Answered step by step

Verified Expert Solution

Question

1 Approved Answer

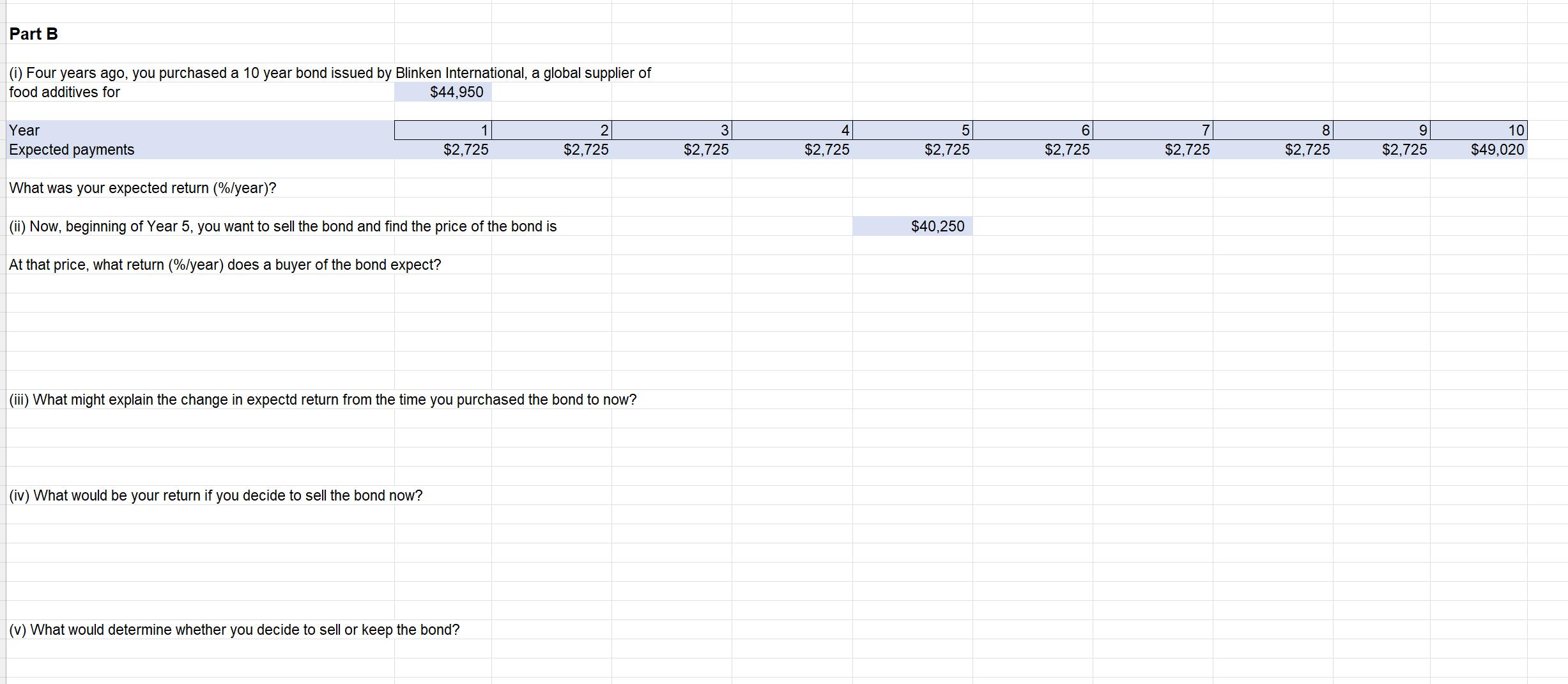

Part B (i) Four years ago, you purchased a 10 year bond issued by Blinken International, a global supplier of food additives for Year

Part B (i) Four years ago, you purchased a 10 year bond issued by Blinken International, a global supplier of food additives for Year Expected payments What was your expected return (%/year)? $44,950 1 $2,725 2 3 4 5 $2,725 $2,725 $2,725 $2,725 (ii) Now, beginning of Year 5, you want to sell the bond and find the price of the bond is At that price, what return (%/year) does a buyer of the bond expect? $40,250 (iii) What might explain the change in expectd return from the time you purchased the bond to now? (iv) What would be your return if you decide to sell the bond now? (v) What would determine whether you decide to sell or keep the bond? 6 $2,725 7 $2,725 8 $2,725 9 $2,725 10 $49,020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started