Answered step by step

Verified Expert Solution

Question

1 Approved Answer

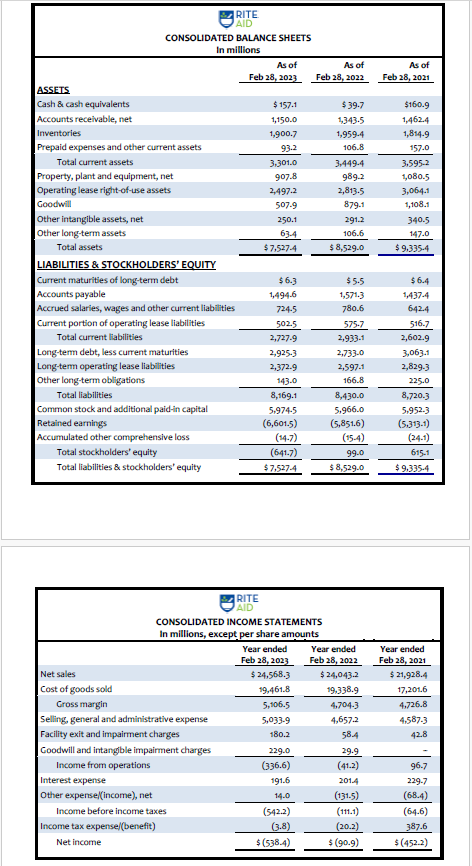

PART B Financial Statement Inferences related to Inventory Use Rite Aids financial statements to answer the following questions. What inventory flow assumption did Rite Aid

PART B Financial Statement Inferences related to Inventory

Use Rite Aids financial statements to answer the following questions.

- What inventory flow assumption did Rite Aid use to value most of its inventory? Why do you think they chose that assumption?

| Rite Aide used the last-in, first-out (LIFO) cost flow assumption for substantially all of its inventories. |

- Find or compute Inventory and COGS (a) in Rite Aids existing financial statements and (b) if Rite Aid had instead used FIFO to value its inventory.

| Current Financial Statements (i.e., primarily LIFO) | If company had instead used only FIFO | |

| Inventory at 2/28/23 | ||

| Inventory at 2/28/22 | ||

| COGS for year ended 2/28/23 |

- What were Rite Aids approximate tax savingsin the most recent fiscal year from using LIFO rather than FIFO? Assume a tax rate of 20%.

- What were Rite Aids approximate cumulativetax savings from using LIFO rather than FIFO? Assume a tax rate of 20%.

- Calculate Rite Aids Days Inventory for the two most recent fiscal years. Do these ratios suggest Rite Aid managed its inventory better in the year ended 2/28/23 or 2/28/22?

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{CONSOLIDATEDBALANCESHEETSInmillions} \\ \hline & AsofFeb28,2023 & AsofFeb28,2022 & AsofFeb28,2021 \\ \hline \multicolumn{4}{|l|}{ ASSETS } \\ \hline Cash \& cash equivalents & $157.1 & $39.7 & $160.9 \\ \hline Accounts receivable, net & 1,150.0 & 1,343.5 & 1,462.4 \\ \hline Inventories & 1,900.7 & 1,9594 & 1,814.9 \\ \hline Prepaid expenses and other current assets & 93.2 & 106.8 & 157.0 \\ \hline Total current assets & 3,301.0 & 3,4494 & 3.5952 \\ \hline Property, plant and equipment, net. & 907.8 & 989.2 & 1,080.5 \\ \hline Operating lease right-of-use assets & 2,497.2 & 2,813.5 & 3,064.1 \\ \hline Goodwill & 507.9 & 879.1 & 1,108 \\ \hline Other intangible assets, net & 250.1 & 291.2 & 340.5 \\ \hline Other long-term assets & 634 & 106.6 & 147.0 \\ \hline Total assets & $7,527.4 & $8,5290 & $9,335.4 \\ \hline \multicolumn{4}{|l|}{ LIABILITIES \& STOCKHOLDERS' EQUITY } \\ \hline Current maturities of long-term debt & $6.3 & $5.5 & $6.4 \\ \hline Accounts payable & 1,494.6 & 1,5713 & 1,4374 \\ \hline Accrued salaries, wages and other current liabilities & 724.5 & 780.6 & 642.4 \\ \hline Current portion of operating lease liabilities & 502.5 & 575.7 & 516.7 \\ \hline Total current liabilities & 2,7279 & 2,9331 & 2,602.9 \\ \hline Long-tem debt, less current maturities & 2,925.3 & 2,7330 & 3,063.1 \\ \hline Long-tem operating lease liabilities & 2,372.9 & 2,597.1 & 2,8293 \\ \hline Other long-term obligations & 1430 & 166.8 & 225.0 \\ \hline Total liabilities & 8,169.1 & 8,430.0 & 8,7203 \\ \hline Common stock and additional paid-in capital & 5,974.5 & 5,966.0 & 5,952.3 \\ \hline Retained earnings & (6,601.5) & (5,851.6) & (5,3131) \\ \hline Accumulated other comprehensive loss & (14.7) & (154) & (24.1) \\ \hline Total stockholders' equity & (641.7) & 99.0 & 6151 \\ \hline Total liabilities \& stockholders' equity & $7,5274 & $8,529.0 & $9,335.4 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{CONSOLIDATEDINCOMESTATEMENTSInmillions,exceptpershareamounts} \\ \hline & YearendedFeb28,2023 & YearendedFeb28,2022 & YearendedFeb28,2021 \\ \hline Net sales & $24,568.3 & $24,043.2 & $21,928.4 \\ \hline Cost of goods sold & 19,461.8 & 19,338.9 & 17,201.6 \\ \hline Gross margin & 5,106.5 & 4,7043 & 4,726.8 \\ \hline Selling, general and administrative expense & 5,0339 & 4,657.2 & 4,587.3 \\ \hline Facility exit and impairment charges & 180.2 & 584 & 42.8 \\ \hline Goodwill and intangble impairment charges & 229.0 & 29.9 & - \\ \hline Income from operations & (336.6) & (41.2) & 96.7 \\ \hline Interest expense & 191.6 & 2014 & 229.7 \\ \hline Other expense/(income), net & 14.0 & (131.5) & (68.4) \\ \hline Income before income taxes & (542.2) & (111.1) & (64.6) \\ \hline Income tax expense/(benefit) & (3.8) & (20.2) & 387.6 \\ \hline Net income & $(5384) & $(90.9) & $(452.2) \\ \hline \end{tabular}

\begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{CONSOLIDATEDBALANCESHEETSInmillions} \\ \hline & AsofFeb28,2023 & AsofFeb28,2022 & AsofFeb28,2021 \\ \hline \multicolumn{4}{|l|}{ ASSETS } \\ \hline Cash \& cash equivalents & $157.1 & $39.7 & $160.9 \\ \hline Accounts receivable, net & 1,150.0 & 1,343.5 & 1,462.4 \\ \hline Inventories & 1,900.7 & 1,9594 & 1,814.9 \\ \hline Prepaid expenses and other current assets & 93.2 & 106.8 & 157.0 \\ \hline Total current assets & 3,301.0 & 3,4494 & 3.5952 \\ \hline Property, plant and equipment, net. & 907.8 & 989.2 & 1,080.5 \\ \hline Operating lease right-of-use assets & 2,497.2 & 2,813.5 & 3,064.1 \\ \hline Goodwill & 507.9 & 879.1 & 1,108 \\ \hline Other intangible assets, net & 250.1 & 291.2 & 340.5 \\ \hline Other long-term assets & 634 & 106.6 & 147.0 \\ \hline Total assets & $7,527.4 & $8,5290 & $9,335.4 \\ \hline \multicolumn{4}{|l|}{ LIABILITIES \& STOCKHOLDERS' EQUITY } \\ \hline Current maturities of long-term debt & $6.3 & $5.5 & $6.4 \\ \hline Accounts payable & 1,494.6 & 1,5713 & 1,4374 \\ \hline Accrued salaries, wages and other current liabilities & 724.5 & 780.6 & 642.4 \\ \hline Current portion of operating lease liabilities & 502.5 & 575.7 & 516.7 \\ \hline Total current liabilities & 2,7279 & 2,9331 & 2,602.9 \\ \hline Long-tem debt, less current maturities & 2,925.3 & 2,7330 & 3,063.1 \\ \hline Long-tem operating lease liabilities & 2,372.9 & 2,597.1 & 2,8293 \\ \hline Other long-term obligations & 1430 & 166.8 & 225.0 \\ \hline Total liabilities & 8,169.1 & 8,430.0 & 8,7203 \\ \hline Common stock and additional paid-in capital & 5,974.5 & 5,966.0 & 5,952.3 \\ \hline Retained earnings & (6,601.5) & (5,851.6) & (5,3131) \\ \hline Accumulated other comprehensive loss & (14.7) & (154) & (24.1) \\ \hline Total stockholders' equity & (641.7) & 99.0 & 6151 \\ \hline Total liabilities \& stockholders' equity & $7,5274 & $8,529.0 & $9,335.4 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline \multicolumn{4}{|c|}{CONSOLIDATEDINCOMESTATEMENTSInmillions,exceptpershareamounts} \\ \hline & YearendedFeb28,2023 & YearendedFeb28,2022 & YearendedFeb28,2021 \\ \hline Net sales & $24,568.3 & $24,043.2 & $21,928.4 \\ \hline Cost of goods sold & 19,461.8 & 19,338.9 & 17,201.6 \\ \hline Gross margin & 5,106.5 & 4,7043 & 4,726.8 \\ \hline Selling, general and administrative expense & 5,0339 & 4,657.2 & 4,587.3 \\ \hline Facility exit and impairment charges & 180.2 & 584 & 42.8 \\ \hline Goodwill and intangble impairment charges & 229.0 & 29.9 & - \\ \hline Income from operations & (336.6) & (41.2) & 96.7 \\ \hline Interest expense & 191.6 & 2014 & 229.7 \\ \hline Other expense/(income), net & 14.0 & (131.5) & (68.4) \\ \hline Income before income taxes & (542.2) & (111.1) & (64.6) \\ \hline Income tax expense/(benefit) & (3.8) & (20.2) & 387.6 \\ \hline Net income & $(5384) & $(90.9) & $(452.2) \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started