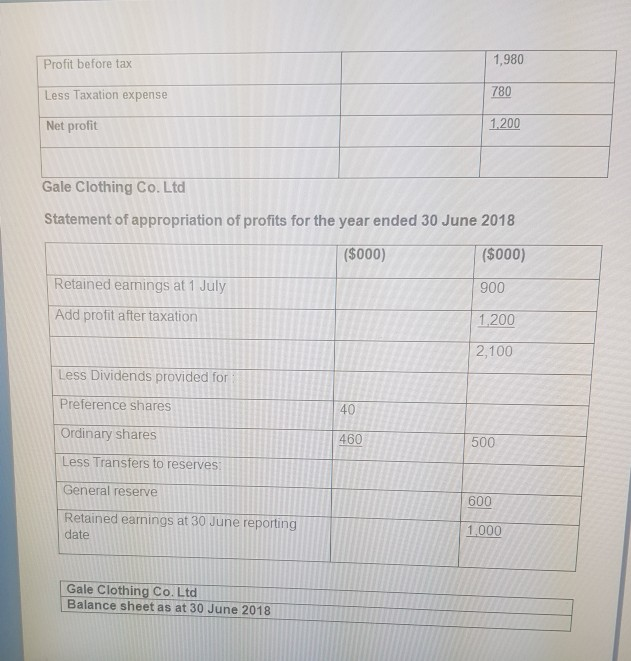

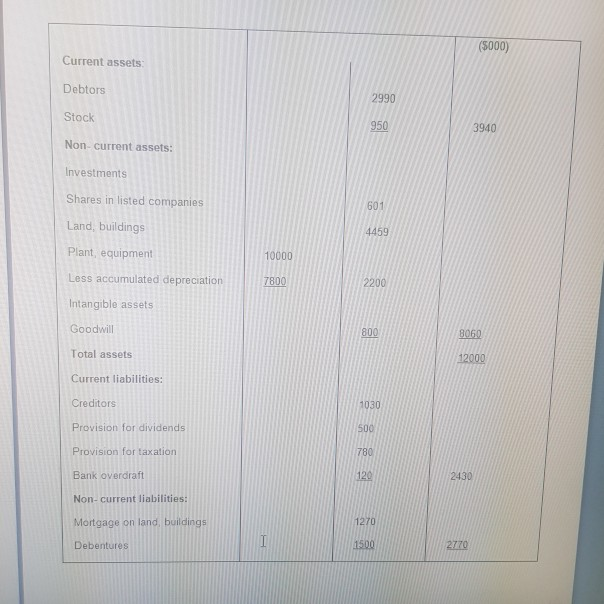

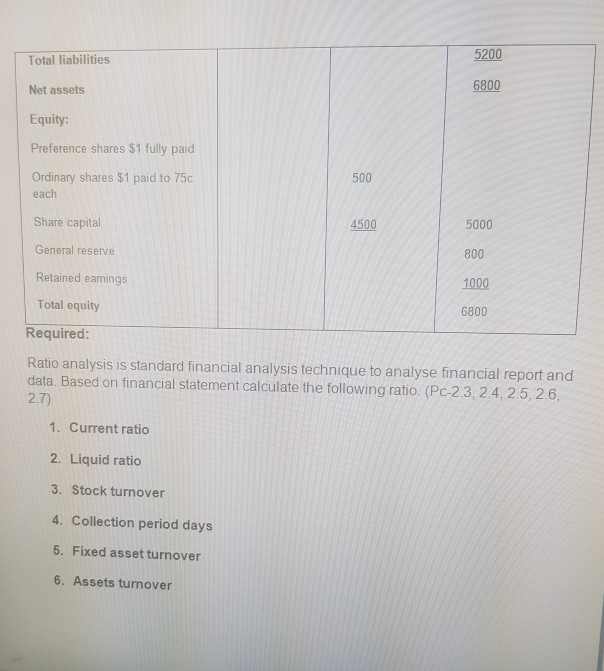

Part B: Calculations Gale Clothing Co.Ltd Income statement for the year ended 30 June 2018 ($000) ($000) Sales 16,000 Less cost of goods sold Stock at 1 July 850 Purchases 3.700 4,550 Less Stock at 30 June 950 3.600 Gross Profit 12,400 9.970 Less operating expenses (including depreciation $800) Profit before interest and taxes 2.430 Less interest 450 1,980 Profit before tax 780 Less Taxation expense 1.200 Net profit Gale Clothing Co. Ltd Statement of appropriation of profits for the year ended 30 June 2018 ($000) ($000) 900 Retained eamings at 1 July Add profit after taxation 1.200 2,100 Less Dividends provided for Preference shares 40 Ordinary shares 460 500 Less Transfers to reserves: 600 General reserve Retained earnings at 30 June reporting date 1.000 Gale Clothing Co. Ltd Balance sheet as at 30 June 2018 (5000) Current assets Debtors 2990 Stock 950 3940 Non-current assets: Investments Shares in listed companies 501 Land buildings 4459 Plant, equipment 10000 Less accumulated depreciation 7800 2200 Intangible assets Goodwill 8060 Total assets 12000 Current liabilities: Creditors 1030 Provision for dividends 500 Provision for taxation 780 Bank overdraft 2430 Non-current liabilities: Mortgage on land, buildings 1270 Debentures 1500 Total liabilities 5200 Net assets 6800 Equity: Preference shares $1 fully paid 500 Ordinary shares $1 paid to 75c each Share capital 4500 5000 General reserve 800 Retained earnings 1000 Total equity 6800 Required: Ratio analysis is standard financial analysis technique to analyse financial report and data. Based on financial statement calculate the following ratio (PC-23, 24, 25, 26, 2.7) 1. Current ratio 2. Liquid ratio 3. Stock turnover 4. Collection period days 5. Fixed asset turnover 6. Assets turnover 7. Assets employee ratio: 8. Gross profit margin (%): Gross/Sales X 100= 9. Net profit margin (%) 10. Return on net worth 11. Return on total assets (%) 12. Debt to equity (%) 13. Total debt to total assets (%) 14. Earning yield **End of Assessment 2***

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started