Part B: Estimating Cost of capital for a new line of business (7 marks) Refer to the Excel file posted on Stream XXX company and Market Index in the Assignment 1 section: Your company is operating in a rather risky industry with the average industry beta of 1.25. Given that the products of your company are, on average, in a more volatile (to nondiversifiable factors) section of the industry, your companys beta has been estimated as 1.32. Recently, the management team of your company is looking into another line of more stable business to expand into. As a financial manager of the company, you were asked to find the cost of capital of this new line of business (with lower risk), which will be entirely financed by equity. As of now, your company has the Debt-to-equity ratio of 1.75. While the beta of the new project will not be observable, you know that you can observe the beta of a comparable company in such industry as a benchmark. You have chosen XXX Company for such purpose. You then asked Mr. Frank Zappa, a young intern in your company, at the very last minute of a working day to collect the daily prices of XXX company (traded in the local stock market) and the corresponding stock market index level for the last 250 trading days or so. You told him you would need that information NOW. He handed in to you the Excel file XXX company and Market Index in the next ten minutes, looking a bit disoriented and cannot wait to call it a day. QUESTIONS 1. Estimate the Beta of XXX Company estimated from the observed data just collected. (3.5 Marks) 2. The debt-to-equity ratio of XXX Company is 0.5. Estimate the cost of capital (e.g. the discount rate to be used) for the new line of business that your company is considering. The relevant risk-free rate and market return are 3% and 7% respectively. (3.5 Mark)

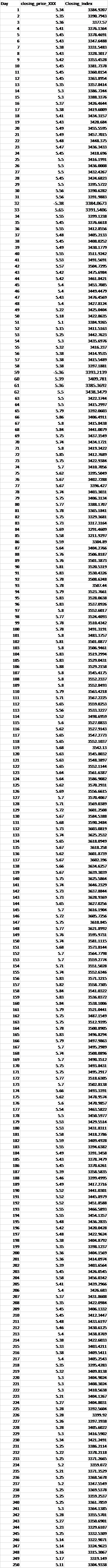

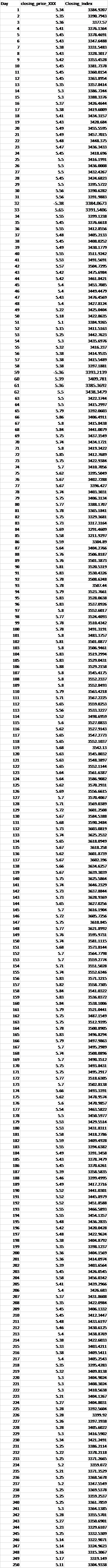

Excel File: Note: Day 2 is the day after Day 1, Day 3 is the day after Day 2, and continue in that fashion.

5.5 1 5 14 closing price XXX Closing Index 54 3M 9207 55 0043 5% .57 541 14 55 860 58 7.M 5.8 1548 53 52 ,528 545 56 ,4 5.5 5.5 37414 5.3 336, TM4 15.3 338.33 5.37 34. 4M 5. 19.6NOS 51 44.3157 58 3428 59 45.5% 59 475 5.8 4835 5 3463433 545 18.6% 55 16.1 5.5 4% MOB 55 42467 55 248 5.5 3 .5 5. 5 5.5% -5.38 3384.063 5.65 3391.5406 5.5 312 5.5 3 .18 5.5 34128556 58 545 3482 59 41 5.5 11.242 58 561 557 % 5 52 54 458 54 4949 5.8 6.45 154 274 5.2 4. MAM 5.18 4 5.1 4. 926 5.5 11.5168 5 4263 53 3456 5 3416.37 5% 34145 5 45.549 5% 718 -535 333219 539 3409.781 5.5 3385.3692 55 3438349 234 5.5 15.7997 5 SIS 5 6.41 15.8 45.38 5.4 ALTID9 5. 43719 54 44.1 15.8 19.342 5.5 1269 5 34 .9 57 10. 6 5 509 5 3M TW 5.6 27 54 41 5 36314 5 17 5 11 5 1 5 17.31 5.9 39 5.58 1997 5.59 A. 5.4 MIM. 26 5 06.187 5. 3 51 5519 5.8 5 .43 5 B. 248 5 57.4 5 5281 5.3 528. 0678 5.3 536 5.8 52.607 524.40% 58 51142 5 58 3357 12 51 5.3 36.91 5. 19.24 5. 35.0M31 5.8 5. USB 5.8 15.115 5.8 5527837 19 5524983 10 5 363418 11 51 3567% 11 56 3559. 3 113 5.56 353337 14 58 48.6959 5 5.6 52733 16 5 27.13 111 56 7.2TB 13 5.6 52187 19 5 2.13 58 5.32 58 48. 7 5.6 2.114 5 3L 5 5. 912 12 5 126 58 556.65 157 35467 W 51 350.00 5 SW 17 5 545 11 58 590244 1 58 19 54 32 14 56 18.999 5.67 18 1 5. 3878 7 5g 56 19 5.67 30.309 5 3. 5M 141 54 +, 142 5. A 3374 13 5A 8. 969 14 5.6 276 145 157 16.1904 16 5 T6 147 5 10.45 148 5 19 5 5991 15 54 51115 151 58 B14 57 78 51 9.24 5 150CM 18 5.8 35 157 5. 58 AM 15% 5. ALBZ 159 5.8 , 5.4 5 106 11 5 35LIMAL 1 5. 347159 5 12.8% 5 16 58 346.84 166 5 37.8 51 45.7 168 54 BB% 53 4902 10 5 48431 5 49. 7 518.63% 57 14 5 3483 5 34854 5.6 5.4 3463.52 1 5.5 3450.59 5.8 34.5514 1 5.8 31311 11 5.58 3418. 26 12 5.59 34.498 183 5.5 4682 59 3458 58 384 1 545 3606 17 5.39 8.58% 1 56 19 17.216 10 5.2 5.2 6. 12 52 351 18 5.5 46.5 19 55 5417 5.48 3428 1% 5.2 4. MTW 5.48 34.5CM 1% 5. 04.8 1 5 08.137 2010 5 340M1569 5% 34144 22 59 34864 55 4645 M 5.8 3456.42 2 54 40.96 6 4 34% 207 5.37 34318 5 24 55 46.1337 10 56 12347 58 43.197 12 56 3 154 69 14 5. 2633 5.3 841 5. 34.5411 154 345,543 5. 34283 9 5.32 , 5.3 344 NOW 53 34834 5.3 10.56 93 51 3M12%, 4 5.7 3MB] 58 54 58 0.2 5 % 798 58 6. PT 53 16.59IT 54 24 5 114 282 5 118 5.5 24 152 39.0T 5.1 2 5.5 28.5hH 237 15.2 7.549 5.5 360.58 29 5.5 9. 3 40 5.5 859 53 41 42 5 50 5.7 L 690 5 0. 01 4 55 3332.5D 5.14 907 4 514 A %= 48 516 15.3% 9 5.17 12.14 5.11 04.93 19 140 15 10 16 14 10 Fun 15 16 17 10 549 19 1% 97 9 13 50 5.5 1 5 14 closing price XXX Closing Index 54 3M 9207 55 0043 5% .57 541 14 55 860 58 7.M 5.8 1548 53 52 ,528 545 56 ,4 5.5 5.5 37414 5.3 336, TM4 15.3 338.33 5.37 34. 4M 5. 19.6NOS 51 44.3157 58 3428 59 45.5% 59 475 5.8 4835 5 3463433 545 18.6% 55 16.1 5.5 4% MOB 55 42467 55 248 5.5 3 .5 5. 5 5.5% -5.38 3384.063 5.65 3391.5406 5.5 312 5.5 3 .18 5.5 34128556 58 545 3482 59 41 5.5 11.242 58 561 557 % 5 52 54 458 54 4949 5.8 6.45 154 274 5.2 4. MAM 5.18 4 5.1 4. 926 5.5 11.5168 5 4263 53 3456 5 3416.37 5% 34145 5 45.549 5% 718 -535 333219 539 3409.781 5.5 3385.3692 55 3438349 234 5.5 15.7997 5 SIS 5 6.41 15.8 45.38 5.4 ALTID9 5. 43719 54 44.1 15.8 19.342 5.5 1269 5 34 .9 57 10. 6 5 509 5 3M TW 5.6 27 54 41 5 36314 5 17 5 11 5 1 5 17.31 5.9 39 5.58 1997 5.59 A. 5.4 MIM. 26 5 06.187 5. 3 51 5519 5.8 5 .43 5 B. 248 5 57.4 5 5281 5.3 528. 0678 5.3 536 5.8 52.607 524.40% 58 51142 5 58 3357 12 51 5.3 36.91 5. 19.24 5. 35.0M31 5.8 5. USB 5.8 15.115 5.8 5527837 19 5524983 10 5 363418 11 51 3567% 11 56 3559. 3 113 5.56 353337 14 58 48.6959 5 5.6 52733 16 5 27.13 111 56 7.2TB 13 5.6 52187 19 5 2.13 58 5.32 58 48. 7 5.6 2.114 5 3L 5 5. 912 12 5 126 58 556.65 157 35467 W 51 350.00 5 SW 17 5 545 11 58 590244 1 58 19 54 32 14 56 18.999 5.67 18 1 5. 3878 7 5g 56 19 5.67 30.309 5 3. 5M 141 54 +, 142 5. A 3374 13 5A 8. 969 14 5.6 276 145 157 16.1904 16 5 T6 147 5 10.45 148 5 19 5 5991 15 54 51115 151 58 B14 57 78 51 9.24 5 150CM 18 5.8 35 157 5. 58 AM 15% 5. ALBZ 159 5.8 , 5.4 5 106 11 5 35LIMAL 1 5. 347159 5 12.8% 5 16 58 346.84 166 5 37.8 51 45.7 168 54 BB% 53 4902 10 5 48431 5 49. 7 518.63% 57 14 5 3483 5 34854 5.6 5.4 3463.52 1 5.5 3450.59 5.8 34.5514 1 5.8 31311 11 5.58 3418. 26 12 5.59 34.498 183 5.5 4682 59 3458 58 384 1 545 3606 17 5.39 8.58% 1 56 19 17.216 10 5.2 5.2 6. 12 52 351 18 5.5 46.5 19 55 5417 5.48 3428 1% 5.2 4. MTW 5.48 34.5CM 1% 5. 04.8 1 5 08.137 2010 5 340M1569 5% 34144 22 59 34864 55 4645 M 5.8 3456.42 2 54 40.96 6 4 34% 207 5.37 34318 5 24 55 46.1337 10 56 12347 58 43.197 12 56 3 154 69 14 5. 2633 5.3 841 5. 34.5411 154 345,543 5. 34283 9 5.32 , 5.3 344 NOW 53 34834 5.3 10.56 93 51 3M12%, 4 5.7 3MB] 58 54 58 0.2 5 % 798 58 6. PT 53 16.59IT 54 24 5 114 282 5 118 5.5 24 152 39.0T 5.1 2 5.5 28.5hH 237 15.2 7.549 5.5 360.58 29 5.5 9. 3 40 5.5 859 53 41 42 5 50 5.7 L 690 5 0. 01 4 55 3332.5D 5.14 907 4 514 A %= 48 516 15.3% 9 5.17 12.14 5.11 04.93 19 140 15 10 16 14 10 Fun 15 16 17 10 549 19 1% 97 9 13 50