Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Part B: Cash to accrual review. Before month - end adjustments are made, the December 2 0 2 5 trial balance of Entity B contains

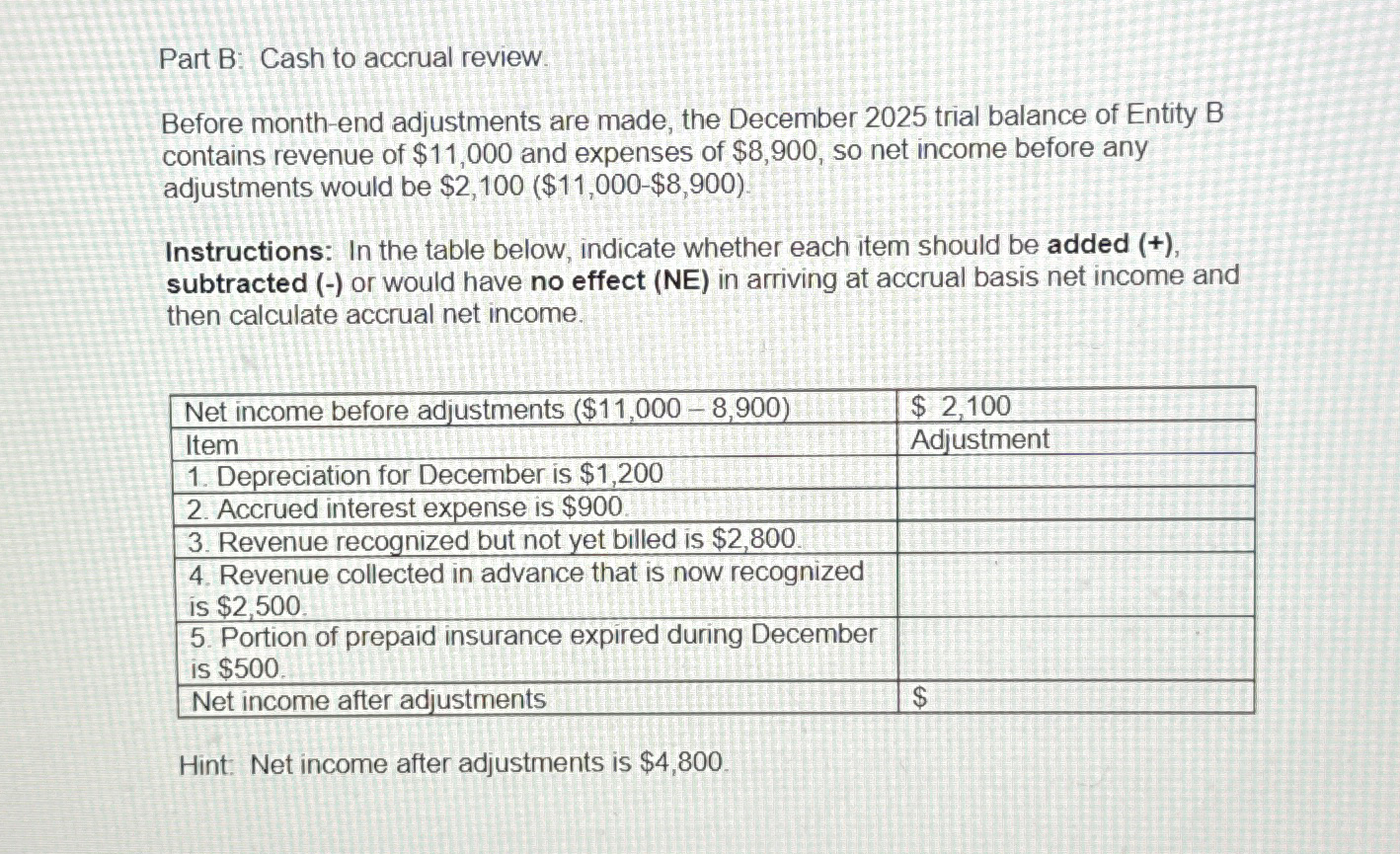

Part B: Cash to accrual review.

Before monthend adjustments are made, the December trial balance of Entity B contains revenue of $ and expenses of $ so net income before any adjustments would be $$$

Instructions: In the table below, indicate whether each item should be added subtracted or would have no effect NE in arriving at accrual basis net income and then calculate accrual net income.

tableNet income before adjustments $$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started